Saving Grace

Activity in United States base oils market has been lackluster since the start of the year, with demand deemed rather subdued during the spring production cycle when lubricant manufacturers prepare stocks for the busy summer driving season. And unlike in previous years, demand for base oils and lubricants this year lacked brilliance, even when increased numbers of drivers took to the road.

While base oil suppliers prepared for a slowdown in consumption in the fall, they also expected a small uptick in requirements from consumers who have depleted inventories and needed to return to the market to replenish stocks, particularly as buying has been timorous for most of the year. Some buyers also preferred to postpone purchases until the fourth quarter, when prices tend to come under pressure, depending on supply fundamentals and crude oil and feedstock costs.

Despite fairly sluggish base oil demand trends since January, a number of paraffinic base oil producers appeared to be in balanced-to-snug supply positions as September rolled around. This was partly attributed to freshly completed and ongoing turnarounds, along with reduced base oil output in favor of fuels production at a number of refineries as diesel margins strengthened.

Many participants noted that what saved the domestic market from becoming flooded with product was the conclusion of export business. Several transactions were completed over the summer, with U.S. cargoes finding their way to countries within the Americas as well as faraway destinations like South Africa.

Brazil has been one of the bright spots for U.S. exports. With a couple of plants there either currently undergoing a maintenance program or preparing for one, base oil consumers have been concerned about securing sufficient raw materials to continue producing lubricants over the next few months, particularly as there was some uncertainty surrounding the exact duration of the turnarounds.

There was also an uptick in demand from Mexico—where buying activity had been rather lethargic—with buyers seeking light grades for fuel blending. Some end users preferred to wait for prices to be revised in the last quarter of the year, but others have used up existing inventories and could not wait to place orders.

Contrary to previous years when many U.S. cargoes made their way to India in the third and fourth quarters, transactions this year to India were less prevalent and shipments remained more regional, as prices and logistics were considered to be more advantageous. The arbitrage from Asia also seemed closed for the time being, and supply in that region tightened, offering less incentive for Northeast Asian suppliers to ship product to deep-sea destinations in Latin America.

Turnarounds at several U.S. facilities and rerefineries since June also contributed to a tightening of base oil supplies. Chevron and Calumet completed turnarounds in July, and there were reports that Motiva had scheduled a brief turnaround at one of the trains in its Group II/III plant in Texas in late August. The shutdown only affected Group II 600N production, and it did not seem to have a significant impact on general availability.

HollyFrontier will be shutting down its Group I plant in Oklahoma for a 45-day turnaround in mid-September. The producer limited its spot offers to build inventories and utilized more of its base stocks for its own lubricant production, contributing to an overall tightening of Group I grades.

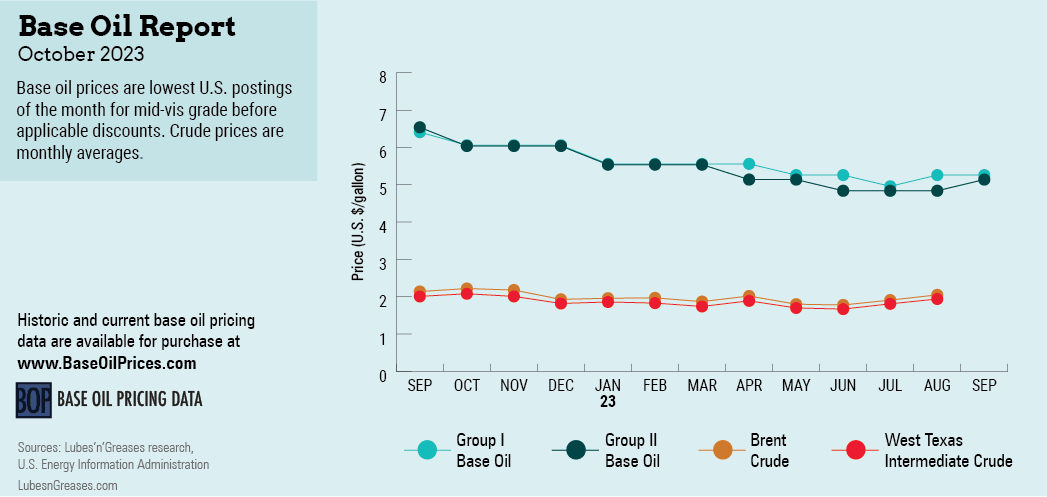

Despite the tightening of domestic base oil supplies and the upward trek in crude oil and feedstock prices in late August and early September, there were no posted price adjustments following increases implemented in the first half of August. The initiatives had raised Group I, Group II and Group II+ postings by 20, 25 and 30 cents per gallon, depending on the grade.

Group III prices remained fairly steady, although numbers were exposed to downward pressure given plentiful supplies and additional domestic production. Importers were heard to be planning to reduce volumes shipped to the U.S. for the rest of the year to minimize price pressure. Furthermore, supply in Asia might be tightening on ongoing turnarounds and reduced operating rates at some refineries.

Many participants also worried about potential supply issues, as August and September are the most active months in terms of hurricanes and tropical storms along the United States Gulf Coast, where many base oil facilities are located. In late August, Hurricane Idalia brought a storm surge, strong winds and flooding in Florida, Georgia and the Carolinas, but no production disruptions were reported.

Naphthenic base oil prices were exposed to upward pressure due to steep crude oil and feedstock values, along with balanced-to-tight supply and demand fundamentals. Accounts whose contracts are linked to a diesel index saw increases given the upward trend in diesel values. Given these conditions, it was not surprising that in mid-September, San Joaquin Refining communicated a 30 cents-per-gallon increase on its naphthenic base oils, effective September 15. The producer also raised export prices on the same date, as export business into Latin America and Asia was robust.

At the time of writing, other naphthenic producers were contemplating price adjustments and watched crude oil price developments closely, particularly since values were on the rise following Russia’s and Saudi Arabia’s announcement that they would extend their oil production cuts until the end of the year.

Several factors seemed to have helped keep the base oil supply overhang in check during the third quarter, and producers’ decisions were likely to be contingent on some of these same elements over the next three months.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com