In Uncharted Territory

The world appears to have turned into one of those intrepid 15th Century explorers that embarked to find fresh opportunities but had to endure unforeseen hardships along the way.

The world is shrouded in uncertainty as the war in Ukraine rages on, energy prices soar and inflation spirals out of control in many countries.

In the United States, the reopening from the pandemic triggered pent-up demand for everything from raw materials to used cars. This, coupled with product shortages due to supply chain disruptions, pushed prices to unprecedented highs.

Base oil buyers and sellers acknowledged the difficulties in making projections in the long term and on a daily basis.

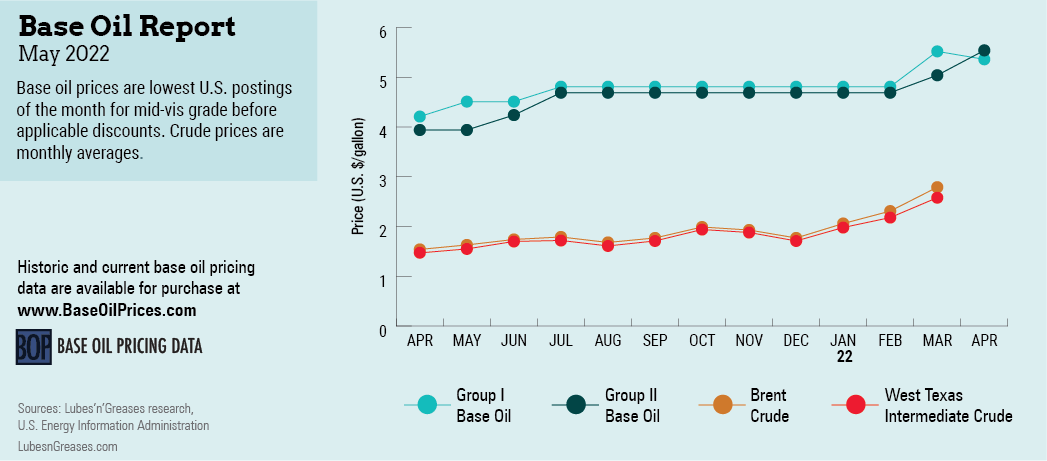

This struggle was evidenced in the confusing pricing scenario that ensued after crude oil prices spiked to multi-year highs and base oil suppliers reacted by nominating hefty posted price increases to protect margins and justify base oil output over fuel production. Then some suppliers rescinded part of the increase amounts as crude prices retreated.

Producers first implemented a round of price hikes of 30 to 35 cents per gallon between March 8 and March 17. The following week, a second initiative called for increases to go into effect between March 15 and March 24.

ExxonMobil was reported to have originally communicated an increase of 30 cents/gal for its API Group I, II and II+ base oils, effective March 14. A few days later, it bumped the increase to 70 cents/gal for all grades, keeping the same effective date. Several other producers—including HollyFrontier, Petro-Canada and Calumet—followed with similar upward revisions.

The steeper figures were triggered by the sudden jump in crude prices after President Biden announced a U.S. ban on Russian crude, natural gas and coal imports.

Just as the base stock increases had been announced, crude prices plunged. Many felt optimistic about a possible resolution when diplomatic talks between Russia and Ukraine occurred in mid-March. China’s COVID-related lockdowns due to surging Omicron infections also caused concern that the country would be consuming less crude than anticipated, placing downward pressure on oil prices.

Base oil producers responded to the drop in crude values by rescinding part of the announced increases, although most adjustments for Group III base oils were upheld.

According to reports, ExxonMobil was the first producer to retract the full increase it had intended to implement on March 14. The 70-cents/gal increase on API Group I SN115 was reduced by 30 cents/gal, while the rest of its Group I cuts and Group II and II+ grades were lowered by 45 cents/gal, effective March 18.

HollyFrontier, Petro-Canada, Calumet and Paulsboro also rescinded some increases, depending on the grade, between March 18 and March 21. Petro-Canada’s increase of 60 cents/gal for Group III remained intact.

Some producers announced more moderate posted price increases and refrained from adjusting the amount of the markups. Chevron, Excel Paralubes, and Safety-Kleen lifted posted prices by 15 to 25 cents/gal between March 15 and March 16.

Motiva increased its Group II prices by 50 cents/gal and its Group III grades by 60 cents/gal as of March 15. The increase amounts were higher than other producers’ because Motiva had not raised postings during the previous round of hikes.

Avista Oil lifted its Group II+ cut by 50 cents/gal and its Group III grade by 60 cents/gal on March 18.

SK Lubricants Americas raised the price of its Group II+ cut by 40 cents/gal and all its Group III grades by 55 cents/gal on March 24.

Aside from sky-high crude and feedstock values, the increases were supported by a balanced to tight supply-demand situation, as buying interest flourished at the start of the spring production cycle. Additionally, some refiners opted to divert more feedstocks into fuel production.

Naphthenic producers implemented increases, too, driven by similar conditions as the paraffinic markups.

Cross Oil, Calumet, Ergon and San Joaquin Refining all raised naphthenic prices by 35 cents/gal between March 11 and March 14.

Aside from receiving support from the mounting cost of crude, labor and other factors, the naphthenic increases were propped up by a snug supply-demand balance due to plant maintenance programs.

At the time of writing, the Russian war on Ukraine continued unabated as the U.S. and its NATO allies contemplated additional sanctions on Russia. The conflict did not appear close to ending soon, and its reverberations were impossible to appraise, forcing the world order into uncharted territory again.

Base Oil Report Video

Watch as Gabriela Wheeler and Sydney Moore discuss some of the most prevalent factors contributing to the current—and confusing—base oil pricing dynamics.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com