The time is now for rerefined base oil. Fear of climate change is reaching a crescendo, especially among young people, and crude oil prices are dancing around U.S $100 per barrel. It is the perfect moment for this valuable resource to go mainstream, according to industry insiders on both sides of the Atlantic.

The world consumes 37 million metric tons of lubricants per year. A small yet growing amount of that volume is collected and rerefined into base oil, while the rest is incinerated to produce energy, used as marine fuel or dumped illegally.

Lawmakers in Europe and North America, the two largest rerefining regions, are legislating to decarbonize the economy by more effectively managing waste and promoting resource circularity. Rerefined, or regenerated, waste oil has substantial sustainability benefits and is in harmony with carbon neutral goals on either side of the Atlantic.

Being a “closed loop business,” as described by Craig Linington, Clean Harbors’ executive vice president responsible for U.S. rerefiner Safety-Kleen, rerefined base oil has a superior carbon footprint than virgin base oil. The company found that lubricants using rerefined base oil saved 7,500 metric tons of greenhouse gases for every 3.78 million liters used. Safety-Kleen collects more than 757 million liters per year of waste oil and is the largest rerefiner in North America. It produces Kleen+, an API Group II base oil, as well as passenger car motor oil.

The current industry preoccupation with sustainability is an opportunity for the rerefining industry to take center stage. “From large blenders who are under pressure from investors, as well as pending government regulations, looking to reduce their own Scope 1 and 2 emissions … right down to the end customers, especially,” Linington told Lubes’n’Greases.

Safety-Kleen’s carbon-saving figures are borne out by GEIR, the trade association that represents European rerefiners’ interests. In 2005, it carried out its first life cycle analysis of rerefined base oil. The LCA found that rerefined base oil’s carbon dioxide footprint was 30%-50% less than virgin fossil-fuel derived materials.

In its latest LCA, which was due for publication in 2022, GEIR calculated that to be 70%-80% that of a virgin base oil.

“The higher and higher level of regeneration technologies adopted by our industry allows the production of regenerated base oils equivalent to or even better than virgin stocks,” Marco Codognola, president of GEIR, told Lubes’n’Greases. “That represents a fundamental rationale for consumers to use regenerated products, which bring an added environmental value compared to virgin ones, especially in terms of carbon footprint, and therefore our industry contributes positively to the decarbonization targets recently set during COP26.”

Its reduced carbon footprint is an attractive benefit for lubricant blenders looking to improve their sustainability profiles. It can help them to meet climate change legislation aimed at carbon-intensive companies. They will naturally turn to rerefined materials, U.S.-based industry consultancy Kline & Co. thinks. Not only do blenders look to benefit from rerefined base oil’s carbon credentials, but investors do, too.

“On the investment level, there’s certainly interest in us as a public company,” Linington said. “We have a growing number of ESG investors who appreciate the clear sustainability story behind Safety-Kleen.”

A Sustainable Resource

The EU classifies waste oil as hazardous, and just 1 liter of discarded oil can contaminate 1 million L of water. The EU Waste Framework Directive requires the 27 member states to collect their waste oil and regenerate it, preferably back into base oil.

But it’s more than waste; used oil is a valuable resource. In Turkey, for example, the greenfield rerefiner Tayras is as concerned with drawing back on imported base oil as it is with the environment.

“Used oil is a strategic feedstock, not waste,” Tayras’ Chairman Mehmet Afsin told Lubes’n’Greases during a visit to the site in 2020. “Due to COVID, all countries are trying to reduce dependence [on imports and] are trying to survive on their own production.”

Waste streams are an important and existing renewable carbon source, explained Raoul Meys, the co-founder and chief technology officer of Carbon Minds, a carbon cycle data provider that helps companies in the petrochemicals industry reduce the environmental impacts of chemicals and plastics.

The EU’s waste legislation encourages the use of waste carbon sources in the most environmentally friendly ways, Meys told Lubes’n’Greases. The benefits of recycling are that it replaces other waste treatment options such as incineration and the production of lubricating oils from virgin and fossil raw materials.

