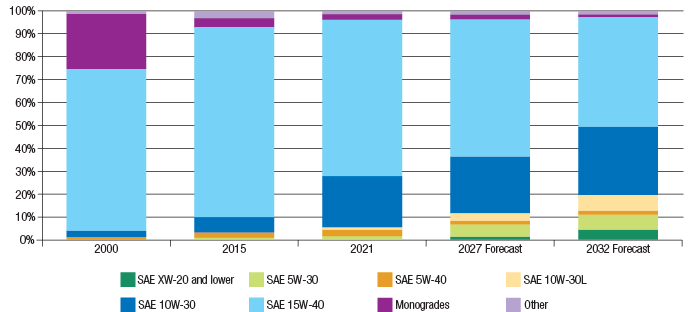

Unlike passenger car engine oils, heavy-duty engine oils have been slow to migrate to lower viscosity grades. The pace is slower, but the trend is clear: Lower-viscosity HDEO continues to displace demand for SAE 15W-40, primarily in favor of 10W-30. This shift from heavier to lighter viscosity will continue as OEMs drive toward higher fuel efficiency and lower emissions.

The evolution of HDEO viscosity grades started with the declining use of monogrades following the introduction of multigrades in the 1950s. While it took nearly 30 years for the transition to reach an inflection point, demand for monogrades was supplanted primarily by SAE 15W-40, dropping to roughly 30% in the 1990s. Today, monogrades account for less than 3% of demand in North America and continue to decline globally.

Even though SAE 15W-40 was the dominant viscosity grade for over 30 years, it too is being transitioned out of the market in favor of more fuel-efficient SAE 10W-30 and lighter grades. From its peak at over 80% of market share in 2010, 15W-40 demand fell to about 67% in 2022, according to Infineum.

Similar trends are seen globally, but there are regional differences. In Europe, for example, there is significantly higher interest in 10W-40 than in North America, and 20W-50 has grown to become a popular grade in Asia-Pacific.

Rate of Change

While it’s clear that HDEO is moving to lighter viscosity grades, what is less clear is the rate of change and the market development of viscosity grades lower than SAE 10W-30. End users in the commercial automotive sector resist changes for many reasons, including concern that the benefits of enhanced fuel economy offered by lower-viscosity HDEOs come with a compromise in engine protection.

Although it will take time for some fleet operators to separate the perceptions from the realities concerning the costs and benefits of using lower-viscosity HDEO, there is a significant body of work in support of the benefits. While there is merit to some of the concerns (i.e., back serviceability and availability), the benefits are expected to become more compelling as the market develops.

In 2016, the EMA and API introduced the FA-4 quality level. This gave birth to a low- and high-viscosity 10W-30—the low viscosity with a 2.9-3.2 centistoke HTHS and the high viscosity with a minimum 3.5-cSt HTHS. This was the first time an HDEO was licensable with an HTHS below 3.5 cSt. Importantly, where the high-viscosity 10W-30 (CK-4) formulations are backwards compatible, the FA-4 versions are not.

While PC-11 allowed adoption of API FA-4 fluids by OEMs in 2016, OEM recommendations for their use were slower than expected, and their use by end users remains below what was anticipated when FA-4 was first introduced. Despite significant gains in fuel economy, end users have resisted these fluids due to a lack of universal application and back serviceability concerns. There also appears to be a growing divide between the products needed for on-road diesel engines and off-road diesel engines. For these reasons and others, market acceptance and the rate of transition to lower-viscosity HDEOs has been slow and complex.

Mike Alessi, technology integration manager at Exxon Mobil, described viscosity trends in North America: “5W-30s and 10W-30s can offer a tangible improvement in fuel economy, which is clearly increasing in importance with users. But many fleets have a range of equipment ages, which raises concerns of suitability of a single fluid. At this point, XW-30s have been on the market since 2006 in North America, so concerns about older equipment being unable to use lower viscosity grades have decreased as vehicles in the fleet have turned over. We expect XW-30s to eventually become dominant in the North American on-highway market as OEMs design engines for better efficiency and promote the use of the grades. Off-highway will be much slower to turn over, if at all, due to the age and cost of the equipment. The high costs of maintenance and replacement will slow adoption, since regulatory pressure on this market is behind the on-highway segment. The drive for efficiency will eventually catch up to off-highway, and the industry will need to support the OEMs when the demand arrives.”

FA-4 adoption, in particular, is likely to be slow for several reasons. “FA-4 faces further headwinds in the market due to several factors,” Alessi said. “Slower OEM adoption than initially expected limited the immediate demand, there was confusion in the market with two 10W-30 grade oils, limited backwards compatibility meant mixed-age fleets would need to carry two oils, and some auxiliary power unit manufacturers were uncomfortable with FA-4. All these factors combined to make for a slow adoption rate, but API and EMA continue to work on consumer education, and we expect the new fuel economy category in PC-12 to have better adoption.”

Tom Glenn of Petroleum Trends International added: “End users generally favor a one-size-fits-all engine oil that meets the performance requirements of as many power platforms in their fleet as possible. In addition to the economic advantages of purchasing and storing such products in bulk, single barrel solutions also minimize the probability of error when servicing mixed fleets. Due to its high demand, SAE 15W-40 is commonly available to end users in bulk quantities, and this makes it very cost effective to meet most, if not all, of their needs. While demand for 10W-30 with CK-4 credentials has grown to a point where it too is now readily available in bulk, that’s not the case with FA-4. With fewer applications and limited back serviceability, FA-4 is not readily available in bulk and has not been an attractive alternative. For this reason, many marketers and their customers have landed on SAE 10W-30 CK-4 as the new one-size-fits-all product.”

