Summer Highs

Base oil demand seemed to peak later than usual this year—with many suppliers reporting a vigorous second half of April and a fairly robust May, rather than a strong showing in March and early April. With consumption having registered rather disappointing levels in spring 2023, participants harbored reservations about the health of the market ahead of the summer driving season, which unofficially begins at the end of May.

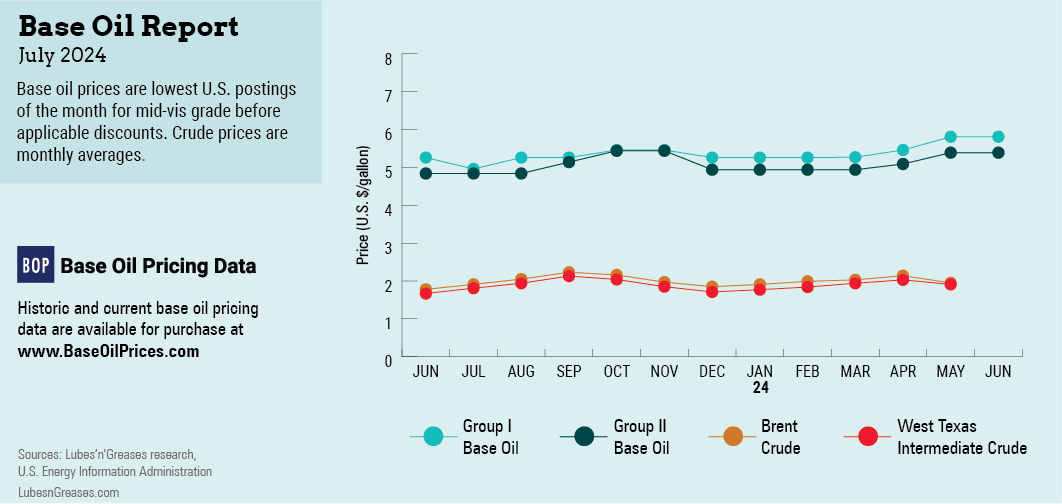

The early part of the spring season had been somewhat anomalous and lackluster, with consumption showing a small uptick but not an invigorating increase as suppliers had hoped. Posted price increases for most paraffinic oils were implemented in March and April, driven by surging crude oil and feedstock prices and thinning margins. Naphthenic producers also raised pale oil prices in the second half of April, prompted by similar fundamentals.

However, the support for these initiatives started to peter out by early May as crude futures tumbled due to geopolitical upheaval, economic forces that were anticipated to dampen oil demand, and expectations of a crude supply glut. West Texas Intermediate futures had jumped to multi-month highs near $85 per barrel in late March and early April but had slipped to around $78/barrel by early May.

At that time, several suppliers announced a posted price decrease on some of their API Group II, Group II+ and Group III base oil grades to align values with actual transaction levels, which had fallen due to oversupply conditions and weaker crude oil prices.

By late May, suppliers noticed a considerable improvement in base oil orders from most segments of the market, with many buyers and sellers focusing on building inventories ahead of the hurricane season and replenishing stocks that were used up in the weeks leading up to the summer driving season. Base oil supply tightened, particularly within the Group I and Group II segments, given healthy domestic activity and brisk export transactions.

Availability of Group I base oils had been partly impacted by a brief shutdown at Paulsboro’s Group I facility in late May, along with a pick-up in demand on the domestic front and from the export market. A tight scenario in Europe enticed spot cargoes away from the U.S. supply system, while increased buying interest from Mexico and West Coast South America also drew on supplies from the U.S. Buying interest from Brazil was steady to softer, with transactions having been hindered by steeper prices in the U.S., reduced spot availability, logistical issues and flooding in a key industrial region of Brazil.

The Group II segment also experienced some effects from a partial shutdown at Motiva’s Group II facility in May, which was reported to have only affected the low-viscosity grades.

While supplies in the Group III segment were plentiful, the 6-centiStoke and 8-cSt grades enjoyed improved buying interest, and spot prices stabilized. The U.S. continued to draw ample volumes from Asia and the Middle East given steady demand and attractive prices compared to other regions, coupled with the fact that domestic production is not sufficient to cover growing product needs.

Meanwhile, rerefiners received an increased number of inquiries for additional volumes of Group II, Group II+ and Group III grades to fill some of the domestic supply gaps in May, and rerefining plants were run at top rates to meet the burgeoning requirements. Rerefiners also mentioned that there had been an increase in used oil collection rates—an indication that lubricant consumption had been stronger.

Most base oil segments saw an uptick in requirements as participants build inventories to cover potential production disruptions during the Atlantic hurricane season, which was predicted to be more intense than in the previous two years, with several severe storms and hurricanes forecast to hit the U.S. Gulf Coast between June 1 and November 30. Most of the activity is expected to occur in August and September.

Amidst the busy base oil market scenario, blenders were dealing with a storm of their own as they encountered difficulties in transferring base oil and additive price increases down the supply chain. Base oil producers had introduced increases in March and April, and additive suppliers announced price markups between 8% and 10% for May. Given plentiful finished product supplies, there continued to be competitive actions among manufacturers, making it difficult to implement the proposed price markups.

Several independent finished product manufacturers and at least two majors announced price increases of up to 10%-15% to offset the higher cost of base oils, additives, packaging and transportation, for May and June implementation. Some of the increases went through despite consumer resistance and ongoing competition among sellers, and a number of suppliers continued to assess the rates of implementation before announcing markups of their own.

Base oil market participants expressed some concerns about the second half of the year and prepared for the lows that were likely to follow the highs experienced in the summer. Historically, base oil demand has always slowed down once the summer gets underway, with inventories starting to build and prices coming under pressure, but any unexpected events could upset the delicate balance that both buyers and suppliers work so diligently to achieve.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com