New tests, tools and regulations are driving oil analysis.

According to Research Nester, the high-performance lubricants market is expected to exceed $3 billion in the next 12 years—about 50% more than the value of the current market. Much of this will be driven by the automation rate of gear- and bearing-dependent industrial equipment that cannot function without proper lubrication. Fortune Business Insights has projected similar growth.

Reliability testing facilities need to keep pace with this growth, along with the new fluids and new demands on existing fluids. Although some larger companies have in-house testing labs and others are experimenting with inline sensors, today’s reliability testing labs are dealing with an unprecedented volume of samples. In addition, the pressure on reliability labs to keep up with expanding testing requirements and capabilities is continually mounting.

Demands on Lubricant Performance

Lubricant formulators have been introducing a steady stream of high-performance lubricants to keep pace with a host of requirements necessitated by new environmental regulations, machinery requirements, market demand and more. These requirements, which include the following, affect lubricants for both stationary and mobile equipment.

- Efficiency and sustainability. Lubricants must work harder to minimize friction and reduce energy consumption.

- Elevated operating temperatures. Newer machinery is operating at continually elevated temperatures, which increases the strain on lubricants—especially in terms of viscosity.

- Advanced materials. Lubricants need to be compatible with a greater variety of materials, such as advanced alloys, composites and polymers.

- Contamination control. Even minute particles can result in flaws that render products unsalable. This means lubricants need to be resistant to contamination.

- Regulatory compliance. In addition to stricter environmental regulations, worker safety regulations are increasing as well. Of particular concern are toxins, most recently in fluorinated substances (PFAS), which are essential in some industries but are on the way to being phased out.

- Extreme operating conditions. These include high pressures, low temperatures and corrosive environments.

- Compatibility with alternative powertrains. As electric and hybrid cars have become more popular, lubricants need to be able to work with the new powertrains and materials from which these cars are made.

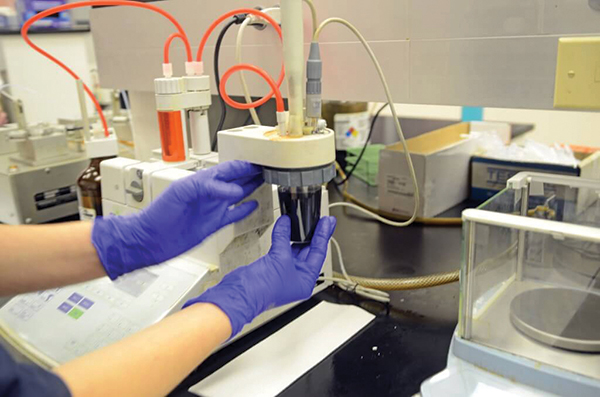

Base number titrator © Source: Eurofins TestOil

To address all of these concerns, there is a growing family of high-performance lubricants that require sophisticated testing to sustain and extend lubricant and equipment life.

New Equipment Reliability Tests

New oil analysis methods and tests are continually being developed to accommodate new lubricants as well as more challenging operating conditions. Several such tests and methods are listed below:

- Particle counting and sizing. Advances have allowed for more precise particle counting and sizing in order to detect wear debris, track contamination levels and predict component failure.

- Elemental analysis. Inductively coupled plasma (ICP) spectroscopy and X-ray fluorescence (XRF) are becoming increasingly precise; they are able to identify more trace elements and impurities in oil.

- Viscosity index. Viscosity can be measured more quickly and accurately with new tests and technology.

- Fluid cleanliness testing. More precise information regarding the cleanliness of oil is provided through enhanced techniques for evaluating fluid cleanliness, such as ISO cleanliness codes and patch testing.

- Wear debris analysis. To examine wear debris in more detail, methods such as scanning electron microscopy (SEM) and infrared spectroscopy are now essential.

- Oil degradation monitoring. New tests are able to track changes in the characteristics of oil over time, such as acidity levels and base oil degradation.

- Fluid identification and authentication. The proliferation of new lubricants increases the chance that the wrong lubricant will be delivered or is in use. With more lubricants to identify, tests such as spectroscopy continue to advance.

- Machine learning and predictive analytics. Higher-level data analysis is becoming more and more prevalent. This is especially true for predictive and proactive oil analysis. New technologies are better able to recognize patterns and trends, forecast equipment breakdowns and recommend maintenance procedures.

Membrane Patch Colorimetry (MPC) test setup © Source: Eurofins TestOil

Oil analysis is becoming increasingly accurate, predictive and integrated with other maintenance and monitoring systems as technology develops. This allows enterprises to make confident assessments on the health of lubricants and machinery performance.

