Chemical regulation may be reducing the flow of new molecules into the market, but it has prompted a variety of new approaches to product R&D and introduction to market, plus a significant review of products that had previously seemed unattractive. This, to many, is a highly desirable form of innovation, reports Trevor Gauntlett.

The 21st Century has seen the introduction or extensive modification of chemical legislation and regulation globally. These include REACH (the Registration, Evaluation and Authorization of Chemicals) in Europe, REACH-like regulations in Turkey and Korea, the so-called TSCA reform in 2016 in the United States (actually, the Frank R. Lautenberg Chemical Safety for the 21st Century Act) and many others covering operational health and safety as well as environmental impact.

Many argue that regulation adds cost and complexity to the research and development of new molecules and their applications, leading to fewer successful developments and reduced choice. This is further complicated by those regulations possibly not being consistent between regions.

On the opposite side of the coin, the European Union’s official website states that “REACH … aims to enhance innovation and the competitiveness of the EU chemicals industry.” This is certainly the case based on the many new chemistries that were on offer at industry conferences in the first half of this year.

I’ll Show You Mine…

Woodlands, Texas-based SI Group’s Tyler Kuchta explained the challenges of developing new additives to Lubes’n’Greases. “Lubricants and greases are complex mixtures, formulated to meet specific performance and marketing needs, and OEM specifications. Changing formulations can be technically complex due to additive interactions, as well as gaining OEM approvals for those modifications.”

The development and registration costs of long-established additives were recouped many years ago. Up front R&D, manufacturing and registration costs to develop and produce new additives are therefore a significant barrier, and new chemistries typically require global registration, which can take several years and cost millions of U.S. dollars.

SI Group was taken over in 2018 by private equity company SK Capital Partners, which had acquired Addivant from Chemtura in 2013. Addivant’s additives business was focused on the plastics and rubber industries. (Chemtura had retained the lubricant additives and polyalphaolefins businesses and was subsequently acquired by Lanxess in 2017.)

Upon acquisition, the new SI Group sought to generate synergies between the two legacy businesses, some of which it hoped would be from the cross-selling of existing products. “We took a journey to look at products in adjacent markets from elsewhere in SI Group,” Kuchta said.

One likely candidate was a phosphite-based antioxidant for polymer production with its development history firmly in Addivant that was non-hazardous and approved for incidental food contact (HX-1). This product was to become ETHAFLOW 6705. Could the phosphorus content lead to beneficial antiwear or friction-modifying properties?

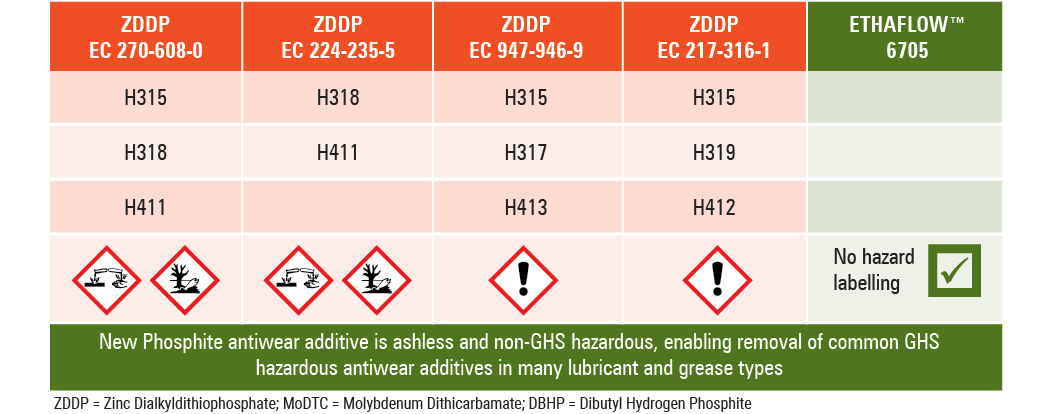

Figure 1. GHS Hazard Labelling: Common Antiwear Additives

• Widely used antiwear additives are classified by GHS as hazardous materials and corrosive

• Regulatory labels can also be present on finished lubricants dependent on additive concentration

The legacy SI Group had the abilities and knowledge to test film forming tendency in rolling and sliding tests. “We found pretty quickly that the technology provided some wear protection and some friction modification, similar to traditional friction modifier chemistries,” Kuchta said. “And it continued to shine in gear and transmission rig tests and grease bearing wear tests.”

