Riding the Wave

There were many exciting moments during the Olympic surfing competition this August—including the surprise appearance of a whale during the semifinal—but what most surfers seemed worried about were the unpredictable, intense waves of Tahiti. Similarly, while the base oils market has been riding a fairly steady wave this summer, participants remained conscious of the fact that severe weather events during the hurricane season in the Atlantic basin might upset the delicately balanced conditions. They had therefore prepared inventories ahead of time.

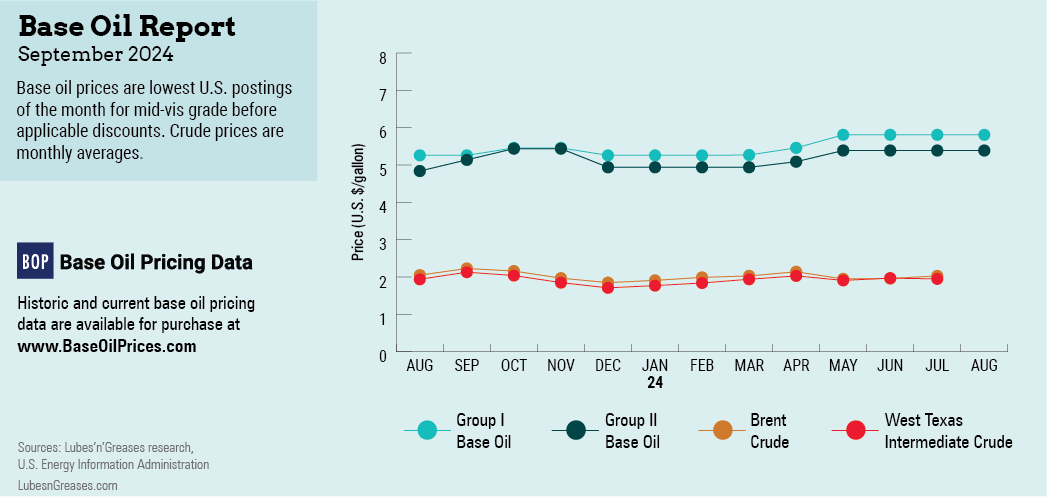

It was precisely these inventory building efforts, along with steady demand for most grades, recent plant outages and ongoing export business that led to a balanced-to-tight paraffinic base oils scenario and stable posted prices in July and the first half of August. While crude oil values had lost ground since June, base stock suppliers stood firm by their postings, as they had been able to keep oversupply conditions at bay, despite the first intimations of a seasonal slowdown.

The API Group I and Group II segments remained fairly tight, limiting spot availability—particularly of the light grades—and lending support to stable-to-firm spot prices. However, as base oil margins had risen vis-à-vis vacuum gasoil and competing fuel values, refiners saw an incentive in maintaining—or even increasing—base oil output rates, which might offset some of the supply tightness.

Several producers focused on contract commitments and were unable to offer additional supplies of the Group II 100 neutral grade. Sources acknowledged that extra availability of Group II 100N was negligible, and some contract customers were unable to secure the entire amount of base oil they desired. A few buyers were able to cover requirements with rerefined 100N, but rerefined supply was limited, too, despite the fact that rerefiners have been running plants at high rates to meet healthy demand. There appeared to be slightly more supplies of the Group II 220N and 600N grades.

An exception to the snug base oil conditions may have been the Group III grades. These cuts had experienced some tightening in June and early July, mainly triggered by steady demand and the delayed arrival in the U.S. of an import cargo from the Middle East. However, shipments were back on schedule and some cuts began to lengthen, placing downward pressure on prices. The plentiful supplies were partly a result of Group III prices in the U.S. being more attractive than in other regions, enticing additional shipments. Demand in some key markets such as China had weakened as well, leaving more Asian and Middle Eastern cargoes available for shipment elsewhere.

The cut that seemed to be showing the most lengthening was the Group III 4 cSt, particularly as domestic production of this grade was also steady, contributing to the ample availability. Prices were therefore exposed to downward pressure, with suppliers starting to adjust indications down. Sources were of the opinion that Group III prices had been held artificially high in the U.S. for some time, and with demand slipping and supply growing, values were settling at more realistic levels.

In terms of exports of Group I and Group II grades, activity was less brisk in July and August because spot availability in the U.S. was sparse and buying appetite from India, Brazil and other countries in South America was less robust than during the first half of the year. Nevertheless, there continued to be discussions to move U.S. cargoes to Europe and Africa, while Mexican buyers were also eyeing shipments of Group I and Group II grades—although bids fell below suppliers’ expectations in some cases, thwarting the conclusion of business.

Naphthenic base oil supply was generally balanced against demand, with some grades such as the pale 60 seeing healthier consumption levels, namely from the transformer oil segment. Demand for U.S. naphthenic base oils from Europe—and to a certain extent, from South America—was helping keep domestic inventories in check.

Buyers were monitoring crude oil prices closely, hoping that falling values would trigger downward price revisions for base oils. Given slipping diesel prices, some pale oil accounts that are indexed against diesel would see downward adjustments, but other prices held steady, supported by the supply tightness and solid demand globally. Any future adjustments would have to come on the back of falling demand, coupled with crude oil values hovering at much lower levels for an extended period.

Crude oil futures plummeted the first week of August as equity markets sold off on fears that the U.S. economy might slip into a recession. Lackluster crude demand from China also exerted downward pressure. West Texas Intermediate crude oil closed at a six-month low below $73 per barrel on August 5. It edged up during subsequent trading sessions as equities showed a rebound, and there were increased concerns about an Iranian attack against Israel, which could lead to a wider conflict in the Middle East.

Sharp crude oil and feedstock price swings, together with changes in demand and unexpected events, might create some large swells in an otherwise waveless market. But like any seasoned surfer, base oil and lubricant industry participants will have the right resources and be prepared to face a rough sea.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com