Strange Times

If you read the news on a daily basis, it would be difficult to deny that we are living in strange times. On July 8, the assassination of Japan’s most well-known former Prime Minister, Shinzo Abe, darkened the headlines. Sadly, shootings are a common occurrence in the United States and many other countries (several horrific incidents took place in June alone), but they are extremely rare in Japan. Such an act shocked not only the Japanese but also people around the world. On a much smaller scale, unusual developments have been taking place in the base oils market since the start of the year, too.

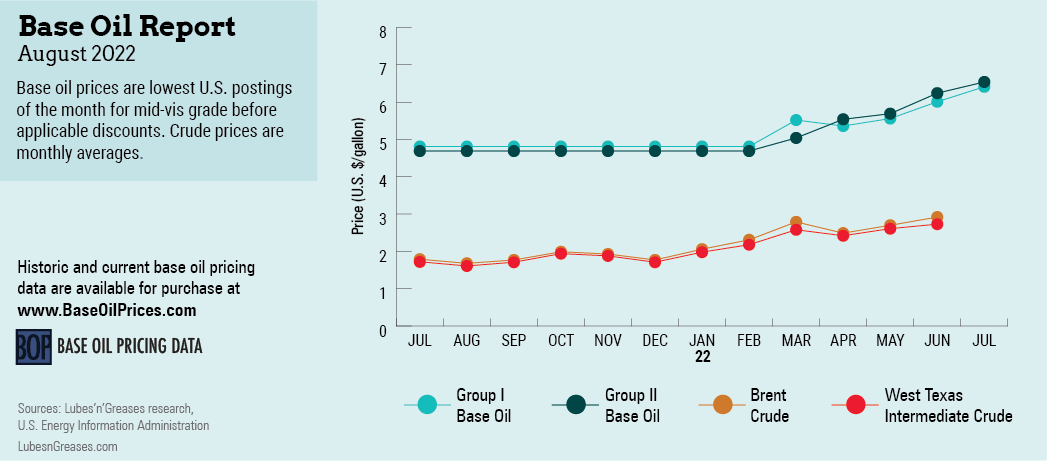

In years past, about five or six base oil posted price adjustments would take place in a year. So far in 2022, there have been six rounds of increases communicated by suppliers, ushering in almost monthly price revisions.

In early May, producers communicated markups that raised postings between 20 cents per gallon and 70 cents/gal, with implementation dates between May 4 and May 23.

Only a few days later, a majority of API Group I, Group II and Group II+ producers implemented posted price increases of 20, 25, 30, 35 and 45 cents/gal, depending on the supplier and the product, with effective dates peppered between May 20 and May 27. The only cuts that were not adjusted were the Group III grades.

In early June, several fresh price initiatives were again reported on both the paraffinic and naphthenic sides of the business. The price movements were prompted by sky-high crude oil and feedstock values, rising production and transportation costs, a tight supply and demand balance, and a need to bolster margins due to steep competing fuel prices.

A vast majority of base oil producers communicated posted price increases of 20, 30, 35 and 40 cents/gal, depending on the grade and the supplier, with implementation dates sprinkled between June 14 and June 27.

On the naphthenic front, Cross Oil and Calumet implemented increases of 30 cents/gal across the board on June 15 and June 20, respectively. They were closely followed by Ergon, which lifted the price of its naphthenic base oils by 45 cents/gal, effective July 1, and San Joaquin Refining, which communicated a price increase of 30 cents/gal, effective July 6.

Producers explained that the increases were driven by market factors, including the unprecedented and continued price increases in crude oil and natural gas values, inflation, as well as the need to keep pace with high-priced alternate markets, including diesel. For many refiners, the pronounced increases in gasoline, diesel and jet fuel values on the back of rising crude oil prices since late February meant that base oils had to compete with fuels in terms of feedstock streams.

The June/July naphthenic base oils initiative came after a preceding upward adjustment of 25 cents/gal and 30 cents/gal by a majority of naphthenic producers, implemented between May 16 and May 31.

In the first few days of July, crude oil futures remained very volatile, plummeting one day and jumping the next as the ongoing conflict in Ukraine, supply concerns and the possibility of a worldwide recession impacted trading sentiment. In comparison to early June, crude oil values eased, reducing some of the heat that had brought base stock pricing close to a boiling point.

Downstream, mounting base oil and additive prices also led lubricant manufacturers to announce increases of up to 15%-20% slated for implementation between July 1 and August 1—the fourth round of increases since January.

In terms of base oil demand, suppliers reported healthy buying interest for most grades, although the consecutive posted price increases dampened purchase volumes slightly. Some buyers turned more conservative, as finished lubricant demand tends to soften toward the end of the summer. Consumers did not want to be in possession of high-priced base stock inventories if prices were to drop on softer demand, while inflation and economic uncertainties added to the concerns.

At the same time, consumers and suppliers carry extra inventory from early June until the end of November to cover potential production outages due to hurricanes along the United States Gulf Coast, where many base oil plants are located.

Perhaps an unusual event that market players would welcome would be reaching the end of the hurricane season without any major storms or supply disruptions. Getting through the second half of the year without too many unpleasant surprises would feel strange but would bring some much desired relief.

Base Oil Report: Pricing Video

Watch as Gabriela Wheeler and Sydney Moore discuss

recent base oils market activity and pricing.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com