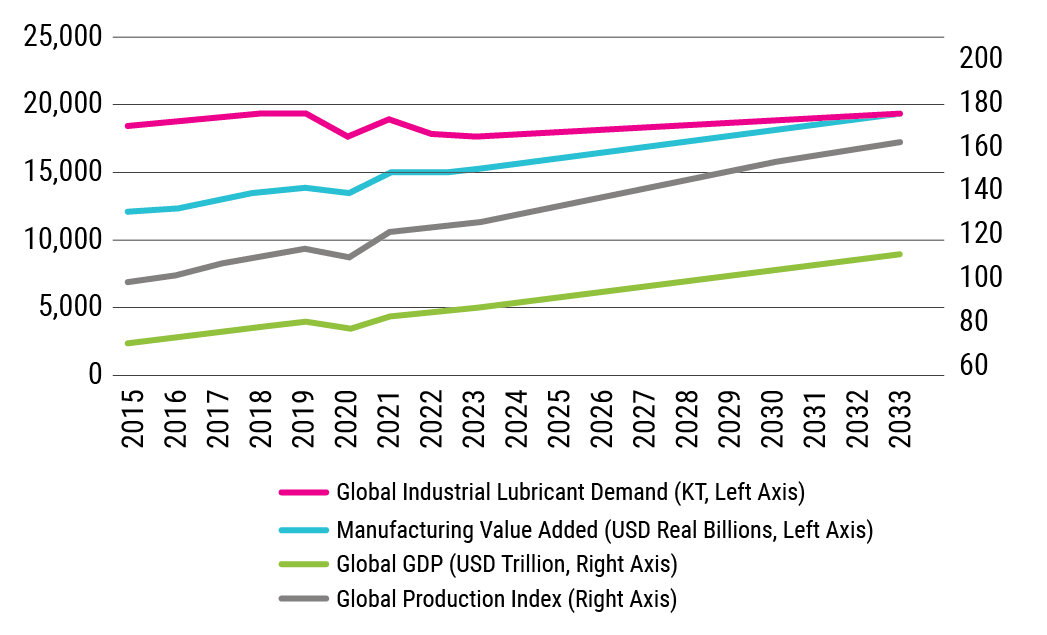

Global industrial macroeconomic indicators have remained strong against the backdrop of erratic economic and political conditions across the world in recent years. After a significant decline in 2020, the global industrial segment experienced a quick recovery in 2021. Nevertheless, this recovery was accompanied by several challenging headwinds, such as higher costs of capital, long-run inflation, continued risks of supply shock, and softer demand. Despite these bumps, the industrial segment on a global level remains bold.

The industrial world is currently navigating four megatrends that are likely to reshape the developments that will be witnessed in the years ahead, both in sectoral growth as well as associated lubricant demand. These are:

- High-tech manufacturing and digitalization

- Regulations and sustainability

- Global rebalancing

- Supply chain volatility

Figure 1. Global Industrial Lubricant Demand Trend

Vis-á-vis macroeconomic indicators

Source: Kline & Co.

While high-tech manufacturing, digitalization, regulations and sustainability will have a greater impact on industrial fluid formulations, the global rebalancing trends and supply chain volatility are more likely to change the direction of barrels delivered, as highlighted in a recent Kline study. Focusing on key volume markets and growth areas for industrial lubricants, there are clear opportunities in both mature and emerging markets.

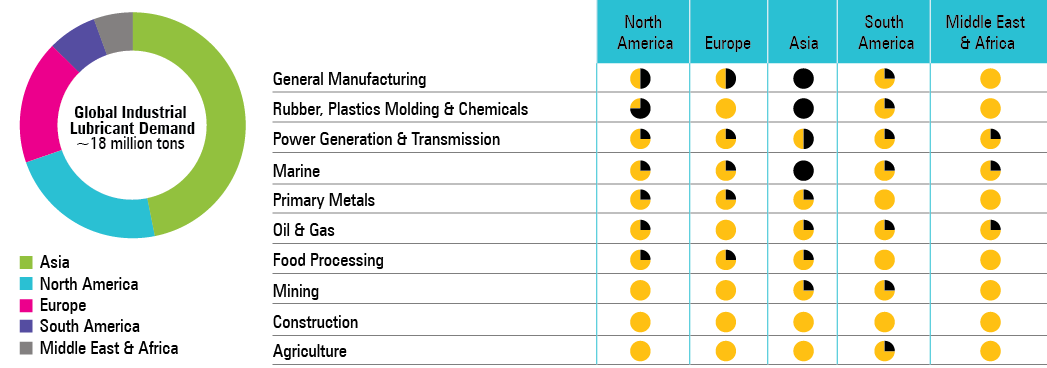

Leading the Way for Industrial Oils and Fluid Demands

The Asian region stands out with the highest growth for the industrial lubricants market. This is underscored by the region’s rapid industrialization and economic expansion. Countries such as China, India and Southeast Asian nations are at the forefront of this growth, propelled by investments in various industrial sectors, expansion of the energy sector, infrastructure development and an increasing focus on manufacturing.

