As the heavy-duty and passenger car populations continue to modernize throughout Latin America, there is a widening performance gap between engine oils that new vehicles require and what is available in the market.

Vehicles today—be they heavy-duty diesel trucks or passenger cars—are changing. This is happening by necessity, as governments throughout the world enact new initiatives to curb greenhouse gas emissions commonly generated by internal combustion engine-powered vehicles.

As drivers everywhere find themselves behind the wheels of increasingly efficient and sophisticated vehicles, the lubricants market must be there to provide support. Engine oil is a critical enabler of modern engine technology, and as those engines proliferate in growing markets around the globe, lubricant standards must reflect the engine population they support.

This brings a focus to one region in particular: Latin America, which is an increasingly important market for heavy-duty trucking and numerous forms of passenger transport. Modern engines, including new-model diesels and sophisticated gasoline-powered engines, are becoming increasingly common within the region. The case is such that in countries like Brazil and Mexico, lubricant standards have not kept pace. This has presented a critical challenge for lubricant manufacturers, original equipment manufacturers and end users.

The widespread availability of high-performing lubricants in a growing, major automotive market is important. New hardware depends upon several performance characteristics that older, out-of-spec lubricants simply are not able to provide. Sufficiently upgrading the Latin American market to keep pace with newer engines will not be without its challenges, but it is a necessity for a changing car parc. Let’s explore the current state of the Latin American market, the variety of newer engine types making gains in the market and their lubrication requirements, and actions the lubricants industry can take to advocate for and promote the use of high-performing formulations in Latin America and throughout the world.

Snapshot of the Latin American Market

As of early 2023, the Latin American economies proved themselves quite resilient on their rebound from the COVID-19 pandemic. This has paved the way for the Latin American automotive industry to remain established as one of the most important in the world, where Mexico and Brazil have established leadership not just within the region but around the globe.

Currently, Brazil ranks as:

- 8th largest global vehicle producer

- 6th largest global vehicle parc

- 7th largest market for new vehicle registrations

Meanwhile Mexico ranks as:

- 7th largest global vehicle producer

- 8th largest global vehicle parc

- 14th largest market for new vehicle registrations

Decarbonization is a key topic in both Mexico and Brazil, but the ways in which each country will go about achieving their goals will diverge. Brazil is expected to establish continued leadership in biofuels, which make effective use of the country’s natural resources. Mexico will most likely follow the United States due to the two countries’ important commercial alliance and geographic proximity.

ICE technology stands to remain critically important throughout the region in the coming years. In fact, ICE technology represents the vast majority of today’s Latin American vehicle production. Some industry experts predict that in the next ten years or so hybrid electric vehicles will represent the larger part of total vehicle production in the region, while ICEs and fully electrified vehicles (be they plug-in hybrids, battery electric vehicles or fuel cell electric vehicles) will round out the population.

It is instructive to compare this forecast to other regions, where full electrification is anticipated to be much more impactful. The North American marketplace is expected to see about half of its total vehicle population become fully electrified in the coming decade. The percentage of EVs in the European car parc will significantly outweigh that in North America. Hybrids will be common in both markets as well, while ICE technology will be relegated to a minority.

As hybrids and ICE vehicles are forecast to make up the majority of the vehicle population in Latin America into the foreseeable future, it is critically important that high-performing lubricants are available to help them perform as intended and meet their full potential.

Enabling Modern Passenger Car Vehicles

Latin America broadly adheres to the American Petroleum Institute’s service categories, the most recent of which is API SP, introduced in 2020. API SP sets lubricant performance standards that help ensure certified oils can meet the demands of modern engine technology—including engine downsizing, gasoline direct injection and turbocharging.

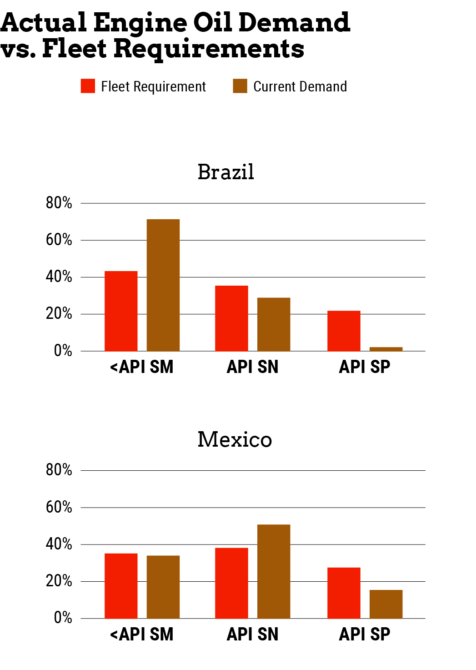

These technologies are rapidly gaining ground throughout Latin America. If for simplification, we consider the fleet vehicle age profile and compare it with the launching date of the most relevant API specifications, we could see that in Mexico close to 30% of the fleet would require API SP category engine oil. However, only about half of the current demand meets that requirement, according to a 2021 analysis by Kline (Kline & Company, 2021, Mexico Lubricant Profile). The same Kline analysis showed that in Brazil more than 20% of the fleet requirement would require API SP, but there is almost no customer demand to meet that need (Kline & Company, 2021, Brazil Lubricant Profile).

