Are We There Yet?

With most COVID-19 restrictions being lifted and the United States seemingly returning to a more normal lifestyle, participants in the base oils market also hoped to return to more familiar terrain.

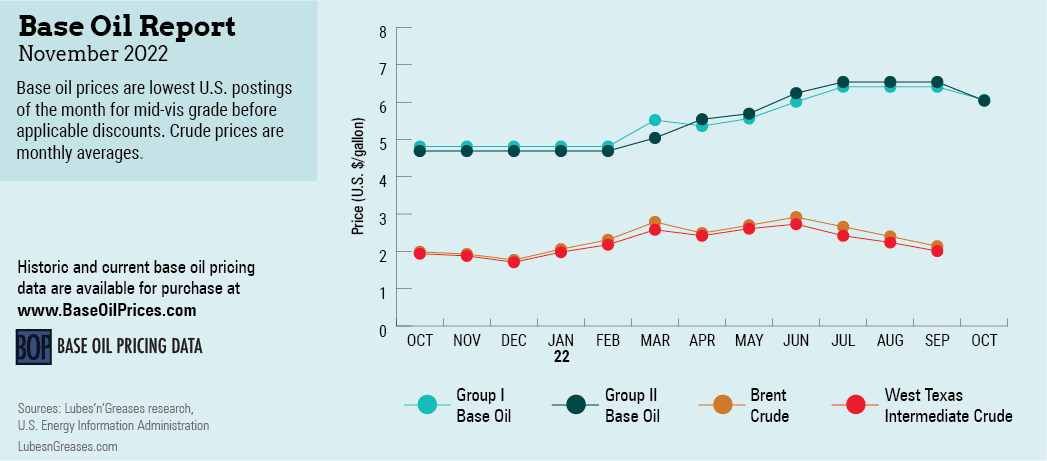

Their wishes seemed to come partially true in early October when posted base oil prices settled into a fairly stable pattern. However, they remained exposed to downward pressure—something which was to be expected as the market entered the last quarter of the year. In fact, September brought a round of price decreases, which wasn’t a complete surprise because historically it is not unusual to see producers lower their prices to encourage orders and place surplus volumes during the second half of the year.

In early September, paraffinic producers informed their customers that they would be reducing postings by 20, 30, 35, 40, 45 and 50 cents per gallon, depending on the grade and the producer, between Sept. 1 and Oct. 1. This string of adjustments was initiated by Motiva, which communicated 20- and 50-cent-per-gallon downward revisions on its base oil grades, effective Sept. 1. This was likely prompted by softer crude oil and feedstock prices, along with lengthening base stock supply.

While demand tends to slow down and supply becomes more plentiful in the last few months of the year, some corners of the base oils market seemed to be tighter than others. But finding enough product in the domestic arena did not appear to be a problem. Most buyers try to use up existing inventories as much as possible, and both producers and buyers start to release some of the extra stocks they kept during hurricane season.

Fortunately, there were no production disruptions during the height of the season. But Hurricane Ian, which wreaked havoc in large portions of the Southeastern U.S. from Sept. 28 to Oct. 2, caused transportation and logistical challenges. Most base oil and lubricant operations experienced minimal impact from the storm. Although several lubricant plants located in the affected areas shut down as a precaution, they suffered no damage and were restarted shortly after.

Some of the naphthenic base oil cuts were tight in the U.S.—particularly those that are used in transformer oil applications—and were expected to tighten further as demand was likely to increase following damage from Hurricane Ian and a need for repairs on housing and equipment destroyed by the storm. There were robust pockets of domestic business as well as keen buying interest from South America.

Furthermore, pale oil supply levels had been impacted by an unexpected production outage at a naphthenic plant in August, which lasted about a month. Calumet also started a turnaround at its naphthenic plant in Princeton, Louisiana, around October 10; the unit was expected to be down until the end of the month.

Production issues and maintenance programs also brought down supply on the paraffinic side. A major API Group I and Group II supplier was forced to extend a turnaround that had started in June, a second Group II producer was experiencing some production issues, and a third major refiner had a scheduled turnaround in October as well.

Motiva took its Group II/Group III unit in Port Arthur, Texas, down for a turnaround in early October as several of the refinery’s units were also undergoing maintenance. The base oil plant was expected to restart at the end of the month, and the producer had built inventories to cover requirements during the outage.

A price reversal observed in crude oil and feedstock markets during the first week of October when futures jumped on the back of an OPEC+ production cut announcement was expected to mitigate some of the downward pressure generated by the base oils supply and demand imbalance. The steeper crude oil prices also fed concerns about rising inflation and an accompanying slowdown in consumer spending.

However, the upward crude oil price trend was cut short by fears voiced by the World Bank and the International Monetary Fund about a potential global recession. A strengthening dollar also raised concerns about additional interest rate increases. China’s renewed COVID-related lockdowns and the possibility they would include cities like Shanghai and limit oil consumption weighed on oil pricing, too. Crude values remained volatile and were easily swayed by geopolitical and economic conditions.

If returning to “normal” entails dealing with unexpected issues and countless uncertainties, then the base oils market is almost there. However, many of the world’s events remained far from ordinary and continued to have a significant impact on base oil fundamentals.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com