How Low Can You Go?

Developing and deploying advanced low-viscosity HDEO is not new to the industry, and the complexity and time required for market acceptance has historic precedence. “Infineum began developing and evaluating HDD fluids as low as SAE 0W-12, since around 2009, as we believed that improved fuel economy could be obtained while protecting critical hardware of the engine,” Danny Pridemore, Infineum liaison manager, said. “Based on this work, we progressed shortly thereafter to successfully complete an HDD fuel efficiency demonstration program using an XW-20 grade product, including completion of all testing required for API CJ-4 performance and additional OEM engine testing.”

Even though these products exist, it takes time for the market to develop. “There have been limited commercial applications for fluids as low as SAE 0W-20 by European OEMs for over 15 years,” Pridemore said.

It is important to note, though, that “XW-20s offers real benefits for hardware and fleets sophisticated enough to implement them,” Alessi said. “These viscosity grades have been used in Europe for well over a decade, so the concept is certainly not new. These will initially be niche products due to some of the same issues that faced FA-4 in terms of OEM acceptance and mixed fleets, but there will be fleets that can and will benefit early from these products.”

While market acceptance is typically a challenge and often takes more time than anticipated, development of PC-12 is currently underway to replace both API CK-4 and FA-4. While the CK-4 replacement will manage legacy applications, on-road OEMs are looking to maximize fuel economy from the engine oil by introducing XW-20 fluids as part of the new category that replaces FA-4.

Defining these products is likely the easy part. Convincing all OEMs to recommend them and end users to use the fluids will be a challenge. These products will be expensive to develop and supply, which will make investments throughout the supply chain hard to justify. Approximately 30% of the market is also used off-road in mining, construction and agriculture. These applications primarily use SAE 15W-40 and have not rushed to use lower-viscosity fluids, even though off-road equipment has allowed the option to use SAE 10W-30 for years.

“To avoid repeating the slow growth experienced by API FA-4, OEMs should actively promote and recommend the new lower-viscosity HDEOs,” Pridemore said. “Fleet managers often have a broad mix of different vehicle makes and older versus newer equipment for which they must select a single product. From a technical perspective, formulating lower-viscosity HDD oils is a combination of viscosity versus application versus wear protection. Advancement in additive technology and engine design have enabled lower-viscosity HDEOs that have proven themselves in millions of miles of successful service. However, reluctant fleets view viscosity as a measure of protection and often choose perceived improved durability over potential fuel economy.”

What might be the timeline for adoption of looming low-viscosity oils? “Given what was experienced with the rollout of API FA-4, it will likely take many years beyond the initial launch of PC-12 before we see wide adoption of XW-20s,” Glenn said.

Future Trends?

What might viscosity trends look like in the coming years?

“Through 2030, we estimate SAE 15W-40 will remain the largest HDEO viscosity grade in North America. Though larger on-road fleets appear to have adopted SAE 10W-30 grades to capture improved fuel economy, smaller fleets and owner-operators have been slower to adopt due to a perceived risk of decreased engine protection,” Pridemore said. “As proof of performance in the real world demonstrates, modern low-viscosity oils do provide the necessary protection, and as diesel prices continue to rise, we expect there will be a growing interest in the fuel economy benefits of lower-viscosity HDD oils.”

Does this forecast hold true for off-road applications?

“Certain sectors of the market, such as off-road, will likely be slower to transition. SAE XW-20 and lower viscosity grades are seen as a means to enhance fuel economy, and new specifications, such as PC-12, are assessing the inclusion of these grades,” Pridemore said. “We anticipate the greatest interest coming from on-highway fleets seeking to lower operating costs. We expect this will be a balance between the rate of transition to electrification and alternative powertrains versus the efficiency gains of moving to lower-viscosity engine oils. Given how slow the market has shifted thus far, it’s reasonable to expect that the rate of adoption of these new lower-viscosity grades will remain slow unless the OEMs or environmental regulations require their use.”

North America HDD Viscosity Grade Trends

In Europe, some believe the adoption rate could be faster. “The North American market has been much less segmented than the EU market,” Alessi said. “A single API specification would be developed, and OEMs would create an OEM spec built closely off the existing API spec with a few increased performance requirements, but oils can be developed that can meet all the major specs. Europe sees much more reliance on OEM specifications and a willingness to separate performance, viscosity and chemical limits. This segmentation makes it easier for OEMs to tailor oil recommendations to technology, and consumers seem more willing to carry multiple oils.”

In Asia-Pacific, “it is difficult to generalize due to its size and diversity,” he said. “Some areas follow ACEA, while others use API, and we still see many even higher-viscosity oils. As China is developing its own specification, D1, it will be interesting to see how it further adds to the complexity of the global supply chain.”

Unlike gasoline engines, which appear to have reached their limits for practical applications of lower-viscosity fluids, there is still a good deal of headroom for 10W-30 and lighter grades to capture market share in the heavy-duty segment. But facing far more resistance to change than that seen in the consumer automotive segment, demand for lighter-viscosity HDEOs will develop slowly. As such, 15W-40 is expected to continue to command a sizable share of the market.

Niche products below SAE 5W-30/40 will emerge in the next decade, with progress likely seen first in Europe. It remains to be seen if a sizeable number of end users in North America will be comfortable going much below 10W-30 and how long it will take for API FA-4 10W-30 to outpace the CK-4 version.

Steve Haffner is president of SGH Consulting LLC. He has over 40 years of experience in the chemical industry, primarily with Exxon Chemicals Paramins and Infineum USA. Contact him at sghaffn2015@gmail.com or 908-672-8012.