Strange Summer

The Memorial Day holiday marked the start of the summer driving season in the United States. After three years of restricted travel, Americans were expected to hit the road en masse, as gasoline prices have dropped compared to last summer.

According to a Reuters article, U.S. motorists were enjoying a so-called Goldilocks gasoline market with strong production and moderate prices—down 31% from peaks last year. The same enthusiasm did not seem to infect the base oils and lubricants market.

Base oil suppliers continued to face weaker demand conditions than expected. Historically, base oil consumption started to rise in February or March and remained healthy through the summer months. This year, demand remained unusually lackluster, and inventories were substantial for both base oils and finished lubricants.

Base oil consumption had also been expected to be boosted by the need to build inventories ahead of the hurricane season—which runs from June 1 until November 30 in the Atlantic Basin—to avoid shortages in case of production disruptions caused by severe weather. This year, forecasters predicted a “more normal” season and there has been muted interest to keep additional inventories. However, the new director at the National Hurricane Center warned that there is nothing normal when it comes to hurricanes.

Base oil rerefiners mentioned that they had seen a significant change in used oil collection rates. “Usually, collection rates grow gradually starting in mid-March and peak in late June. This year, the rates stayed flat (at winter levels) until early or mid-May and then they took an almost abrupt 15%-20% increase,” a source said. Rerefiners were heard to be struggling to handle this sudden increase in used oil collection, which required not only increased operating rates but also additional transportation and logistical resources. Whether the heightened activity reflected an increase in oil change rates and would eventually result in more substantial finished lubricant demand was still a question. It could also mean that oil changes had been taking place, but suppliers had been using up existing stocks instead of securing fresh shipments.

While it remained a bit of a mystery what was dampening demand for base oils and lubricants, in early June base stock producers decided to step out with posted price decrease announcements, perhaps to stimulate orders and keep mounting inventories in check.

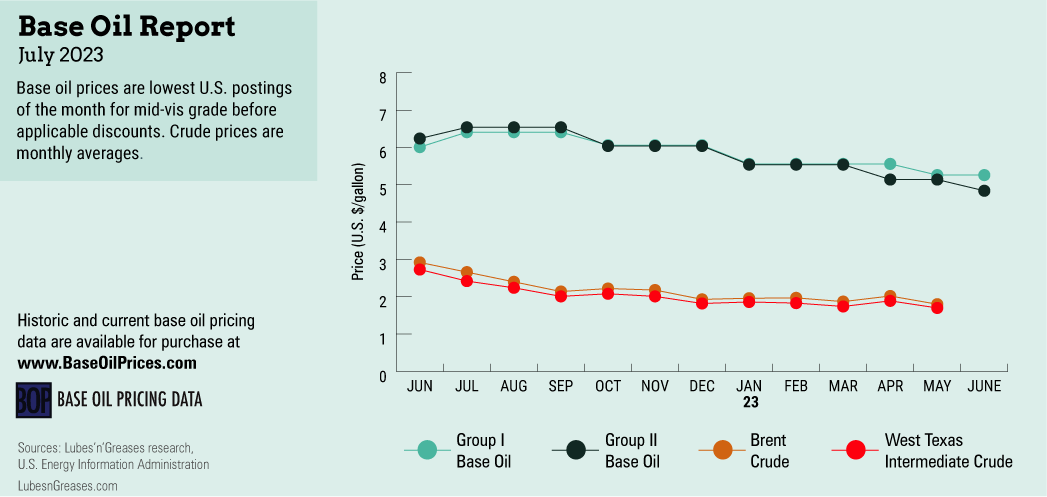

SK Enmove, Motiva and Chevron communicated posted price decreases during the first week of June; these initiatives were quickly followed by other producers. Posted prices for paraffinic base oils were revised down between 5 cents/gallon and 35 cents/gallon, with implementation dates sprinkled throughout June.

The price adjustments were thought to be driven by prevailing sluggish demand, growing availability of most base oil grades and softer crude oil and feedstock prices since the beginning of the year.

Both the Group I and Group II segments were balanced-to-long, depending on the cuts, with the light and mid-viscosity grades slightly tighter than their heavier counterparts. Several transactions were concluded that entailed shipping U.S. products to destinations in Europe, South America, India and Africa. Export business and planned turnarounds at base oil plants were anticipated to tighten domestic supply of Group II grades as June wore on.

Chevron was reported to have started a three-week maintenance program and catalyst change at its Group II plant in Pascagoula, Mississippi, the first week of June.

Calumet scheduled a routine turnaround at its Group I and Group II plant in Shreveport, Louisiana, in the second half of July. Both producers were expected to build inventories to meet contractual obligations during and after the turnarounds.

The Excel Paralubes plant in Louisiana—which was restarted in April after an extended maintenance program and catalyst change—was heard to be running at top rates, leading to additional Group II barrels becoming available.

Maintenance shutdowns aside, lower diesel margins continued to offer incentives for refiners to produce more base oils, which led to high operating rates at most base oil facilities amid healthy inventories.

The Group III segment was largely balanced, with some regions attracting cargoes away from the Americas and leading to reduced shipments from some regular suppliers. A turnaround at a European base oil plant and another in South Korea marginally affected volumes shipped to the U.S. There were reports that two U.S. Group II producers with the ability to make Group III grades have increased output of these cuts given better margins, meeting some domestic demand that is typically fulfilled by imports.

On the naphthenic front, prices were generally steady, supported by balanced-to-tight fundamentals and healthy buying interest from Europe and Asia. But some price pressure was starting to build because of declining diesel values and base oil contracts linked to formulas that include diesel prices.

Supply of the light pale oil grades were more strained than that of the heavier grades, although demand for these grades from the tire and rubber industry experienced a revival at the start of the summer.

Whether the posted price decreases implemented in early June would lead to increased base oil sales remained to be seen. What was fairly clear, however, was that the unusual summer conditions required that both consumers and suppliers remained resilient and inventive to conduct business in an atypical and unpredictable market.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com