“Despite having a heritage very close to the lubricants industry, there are some unique characteristics of the new product that allow differentiation. The product is now in the market and being used in lubricant formulations,” added Tim Chipuk, senior market development manager at SI Group. “We estimate this saved 5-plus years and many millions of USD in R&D, registration and commercialization costs.”

Filling a Gap

While new regulation can present obstacles to new product introduction, it can also open up possibilities as formulators consider moving away from previous chemistries. One area of interest is the substituted diphenylamines (SDPAs) that are used as antioxidants in many mainstream lubricants.

SDPAs containing mixed butyl/octyl (C4/C8) groups have been classified as Reprotoxic Category 2 under GHS (Globally Harmonized System). But they and their C9 substituted analogs could face more severe classification. (See the August 2024 issue of Lubes’n’Greases—volume 30, issue 8, page 26—for more information about the proposed regulation of SDPA.)

Depending on the treat rate, this classification could carry through to the finished oil, requiring the lubricants manufacturer to place “the exploding human” pictogram on their product label (see Figure 2). Several companies in the lubricants market are exploring alternatives to these workhorse molecules to find label-free formulations.

Figure 2: GHS pictogram to illustrate Carcinogenic, Mutagenic or Reprotoxic hazards

SI Group recognized that they had an SDPA in their portfolio, with recent data showing that it was not reprotoxic and also was non-bioaccumulative. “As the additive has a relatively high melting point, there had previously been no driver for the lubricants market to adopt this additive,” said Stuart McTavish, market development director for SI Group. However, it has been taken on by grease and industrial lubricant manufacturers, who can handle solids.

Nyco, based in Paris, France, also saw a low HSE profile antioxidant as having a high potential. Siegfried Lucazeau, marketing and project manager, industry & automotive, explained that Nyco was looking for a non-toxic product for industrial applications. “We built on previous work for aviation, where we had developed a non-toxic aviation turbine oil” based on non-toxic phosphorus-containing products and label-free antioxidants, he said.

With tightening regulation for some common SDPAs on the horizon, Nyco deployed Quantitative Structure-Activity Relationships, or QSARs, to screen antioxidants. QSARs were one of the methods to screen candidate components for the aviation development and “are used by the European Chemicals Agency and many regulatory authorities,” Lucazeau explained. “They use potentially hundreds of molecular descriptors of shape and size and compare them with the available data on biological activity.”

Such a computational study is often called in silico and is also used in the early stages of drug design or in predicting environmental impact. “The biggest challenge is to use the correct descriptors,” Lucazeau said.

Nyco wanted to consider neurotoxicity, carcinogenicity, mutagenicity and reprotoxicity. Their team took available structural and activity data on antioxidants and similar chemicals and used the data on 90% of the molecules to build a learning dataset. The other 10% of molecules of the most interest was kept for testing the newly developed QSAR, which compares the parameters with the known end points. Once the model is validated, it can be used to model new and existing molecules where toxicity data is not published.

The in silico study generated some positive results. “Some specific oligomeric antioxidants appear to have a non-toxic profile using our model,” Lucazeau reported.

Nyco has now reverted to a more conventional approach, investigating their effectiveness as antioxidants and cost-effective manufacturing routes. “It’s imperative that we also consider ease of manufacture and effectiveness in service,” Lucazeau said.

In some cases, the model could not predict no toxicity. “There’s often a grey area where you can’t be adamant about the results you obtain. It’s not a perfect science,” Lucazeau said. “We need to refine our models further.” Sometimes the issue is impurities, so modelling the majority molecule does not necessarily correlate with experimental data.

Playing the Long Game

Oleon, based in Evergem, Belgium, is, like Nyco, looking several years ahead in its market-testing activities. Pieter Struelens, R&D manager industrial applications, and his colleagues noted the interest in ionic liquids in modulating electrical discharges in electric vehicles and wind turbines.