“On the way to the European decarbonization and sustainability goals, recycling of waste oils will certainly play an important role,” he said.

In the U.S., a patchwork of regulations state by state determines the collection and recycling of waste oil, but there is less federal support. However, lawmakers in Washington D.C. did pass the Buy Green Act in 2021, which requires federal fleets to use rerefined finished lubricants.

“I wish that the U.S. government would do more in line with some of some of the other governments around the world: places like Australia or even Ecuador more recently,” Linington said. “Clearly, the government could do more to recognize all the benefits that the rerefining industry represents, as we as a country go on this journey to combat climate change.”

A U.S. Department of Energy report into the motor oil industry published at the end of 2020 details the benefits of rerefining.

“What it doesn’t do, unfortunately, is recommend clear legislation, or even clear additional regulations to incentivize or drive more used motor oil into the rerefining industry,” Linington said.

Adoption Challenges

Sustainability aside, there have been hurdles for the rerefining sector to overcome, and one is perception of the product itself. Since its origins in Germany in the 1930s, rerefiners have had to work hard to shake its second-fiddle reputation.

When Detlev Bruhnke started his career at Avista in 1991 as a laboratory manager, the base oil being produced by many rerefiners was very different from how it is today. Founded in 1951, Avista Oil has plants in Germany, Denmark and the U.S., from which it has capacity to produce 160,000 t/y of Group I and 115,000 t/y of Group II base oil.

“When I started in the 90s, the quality was sometimes low,” Bruhnke told Lubes’n’Greases. “It was old technologies—clay treatment—and the color was not like virgin materials; there was some odor.”

All that has since changed. Over the past 15 years, there have been significant strides in rerefining technology. In the past, the main step in rerefining was filtration with clay that removed contaminants. Catalyst technology has come a long way since the clay treatment Bruhnke would have encountered three decades ago. Today, most modern rerefineries have additional steps—heating to remove water and lighter compounds, vacuum distillation to separate gas oil, base oil and distillation residue, and hydrotreating, which injects hydrogen under pressure and elevated temperatures to produce a stable, high viscosity index base oil.

“Back in the day, the early innovators were figuring it out for themselves. Today, there are technology, engineering and supply companies all with specific expertise in rerefining,” Linington said. “The key providers of that technology have learned from history and mistakes. It’s essentially a natural maturation of the industry.”

Another key factor is that the waste oil feedstock is completely different than it was a few decades ago, due to increased use of fully synthetic passenger car motor oils.

“The quality of the feedstock is better,” Linington said. “The rerefining technology is better. Hence the quality of the finished base oil product is better.”

Aligning Factors

Factors are aligning that will help to mainstream the rerefining sector. One is the greater adoption of electric vehicles. This would seem antithetical, since EVs use no engine oil. They also use no fuel, making the refining of fuels and therefore base oil gradually less profitable.

Over time, demand for lubricants made from virgin base stocks and availability of waste oil will decline. Less engine oil consumption would mean less demand for rerefined base stocks, too.

However, the U.S. Energy Information Administration predicts that the stock of conventional engine vehicles will continue to grow until 2038. This means that demand for engine oils will grow, albeit for synthetics, as it will for other lubricant applications. Rerefined base oils could at least partly fill the gap.

“Similar to the early days of COVID, if [crude] refiners curtail fuel production due to the lack of demand—this time caused by the influx of EVs—base oil production could also suffer. And as experienced in 2020, base oil demand may not fall in tandem with fuel demand. That makes retaining and rerefining the base oils we have in the system even more important,” Mike Turner, vice president for base oil sales at Texas-based rerefinery Blue Tide, told Lubes’n’Greases.

Currently ready to begin construction to redesign and expand capacity to 5,000 barrels per day, the Blue Tide Environmental plant is on the Cedar Bayou just down the road from ExxonMobil’s Baytown refinery, which produces 18,000 metric tons per year of Group II and 9,000 t/y of Group I virgin base oil. Blue Tide’s commissioning is due for June 2023, with a vacuum gas oil product slated first, followed by a Group II base oil by February 2024.

