It is the general consensus that the future of mobility is electric, and that means that the lubricants industry must do what it has always done: evolve with the times and find new, effective ways to lubricate novel technology. One way that a lubricant company can future-proof part of its product portfolio is by adding thermal management fluids into the mix. As the need for liquid coolants grows, the industry is wasting little time jumping into the deep end.

The liquid coolant market is a hot one, with exponential growth expected over the next decade as large technology and chemical companies enter the sector. The most crucial aspect of that growth is the need to cool data centers as companies expand server capacity to handle such technologies as artificial intelligence, machine learning and cryptocurrency—all of which require high computing power.

But the lubricants industry is also shifting some of its focus to the emerging coolants market as part of its efforts to blend electric vehicle fluids. In large part, this is being done in preparation for the dwindling demand for fluids for internal combustion engines.

The Right Stuff

Perhaps one of the most critical components of an electric vehicle is the battery, which needs a thermal management fluid to keep it from overheating and causing damage to both itself and the vehicle as a whole. With many lubricant companies already making the ingredients needed to formulate this fluid and the massive potential for the market, EV coolants present the perfect opportunity for lubricant blenders, additive manufacturers and base oil producers to enter the space.

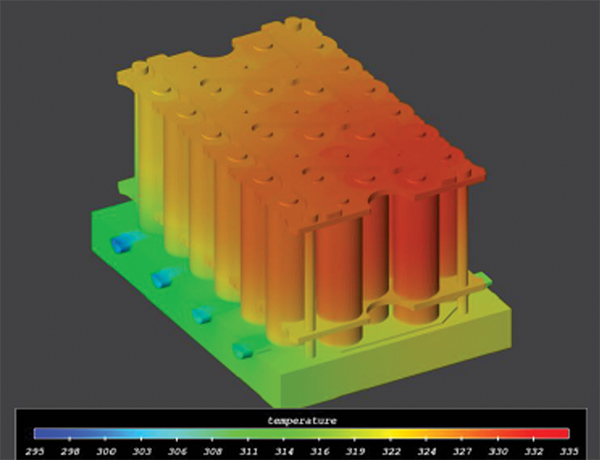

Most electric vehicles use a water-glycol system for battery thermal management. Water obviously conducts a lot of electricity, so the coolant fluid must be applied indirectly using a plate. The fluid flows through this cold plate and is pressed against the battery pack.

Heat maps from CFD calculations by D2H Advanced Technologies. Cooling plate at the bottom, coolant flow from left to right. Thermal gradients within cells from bottom (cool) to top.

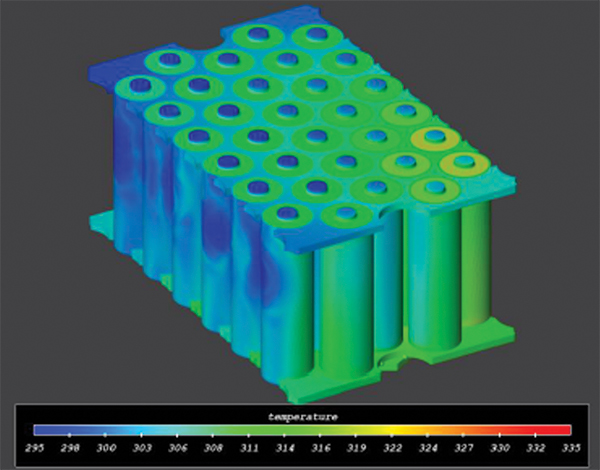

Other companies in the lubricants industry are making dielectric fluids. Since these fluids do not pass electric charge, they enable an immersion cooling system for the battery pack in which the batteries are stored in a casing that is flooded with fluid.

CFD heat maps for immersion cooling. Coolant flow from left to right.

These fluids are made using polyalphaolefins or API Group III base oils because of their desired mix of viscosity, volatility, thermal and electrical parameters. “Compared to a crankcase oil, they have very little additivation,” said Trevor Gauntlett of Wirral, United Kingdom-based Trevor Gauntlett Consulting. “First, you don’t want additives that will mess with the electrical properties or attack the plastics used in the batteries. Then you simply have to protect the fluid with a little antioxidant or some corrosion inhibitor and perhaps protect the plastics used in the battery.”

Heating Up

Batteries require a specific temperature range for optimal performance. This range is around 10 to 30 degrees Celsius for lithium-ion batteries, explained Tom Corrigan, technology development manager with The Lubrizol Corporation.

Any time that current passes through a conductive material, heat will be generated. But exactly how much heat?

“The amount of heat generated can be predicted by H=I2rt, where H = heat, I = the current, R = resistance, and t = time,” Corrigan said. “Activities like charging a battery or quickly discharging during an acceleration can rapidly push the battery out of this temperature range. With no thermal management system in place, a battery may overheat, resulting in a catastrophic thermal runaway event.”

Overheating causes damage over time that will negatively affect a battery’s performance.

