Need to Know

There are four phases of industry consolidation, and successfully navigating through them requires an understanding of where we are in the process as well as planning and acting accordingly as phases change. This is particularly important for lubricant distributors to consider due to the current transition.

Understanding what phase the industry is in and where it’s heading starts with a look back at where it’s been.

The first phase of distributor consolidation started with merger and acquisition activity of the major oil companies in the 1990s and early 2000s. The first was British Petroleum’s acquisition of Amoco Corp., then Pennzoil’s acquisition of Quaker State in 1998. This was followed by Exxon’s purchase of Mobil in 1999, then Chevron’s deal to acquire Texaco in 2001. In 2002, Royal Dutch/Shell Group acquired Pennzoil-Quaker State Co.

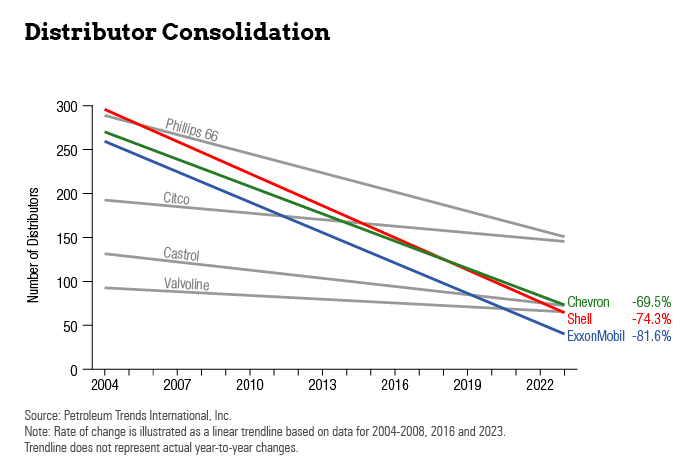

Prior to their M&A activity, majors maintained networks of 300-500 distributors. Later, merged majors had to rationalize the combined number they were doing business with to minimize channel conflicts, improve efficiency and reduce costs. With that, Chevron, ExxonMobil and Shell culled their distributors by alignment models based on volume metrics, brand commitments, sub-jobber arrangements and other methods.

The writing was on the wall and distributors were getting the message that they had to either align and commit to grow business with a given major or risk contract cancellation. Understandably, this drove consolidation and gave rise to new enterprises in lubricant distribution. One of the first was PetroLiance, which was initially formed in 2006 by the merger of four ExxonMobil distributors (Boncosky Oil, Commercial Ullman Lubricants, Young Oil and Lubricant Technologies). Another three distributors were later bolted on before PetroLiance was acquired by PetroChoice in 2014.

Within a few years of the majors’ merging, they reduced their distributor rosters close to what they had prior to the M&A activity.

Further fueling the first stage of consolidation was the Great Recession of 2007-2009. Lubricant distribution was highly fragmented, and with relatively flat demand the economic downturn put significant financial pressure on small distributors. Many found they had to either close or sell their businesses to competing distributors. While most of the deals during this period were relatively small, the fragmentation of the industry and business dynamics attracted private equity (PE) investments. With that, PE entered the space with such notable early builds as RelaDyne, Windward Petroleum, PetroChoice and Maxum Petroleum.

Mergers among the majors, together with the casualties of the Great Recession, sharply reduced the number of dedicated lubricant distributors in the U.S. from nearly 10,000 in the early 1990s to roughly 7,500 in 2002. This set the stage for the second phase of consolidation: a period when large distributors worked aggressively to build scale through acquisitions. One example is RelaDyne. As a PE-owned enterprise, RelaDyne acquired close to 40 distributors from 2010 to 2023, and many of these deals were big, including the acquisitions of Hollingsworth, Hill Oil, Seaboard Neuman, Paulson Oil, PPC, Grupo Lucalza, and Allied Oil. Another is PE-backed PetroChoice, which acquired 15 lubricant distributors and amassed nearly 65 million gallons in annual sales before being acquired by Moove in 2022.

Candence Petroleum, a leading distributor in the Southeast and Mid-Atlantic market, was also acquired by a PE firm. Cadence’s acquisitions include Apollo Oil, Brewer-Hendley, Davison Fuel & Oil, Frost Oil, Halco Lubricants, Mid-South Sales, Pugh Lubricants, Stockman Oil, Veteran’s Oil and Yoder Oil.

In addition to PE, some of the rollups were strategic. The most notable are seen with Brenntag and Pilot Flying J (now Pilot Thomas Logistics). Brenntag, a global market leader in chemical and ingredients distribution, expanded into the U.S. lubricants business by acquiring Lubrication Services, LLC, J.A.M. Distributing Co., G.H. Berlin-Windward, the lubricants business of NOCO, Mayes County Petroleum Products, the Lubricants Division of Reeder Distributors, and B&M Oil Co. Pilot Flying J made a big splash in the lubricant distribution business when it acquired Maxum Petroleum, which at the time was distributing over 1.3 billion gallons of refined petroleum products.

Today there are roughly 900 distributors with a core business in lubricants. Another notable and expected product of consolidation is how it has reshaped the size of distributors. While in the mid-2000s a large distributor was selling 5-12 million gallons of lubricants a year, a large distributor today is moving 12-40 million gallons. Furthermore, it is estimated that nearly 10 distributors have sales exceeding 40 million gallons and several are approaching 70 million gallons.

While there is no clear line of delineation separating one phase of consolidation from another, the size and nature of today’s deals point to the industry moving into the third phase of consolidation. This is when the collaborative race among the majors and their distributors to dominate the industry intensifies. While the pace of acquisitions declines in this phase, the scale of acquisitions will be staggering, including mergers of “equals.” They will bring in more strategic buyers, like we have seen with Brenntag, Pilot Thomas Logistics and Moove.

Further, understanding there are comparatively few left to cut from the ranks of distributors among the big three majors, it is important to consider that an estimated 40% of distributors dedicated to the lubricants business sell less than 2 million gallons annually. Although there are still other brands they can and do represent, many are expected to face some tough financial challenges and decisions, especially considering the cost advantages that come with scale and the intensity of competition in the third phase of consolidation.

Tom Glenn is president of the consulting firm Petroleum Trends International, the Petroleum Quality Institute of America, and Jobbers World newsletter. Phone: (732) 494-0405. Email: tom_glenn@petroleumtrends.com