Rather than something that could create more demand for rerefined oils, EVs reduce the supply of rerefining feedstock. This would drive the need for a more comprehensive collection network, including collection of industrial lubes, not just automotive.

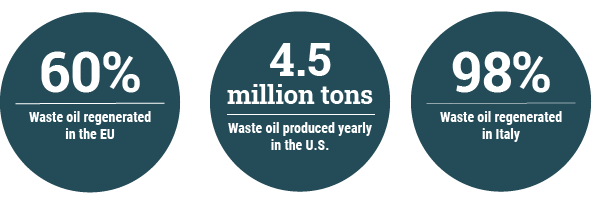

There will be millions of conventional engine vehicles on the world’s roads for decades to come. According to a study conducted by the U.S Department of Energy, about 4.5 million t/y of waste oil is generated yearly in the U.S.

“As far as threats are concerned, the EV revolution of course would have an effect on the rerefining industry,” Linington said. But “in terms of available used motor oil for collection, as well as demand for finished products on the other side, we don’t see the funeral of the U.S. motor oil business. In fact, we expect that the multi-decade transition to EVs in North America is only going to increase the value of our sustainable product in the interim.”

Lingering Questions

For several reasons, the rerefining sector has languished on the sidelines—until now. One is the development of rerefining technology over the past decade, assuaging blenders’ concerns about quality. It may have been in virgin base oil producers’ interests to downplay rerefined base oil quality, leading blenders to shy away from buying it.

Still, there is work to do in pushing for better waste management and collection, as well as production of rerefined material. Trade associations on either side of the Atlantic can only do so much with the budgets they have to persuade authorities to promote collection regulations.

|

It may have been in virgin base oil producers’ interests to downplay rerefined base oil quality, leading blenders to shy away from buying it.

|

In the EU, for example, rates of collection and regeneration are uneven. According to GEIR, 60% of waste oil is regenerated on average across the bloc. According to GEIR, Italy regenerates 98% of its waste oil and incinerates the rest. Meanwhile, large parts of Eastern Europe don’t regenerate any waste oil at all.

With an annual operational budget of €136,000, GEIR has a job of work and is vying with big industries with well-financed voices.

“The limited size of our sector, as compared to others like cement, steel, transport and heating, limits our lobbying capability and the attention that legislators pay to us,” GEIR President Marco Codognola told Lubes’n’Greases.

In the U.S. and South America—especially Brazil—used oil regeneration is present and there’s still room to grow. In other continents, the potential is even higher than the EU and U.S. But these areas need structured regulations, especially environmental and a waste disposal hierarchy, and real enforcement to secure the relevant investments required in such an industry, Codognola told Lubes’n’Greases.

“The lack of regulation or its enforceability in such areas of the world limit, at present, the development of regeneration,” he said.

Another question is whether increased demand caused by the potential decrease in supply of conventional base oils outweigh the loss of finished lube demand volume that EVs will inevitably cause. This may depend partly on whether marketing departments at rerefiners look to automotive or industrial lube players.

A significant factor that could tip the balance toward industrial is approvals. In developed markets, base oils generally do not get used for automotive engine oils—at least not in significant volumes—if they don’t carry approvals showing that engine oils formulated with them have met specifications. Rerefiners tend to not get these approvals because they are so expensive.

There are some rerefined base oils that have found their way into factory fill for some German original equipment makers, though. Some have Mercedes-Benz 228.3, Volkswagen 500.00 and 505.00, and API SN and CJ-4 quality approvals, according to David Whitby, CEO of Pathfinder Marketing, in a recent article for the Society of Tribologists and Lubrication Engineers.

“It’s finally exciting to see the recognition being given to rerefined base oils and the advantages they bring to the marketplace,” Turner said. “High quality and sustainability make for a timely message in today’s world.”

Codognola shares his colleagues’ positive outlook: “We consider the circular economy an irreversible trend, especially in Europe. We do not see major challenges to the sector.”

Simon Johns is an editor with Lubes’n’Greases. Contact him at Simon@LubesnGreases.com.