What are the major factors that forced United States base oil production to plummet in 2022, and how have last year’s unique market dynamics affected import and export volumes?

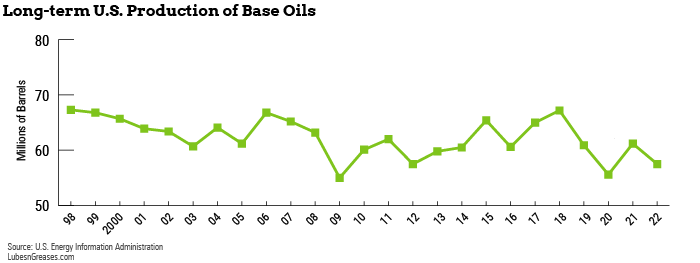

Ringing in at more than 61 million barrels, base oil production in the United States seemed to be rebounding in 2021 from the devastating and cascading effects of the COVID-19 pandemic. However, as has been the general theme of the past several years, anything can—and often will—happen, and last year certainly saw its fair share of tumultuous and market-altering events.

How did these various events affect the U.S. base oil market in 2022?

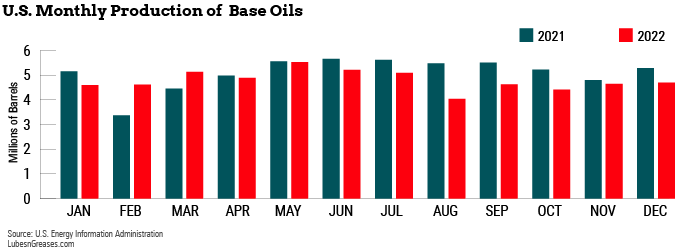

At just 57.5 million barrels, the country’s total base oil production dropped off significantly last year—a 6% decrease from the year previous. August saw the lowest production volume at just over 4 million barrels, 26% less than the same month in 2021 but nearly 20% more than 2021’s lowest producing month (February).

May saw the highest production volume of the year. Compared to the same month the year previous, production in May 2022 fell short by a mere 0.6%, or 35,000 barrels. However, compared to June 2021— that year’s highest-producing month—the highest-producing month of 2022 yielded more than 2% less base oil.

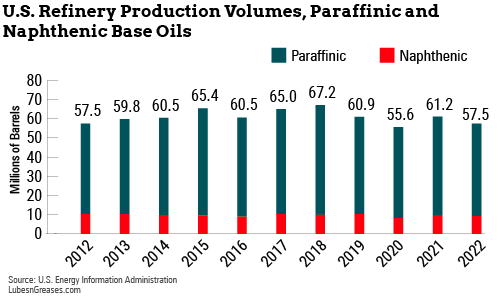

Paraffinic production fell 7% to 48.3 million barrels, down from 51.8 million barrels in 2021. Meanwhile, naphthenic production dipped by a more modest 2% to 9.2 million barrels from 9.4 million barrels the year previous.

The War in Ukraine

Perhaps one of the most market-altering events last year kicked off in late February when Russia invaded Ukraine, prompting a large portion of the world’s developed nations—including the United States, Canada, Japan, United Kingdom, Australia and members of the European Union—to impose strict sanctions on Russian oil and gas products in protest of Russia’s unprovoked attack.

How did these tight sanctions trickle down to affect the base oil market in the U.S.?

The answer is quite nuanced but can be boiled down to a few main points.

First, the sanctions on Russia resulted in a significant increase in the cost of diesel fuel. Lubes’n’Greases Base Oil Editor Gabriela Wheeler explained that “given international sanctions on exports of crude oil and refined products from Russia—and Russia is one of the world’s largest exporters of diesel—the price of diesel really surged last year. This meant that many refiners favored the production of diesel in detriment to base oil output. Feedstocks were streamed to diesel production instead of base oils, causing a drop in base oil production.”

Because many refiners opted to allocate feedstock to diesel production over base oils, supply of many grades became tight for much of the year. Naturally, this affected pricing. In fact, base oil prices stayed on an uphill trajectory for most of the year, with several rounds of increases announced between February and September.

Of course, the historic high prices for base oil in 2022 cannot be entirely blamed on the aftermath of Russia’s invasion of Ukraine. According to Wheeler, “base oil prices moved up during the first three quarters of 2022 because of a tight supply-demand situation and turnarounds in different regions, which made it more difficult to source product in other regions to meet demand shortages at home.”

Additives in Short Supply

In late July, severe flooding in the Midwest region of the United States forced Afton Chemical Corp., one of the Big Four additive suppliers, to temporarily close its production facility in Sauget, Illinois, and declare force majeure. Among the products affected by the declaration were engine oil additive packages and some off-road products.

The global additives market has been plagued by supply issues since a fire broke out at the Lubrizol additives plant in Rouen, France, in September 2019. The blaze caused extensive damage to the company’s facilities and took large volumes of additives out of the supply system for some time. The situation was exacerbated by the COVID-19 pandemic as companies worldwide implemented restrictions and many employees were unable to go to work. As a result, several additive plants cut production or temporarily shuttered their operations.

How do interruptions to additives production affect base oils?