What’s more, the same situation happens when we analyze the API SN profiles; nearly 40% of the fleet requires it. Today, many available lubricants throughout the Latin American market only meet API SM and lower performance criteria. API SM, for instance, was first introduced in 2004 for use in gasoline engines and is not suitable for use in engines introduced after 2010.

All of this makes for a critical performance gap. API SN and SP certified fluids provide several performance characteristics that are necessary for modern passenger car engine technologies to perform as intended, including:

- Anti-wear and friction modification. Advanced anti-wear additives help high-performance formulations deliver robust protection for engine parts under more severe operating conditions, while the right friction modifiers can help allow lower-viscosity formulations to contribute to fuel economy gains.

- Advanced detergents. Mitigating deposit buildup and maintaining engine cleanliness have long been important jobs for lubricants, and they remain as critical as ever. Newer chemistries that are more compatible with modern engine environments can help maintain long-term engine performance.

- Low-speed pre-ignition (LSPI). LSPI is an uncontrolled combustion event that takes place in the combustion chamber prior to spark in GDI engines. The phenomenon can lead to extremely high pressures in the combustion chamber and pressure wave reversals that are violent enough to result in catastrophic engine damage. Most commonly, damage includes broken pistons and rings. API SN Plus- and API SP-certified formulations include critical LSPI protection capabilities.

If available engine oils within Latin America are lacking these performance characteristics, end users could be faced with significant challenges and costly repairs. Elevating the availability of high-performing formulations in this region should be a priority for the entire lubricants industry.

Enabling Today’s Heavy-Duty Diesel Technology

Like the passenger car segment throughout Latin America, available lubricants for commercial vehicles lag behind.

Consider that commercial vehicles produced after 1998 require lubricants that perform at the levels of the API’s CH-4 performance category and above. In Latin America, roughly 25% of the total commercial vehicle lubricant market is stuck in the past. Many fleet owners, despite the improvements in vehicle technology, are using lubricants with API CF-4 grades and lower.

CH-4-grade lubricants or higher provide significant advantages over legacy lubricants, including improved:

- Oxidation and deposit control. Modern equipment has evolved to address harmful combustion byproducts. One way in which OEMs have done this is to move to high-top piston rings in their engines. An unintentional side effect, however, is that it can significantly increase the heat an engine produces, which raises the levels of lubricant oxidation and deposit formation. Using lubricants at grades CH-4 and above reduces the levels of oxidation and provides more effective deposit control.

- Wear protection. Modern equipment has changed the number of valves in diesel engines from two to four to improve combustion. Consequently, the amount of surface area that the lubricant needs to protect is also increased. CH-4 lubricants and above account for this additional surface area, providing the necessary protection that previous generation lubricants cannot.

- Soot handling. To reduce the amount of nitrogen oxide (NOx) emissions, OEMs have broadly lowered combustion flame temperatures. This has led to the unintended consequence of an increased amount of soot production, though. Modern lubricants account for this fact and feature soot control additives in their formulations.

- Complexity reduction. Many Latin American fleets are using different grades of lubricants for different vehicles, ranging from API CF-4 to CK-4, and this can lead to inventory complexity headaches for end users. Upgrading to a uniform lubricant standard will reduce the complexity of these decisions.

Using the right lubricant is critical to keeping modern equipment functioning at its highest levels. The lubricants industry must communicate how and why using a lubricant

designed to meet a 27-year-old specification means today’s equipment is not receiving proper protection.

Elevating Base Oils in Latin America

One hurdle to upgrading the Latin American market, particularly in Brazil, is the ready availability of more highly refined base oils. Brazil is a major producer of Group I base oils, which are defined by the API as those containing less than 90% saturates and/or greater than 0.03% sulfur and have a viscosity index greater than or equal to 80 and less than 120. Simultaneously, supply chain disruptions caused by the pandemic severely restricted the import availability of Group II base oils and higher, and drove prices higher.

Considering these circumstances, Group I base oils remain highly attractive to oil marketers and formulators throughout Latin America. It is here where upgrading the marketplace meets perhaps its biggest hurdle. Formulating higher-performing fluids requires more highly refined base oils. Group II stocks and above are inherently much more resistant to oxidation and are generally more stable, allowing formulators to meet the criteria of API SP or CH-4 and above with greater ease; doing so with Group I stocks is either impossible or prohibitively complex and costly.

It is also worth considering that viscosity grades continue to trend downward as OEMs seek to improve fuel economy in ICE engines by specifying lubricants that can contribute to such gains. Maintaining the necessary levels of protection in thinner and thinner formulations further requires the use of Group II and higher base stocks. As the Latin American vehicle parc becomes newer and is increasingly made up of hybrid technology, it is an absolute necessity that higher-quality base oils become more common throughout the region. It is incumbent upon the lubricants industry to communicate these challenges and advocate for their adoption.

The Time Is Now

The Latin American automotive marketplace faces an urgent need to improve the quality of lubricants sold in the region; increasing hybridization and the proliferation of more modern ICE technology demands it. Oil marketers throughout the region must meet today’s challenges through a combination of advanced additive chemistry and higher-quality base stocks. Doing so can help enable the entirety of the Latin American car parc to meet its full potential.

FABIO ARAUJO is business manager, Latin America, engine oils for Lubrizol.