“We asked, ‘What can oleochemistry offer to this challenge?’” Struelens said.

They were sure that they could make ionic liquids that might work in those applications but with a much-improved HSE profile. They appear to have succeeded in this action with performance data on ionic liquid/base oil blends generating market interest. At the STLE Annual Meeting in Minneapolis in May, Struelens presented data showing that their most promising candidate could both reduce the wear scar size in a four-ball wear test and reduce the electrical resistivity when top-treated into a commercially available polyurea grease. He added, “We have read-across data from similar chemicals that support the improved HSE profile we sought.”

But What’s Next?

“Here, a step-by-step approach is preferred, because you don’t want to engage in very expensive testing on the regulatory side without knowing the molecule’s performance in its application and vice versa,” Struelens explained. But taking steps consecutively adds time, and the process requires a lot of resources.

Struelens is sure Oleon’s approach has done much to de-risk the HSE aspects. “Safe and Sustainable by Design could have been a phrase to describe Oleon’s practice for many years,” he said. This phrase now describes a voluntary approach recommended by the European Commission to guide the innovation process for chemicals and materials.

Open Innovation

Yann Cramer, professor of entrepreneurship & innovation at the ESSEC Business School in Paris, France, oversaw a significant change in the way Shell Lubricants exploited new approaches to formulation in the 1990s and 2010s. One of the approaches Shell adopted, in common with several large players in the lubricants field, was open innovation.

“Open innovation has emerged over the past two decades as a mainstream strategy for large corporations; reaching out to more non-traditional sources of potential solutions helps corporations come up with new products faster,” Cramer told Lubes’n’Greases. “Going forward, as open innovation evolves into broader corporate venturing strategies, tighter regulations will increasingly serve as a filter, distinguishing truly innovative corporations from the rest.”

Recognizing an Opportunity

Scientists at Pendleton, South Carolina-based Tetramer Technologies were developing a molecule for another market segment and recognized its potential for utility in high-performance sustainable lubricants. Minor changes to its chemistry led to the development of a family of Secondary Polyol Ester (SPE) Base Oils and the formation of a spin off company, VBASE Oil Company.

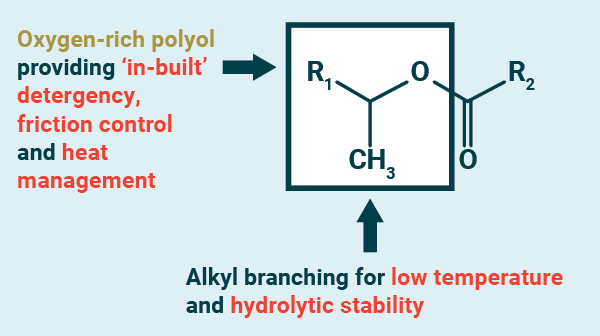

Figure 3. Novel Secondary Polyol Ester Technology

Martin Greaves, chief technology officer of VBASE Oil Company explained that “SPEs are oxygen-rich synthetic esters, unlike other esters that are well-known across the industry. This leads to improved thermal management and energy efficiency—key needs across the automotive and industrial lubricants markets.”

The SPE technology also offers detergency and high levels of both biodegradability and bio-carbon content.

Having developed novel chemistry, the next steps for the company are more incremental than revolutionary. “The SPE platform can be extended beyond base oils to include the development of performance additives and extended to other adjacent markets,” Greaves said.

Regulation as a Stimulus

With new molecules still appearing, and new approaches to market introduction, regulation has not killed off new product development.

According to Cramer, “Constraints, such as tighter regulations, actually tend to spur innovation rather than stifle it, as they call for greater creativity both in terms of number and variety of ideas.” Those who succeed, he said, “will leverage constraints as catalysts for breakthrough solutions, driving industry advancement and sustainability.”

Struelens had similar thoughts. “You could say that the regulatory environment slows down innovation, but at the end, it is for a just cause. If there is inherent novelty, you will succeed.”

Trevor Gauntlett has more than 25 years’ experience in blue chip chemicals and oil companies, including 18 years as the technical expert on Shell’s Lubricants Additives procurement team. He can be contacted at trevor@gauntlettconsulting.co.uk