Asia is also witnessing tremendous growth in deployment of high-tech manufacturing and digitalization—the “next” reality within the region’s industrial and manufacturing sectors. China stands out in embracing automation and robotics in sectors such as automotive and electronics manufacturing that have high-speed, high-throughput applications. Other digitalization tools such as Internet of Things (IoT), cloud computing, big data and analytics are also being integrated into manufacturing operations in sectors such as healthcare, pharmaceuticals, food and beverages, and agriculture, among others. All these trends point toward the future growth of high-quality and synthetic industrial fluids.

Figure 2. Global Lubricant Demand

On the other side of the globe, the North American industrial segment saw a positive opening to 2024, indicated by expansion in industrial orders in the United States. After experiencing a slow period in 2022 and 2023, the United States, the second largest manufacturing nation in the world, is beginning to see the momentum. This momentum is underpinned by three significant acts of legislation that were introduced in the region in 2021 and 2022: the Infrastructure Investment and Jobs Act (IIJA), the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act, and the Inflation Reduction Act (IRA). Within a year of the IRA’s enactment, 39 U.S. states witnessed more than $86 billion in manufacturing investments, including significant projects in batteries, electric vehicles, solar panels and emerging technologies such as semiconductors.

The heightened focus in North America on clean technologies and energy efficiency is expected to drive up the demand for synthetic industrial fluids that offer better performance as well as environmentally sustainable fluids. The trend is likely to intensify with initiatives like Advanced Energy Project Credit and Federal mandates, which will drive up investments in renewable energy, emission cuts and sustainable transport projects.

Which Industrial Sectors Are at the Foreground of New Developments?

General manufacturing and power generation sectors are witnessing a significant transformation that is impacting industrial lubricant demand. The automotive sector, which contributes to a large share of general manufacturing activities across the world, is seeing a significant transformation with a shift toward electric and hybrid vehicles. Multiple automotive manufacturers are unveiling plans to establish new production sites or enlarge current ones to produce electric vehicles (EVs). For example, in the United States, Tesla has constructed new Gigafactories for electric vehicle manufacturing in Nevada and Texas. In India, Hyundai Motor announced its plan to invest more than USD 2.41 billion in Tamil Nadu over the next 10 years, with the aim of strengthening its electric vehicle production. Thailand aims to transition 30% of its automotive production to EVs by 2030.

These developments will have a notable impact on the demand for the industrial lubricants used in automotive manufacturing. As EV and ICE vehicle manufacturing is different, the growth of the former will negatively impact the demand for industrial fluids such as metalworking fluids (MWFs). However, the estimated net growth in the number of new EV plants, especially in Asia, will create new opportunities for the industrial lubricants market.

The transition to electric vehicle manufacturing is also estimated to foster growth in demand for synthetic industrial oils. For example, China has a high adoption of premium products in the automotive sector, and the country is expected to see a penetration of synthetic oils at a growth rate of 3%-4% between 2023 to 2033.

Power generation advancement is seeing some noteworthy changes as the sector navigates through several policies and regulations toward decarbonization. Europe, which saw significant ups and downs in power generation in 2023, is at the epicenter of the transition taking place in the power sector energy mix. The region has a mature and diverse energy landscape that is seeing a strong transition toward renewable sources of power generation, no doubt precipitated by the volatility of the energy supply challenges of recent years, the Ukraine-Russia war and continued legislation in favor of renewables. The European Union’s REPowerEU plan sets ambitious targets of 400 gigawatts by 2025 and 740 GW by 2030, emphasizing Europe’s commitment to renewable energy.

The transition toward renewable energy generation continues and is provoking some impactful changes in the formulation mix for industrial fluids that are used in power generation and the transmission sector. A strong growth in wind energy capacity will mean the need for synthetic gear oils and grease. Most new installations use synthetic lubricants for gear oils and greases due to the need to reduce gearbox failure, increase reliability, withstand extreme operating conditions and extend drain intervals.

Additionally, the transformers that are remotely located in renewable energy projects are now predominantly demanding ester-based oils that have a better performance life and offer biodegradability. In fact, the use of natural ester-based transformer oils in distribution transformers is likely to expand throughout the power sector as utilities focus on reducing their carbon emissions.

Editor’s Note: This article is an extract taken from Kline & Company’s full study on Global Industrial Opportunities in Industrial Lubricants: Global Market Overview.

Pooja Sharma is a project manager within Kline & Company’s Energy & Specialties practice. Her focus is on lubricant specialty products, greases and immersion cooling fluids.