New and Pending Regulations

Oil analysis is affected by a number of regulations and standards. The following recent and impending regulatory categories may have an impact on oil analysis:

- Emission rules. Newer regulations, like those pertaining to air quality and greenhouse gases (GHGs), may have an indirect effect on oil analysis. In order to reduce emissions and maintain compliance, industries subject to emissions regulations need to regularly monitor the functioning of their equipment, including the state of the lubricants.

- Environmental rules. Stricter oversight and management of oil leaks, spills and disposal may be necessary in order to comply with environmental rules. Regulations controlling the treatment and disposal of used oil can be complied with and potential sources of environmental pollution can be found with the aid of oil analysis.

- Worker safety and health regulations. In most sectors where lubricating oils are used, worker safety is a major concern. This means regulations pertaining to worker exposure to dangerous chemicals and substances may necessitate rigorous monitoring and analysis of oil sample data.

- REACH legislation. Manufacturers and importers of chemicals are required to evaluate and control the risks related to chemicals, including lubricants.

- Biodegradability verification. Where biodegradable lubricants are required, the environmental performance and biodegradability of these lubricants can be confirmed through oil analysis.

- Data security and privacy. As oil analysis data is increasingly integrated with digital systems and cloud-based solutions, laws pertaining to data security and privacy—such as the GDPR—may be applicable.

All of this puts additional pressure on oil analysis labs to continually stay on top of both domestic and international regulations, their requirements and implementation dates.

The State of Sensors

The majority of early sensors were straightforward, single-point dielectric conductivity or permittivity measurement tools for oil oxidation detection. However, they were insensitive to other important characteristics. Today, some sensors can estimate the percentage of soot, base number, relative humidity, additive depletion and more. These sensors can offer insight into making preventative maintenance decisions before harm occurs—with the potential to complement rather than replace the results of laboratory analysis.

Sensors are basically miniaturized versions of bench-top devices. They were adopted early on in applications that involved hard-to-access equipment, such as wind turbines. For other equipment, the main barriers have traditionally been their capabilities, but that is now changing. Inline sensors still deliver, in real time, some of the same information as a lab does, but the majority of sensors are unable to identify fuel, metals, nonmetallic pollutants or a combination of these things. Even the most ardent supporters of sensors understand that a lab is necessary to complement and examine sensor findings.

One glaring issue with sensors is their cost—both initial outlay and continued maintenance. Another issue is practicality. While they gather and transmit data, by itself, this information isn’t all that helpful. In fact, it might even be frustrating if it implies that some action is required but fails to specify what that action should be. This scenario would be like receiving a notification from the IRS that merely states the tax return is incorrect.

Data simply reveals what is happening, not why or how to fix it. Data must be examined and understood by an expert in order for it to be useful. Based on a deeper comprehension of the operating environment and priorities of the customer, an experienced CLS analyst will make recommendations for action. Sensors are not capable of this.

To compete on the same playing field as lab analysis, the quality requirements for sensors would have to be very high and they are not there yet. For example, to differentiate between various wear metal particles, laboratories offer testing with accuracy levels down to multiple decimal places.

While sensors sometimes serve as a smart first line of defense, they cannot replace the increasingly complex testing that an oil analysis lab with knowledgeable analysts offers.

The National Institute of Health conducted a sensor study on agricultural equipment in 2021. Five sensors from various manufacturers were utilized for inline monitoring of hydraulic fluids and lubricants.

Although the results were generally favorable for the sensors in terms of accuracy, researchers did find some reason for concern. For example, in order for the sensors to function properly, special attention had to be paid to the oil flow rate and line conformation in order to prevent any turbulence from interfering with measurements.

Sensors and oil analysis labs can seamlessly work together in most applications—with sensors providing immediate notification of impending failure and lab analysis digging into the cause. Lab analysts will be able to confirm or question sensor findings and offer suggestions for corrective action before damage occurs.

Conclusions

Today’s oil analysis takes advantage of advanced testing protocols, increasingly accurate predictive maintenance methodologies and higher-level analytics. As more powerful machinery and increasing regulation make greater demands on the oil, these and other considerations also require oil analysis labs to continually expand and fine-tune testing procedures.

Despite these challenges, oil analysis remains a critical tool for predictive maintenance, helping to avoid equipment problems and minimize downtime.

Mary Messuti is the president of Eurofins TestOil, Inc. located in Strongsville, Ohio. Her lab offers a full line of lubrication testing as well as fuel, coolant, grease and associated tribology services. Mary enjoys over 25 years of experience in both laboratory management as well as heavy industrial and aerospace manufacturing environments.