Simply stated, additives are a key component in finished lubricants, so when additive supply is scarce, the supply of finished lubricants follows suit. Further, when finished lubricant production slows, smaller volumes of base oils are needed.

Afton lifted the force majeure just over a month later on September 8.

Production in the PADDs

Not surprisingly, PADD 3—which covers the U.S. Gulf Coast region—was by far the top producing Petroleum Administration for Defense District in 2022. Outputting more than 46.4 million barrels, the district still fell short of its total production (48.2 million barrels) in 2021, representing nearly a 4% decrease.

The Texas Inland portion of PADD 3 produced just 153,000 barrels of the district’s total, while the Texas and Louisiana Gulf Coast segments produced the lion’s share at 36.1 million barrels. The PADD’s production was rounded out by those refiners located in the northern Louisiana and Arkansas regions, which together produced 10.1 million barrels last year.

The next highest producing region was PADD 1, which covers base oil plants located on the U.S. East Coast. Unlike each of the four other PADDs, PADD 1 actually produced nearly 10% more base oil in 2022 (4.5 million barrels) than it did in 2021 (4.1 million barrels).

At 2.5 million barrels, PADD 2—which is made up wholly of HollyFrontier’s 9,500 b/d Group I facility in Tulsa, Oklahoma— saw a minimal decrease (0.08%) from 2021 volumes.

The West Coast refiners in PADD 5 experienced a much steeper drop from 6.4 million barrels to 4.1 million barrels—marking a 36% decrease.

PADD 4, which encompasses the Intermountain region of the U.S., did not produce any base oil in 2022.

Exports Ease Off

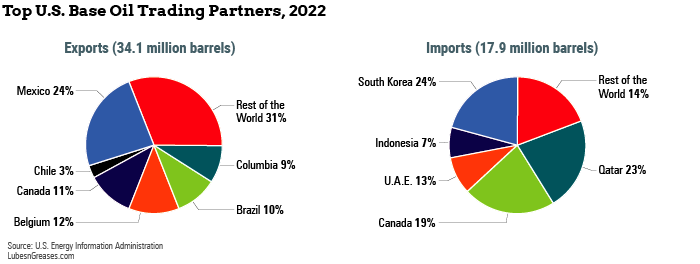

The United States exported significantly fewer barrels of base oil in 2022 than it did the year previous. Down 6%, the country’s exports clocked in at just 34.1 million barrels.

While the countries receiving significant volumes of U.S.-made base oils more or less stayed consistent with previous years, exports to Latin American countries like Colombia (2.9 million barrels) and Chile (1 million barrels) saw a stark increase in 2022.

Exports to Canada—one of the United States’ most consistent base oil trading partners—swelled 7% to 3.7 million barrels. Meanwhile, exports to Nigeria jumped 390% to 960,000 barrels. The U.S. sent very little base oil to France in 2021—just 39,000 barrels—but that amount jumped to 762,000 barrels in 2022.

In contrast, exports to Mexico dropped 34% to 8.3 million barrels last year, while shipments to Belgium and Brazil fell 23% to 4 million barrels and 9% to 3.4 million barrels, respectively. Similarly, U.S. exports to India dropped 38% to just 879,000 barrels.

In December, the U.S. exported just 1.8 million barrels of base oil, the lowest amount for any month last year. Volumes sent to most countries decreased that month: 47% to 510,000 barrels for Mexico; 83% to 77,000 barrels for Belgium; 18% to 237,000 barrels for Canada; 8% to 208,000 barrels for Brazil; 99% to 1,000 barrels for Nigeria; and 95% to 13,000 barrels for India.

Imports Increase

Base oil imports in the U.S. increased by about 6% in 2022, reaching 17.9 million barrels. Comparatively, the country imported about 16.8 million barrels the year previous.

While the U.S. continued to buy base oil from tried-and-true countries in 2022, the portions from its top sources—South Korea, Qatar, Canada, United Arab Emirates and Indonesia—did fluctuate a bit.

Canada and Qatar had been the first- and second-largest countries of origin in 2021, but South Korea passed both last year when its shipments to the U.S. rose 22% to 4.3 million barrels. Canada’s exports to its southern neighbor declined 9% to 3.5 million barrels, while Qatar’s swelled 11% to 4.1 million barrels.

Imports from the United Arab Emirates and Indonesia increased 43% to 2.2 million barrels and 6% to 1.2 million barrels, respectively, while those from the Netherlands and Bahrain fell 26% to 815,000 barrels and 25% to 678,000 barrels.

The United States imported 967,000 barrels of base oil in November, down from 1.6 million barrels the same month of 2021. November was the first month to fall below 1 million barrels since July 2021 and the lowest total since 702,000 barrels that same month. November may have been down at least partly because of the unusually high amount of base oils imported the previous month.

The October import volume was 2.2 million barrels, the highest monthly amount in more than a year and significantly higher than any other month that year. July and August had the next-highest amounts, clocking in at 1.7 million barrels each.

Most of the base oils imported to the United States are Group III grades, as the country has little capacity to produce that category domestically.

Sydney Moore is managing editor of Lubes’n’Greases magazine. Contact her at Sydney@LubesnGreases.com