“Beginning at the relatively low temperature of 50 degrees Celsius, [solid electrolyte interphase] layer decomposition occurs first, causing irreversible evolution of CO2 and ethylene with precipitation of lithium salts,” Corrigan said. The SEI layer plays a role in a lithium-ion battery’s performance as well as its life cycle.

“At temperatures around 150-200 degrees Celsius, the ceramic separator material degrades,” Corrigan said. “Once degraded, anode and cathode chemistries interact, and the cell releases all of its stored energy over a very short time period in a chemical chain reaction. This process, known as thermal runaway, generates even more heat, which can then propagate the runaway event to neighboring cells. This can quickly get out of hand without proper cooling in place and has led to some very serious fires in automobiles as well as electronics like cell phones.”

Down to Business

Most lubricant companies already supply water-glycol fluids for factory and service fill purposes. Therefore, any lubricant blender with a factory fill contract for a major original equipment manufacturer is probably supplying water-glycol lubricants for electric vehicle manufacturing, Gauntlett said.

Other companies, however, are offering products for dielectric fluids in immersion cooling systems, like Novvi. That does not just include thermal management fluids for batteries, either. Immersion cooling for data centers is the biggest sector of the thermal management fluid industry. Lubrizol, ExxonMobil, Fuchs and Shell, for example, make finished fluids for data centers as well.

Chevron Phillips Chemical Co. also said it would double capacity at its plant in Beringen, Belgium, citing increased demand of PAOs, which it uses for data center immersion cooling. BP Castrol announced it plans to build development and testing facilities for immersion cooling technology for data centers.

Last year, SK Lubricants invested $25 million in GRC, a liquid immersion cooling solutions provider, and said it would supply its own base oils for use in the American company’s fluids.

Fuchs even takes what it calls a “holistic” approach to the battery life cycle by offering products in metal forming and cleaners to create battery cell cans and even coatings for screws and corrosion protection for the battery casing. This strategy includes acquiring part of a company that manufactures electrolytes for batteries.

“I think we realized that in the future the battery of a car will be almost what the engine was in the past,” said Matthias Ostertag, head of Fuchs’ global business segment for automotive components. “So it will be a center point of future mobility.”

Much has been made of widespread electric vehicle adoption spelling trouble for lubricant additive suppliers. These companies will remain vital to the industry, though, and are adapting to the rapidly shifting landscape. They are making thermal management fluids and other e-fluids an integral part of their product portfolios.

“The growth of electrified vehicles will certainly have an impact on overall lube additive demand,” said Shawn Jarecki, director of e-mobility at Lubrizol. “Two common misconceptions out there, however, are that electrification is the end of the internal combustion engine and that electrified vehicles do not require lubricants. These couldn’t be further from the truth. We see a growing demand for dedicated e-fluids as OEMs continue to develop new hardware for their next-generation electric drive units.”

What’s more, ICE vehicles are likely to remain popular for some time, as the average age of vehicles on the road is well over a decade in most regions of the world.

“And while growth of electrified vehicles is increasing globally, ICE vehicles are staying on the road longer—and hybrids and other electrified vehicles still contain an ICE—so there will still be demand for traditional lubricants,” Jarecki said.

The Path Ahead

Talking about the battery itself, the technology and the supply chain could change at any time. Any future shifts in supply or technology could mean that changes will be made to the battery thermal management fluid market, too.

“It’s not clear how the battery market will look in the future. There are some estimates; there are some assumptions. But in the end, which technology will really dominate the market—let’s say in 10 years’ time—it cannot be said today,” Ostertag said. “There are several ways and ideas to cool the battery to the right operating temperature. It must be seen which will be the dominating technologies in the marketplace. Fuchs is working on all technologies and has built up a lot of expertise.”

The future of the supply chain may not be clear, but certain details are starting to come into focus. Currently, most OEMs are sourcing their batteries from outside producers. Chinese company Contemporary Amperex Technology Co. Ltd. made about one-third of all batteries sold globally in 2022, with Chinese, Korean and Japanese producers dominating the rest of the top sellers list.

Now, however, some OEMs are spending billions of dollars to build their own battery manufacturing plants in the United States after the Inflation Reduction Act provided almost $3 billion dollars to spur domestic electric vehicle battery production.

Tesla opened its Gigafactory in a joint venture with Panasonic several years ago in Nevada.

Major OEMs—including General Motors, Ford, Hyundai and others—have all announced the construction of U.S. plants in joint ventures with battery producers like LG and SK. Stellantis—the parent company of Dodge, Jeep and Chrysler—is building a factory in Indiana in cooperation with Samsung. Toyota and Mercedes-Benz are also building their own plants in the U.S. Tesla already opened a factory in a joint venture with Panasonic several years ago in Nevada.

Outside of the United States’ borders, Volkswagen invested $1 billion in a Swedish battery start-up. The deal includes the construction of a battery cell manufacturing plant in Germany.

Will Beverina is assistant editor for Lubes’n’Greases. Contact him at Will@LubesnGreases.com