People from many organizations must come together to advance lubricant specifications, ensuring that engines old and new continue to be protected. The COVID-19 pandemic has made doing so more difficult, impeding early work on the next North American heavy-duty diesel engine oil categories and slowing rollout of the latest ACEA sequences from the European Automobile Manufacturers Association, which were published in April.

Infineum Industry Liaison Manager Joan Evans told Lubes’n’Greases that work in North America has faced additional obstacles from hurricanes and other severe weather that taxed resources, and the transition between United States presidential administrations, which altered the legislative environment. “Our industry’s supply chains have been strained for over a year now with these events, and it is sometimes difficult to concentrate efforts on future activities when the present creates such challenges,” she said.

Nevertheless, work has continued—both on the introduction of new specifications and the development of future ones. The newest spec from the International Lubricant Standardization and Advisory Committee, ILSAC GF-6, came to market early in the pandemic and has been gaining traction. “The rollout went without a hitch,” Jeffery Harmening, the American Petroleum Institute’s manager of the Engine Oil Licensing and Certification System, said. ”Not only were we able to initiate first licensing by May 1, 2020, but we were able to ensure that the transition responsibilities for the licensed marketers went much easier than in previous categories.”

GF-6 is ILSAC’s first bifurcated sequence, divided into GF-6B, which covers the SAE 0W-16 viscosity grade and is not backward compatible with older engines; and GF-6A, which covers legacy grades and is backward compatible. As this issue went to press, API had licensed over 3,700 products under GF-6A and 217 products under GF-6B.

So far, ILSAC has not initiated work on the next standard, but spec development insiders think such work may begin later this year. Angela Willis, chairwoman of the Passenger Car Engine Oil Classification Panel, predicted that work on GF-7 will be triggered as much by needs to replace existing tests as by desires for improved lube performance.

“Replacement tests will not necessarily drive new engine oil categories, but history has shown that new category need has lined up with replacement test needs,” said Willis, who is proprietor of Willis Advanced Consulting LLC. “Based on this, I am expecting at least discussions around a new category would start this year, with any type of test development activities beginning in 2022.” She also estimated that first licensing could happen by 2028.

Replacement tests are usually required either because engines evolve to the point that an existing test no longer accurately simulates the operating conditions that oils encounter or the industry runs out of hardware or other materials needed to conduct tests. Hardware depletion is a significant problem—significant enough that one responsibility of API’s Category Life Oversight Group is to watch for early signs of hardware getting used up—and some observers are concerned that GF-6 tests could be depleted early.

“The long-awaited Dexos1 Generation 3 specification is scheduled for September 2021 for first allowable use and will account for changes included in the GF-6 specification as well as other new requirements by General Motors,” Willis said. “It was reported at PCEOCP that the new spec has caused a significant uptick in engine testing, particularly the Sequence VH, as GM is not allowing base oil interchange or viscosity grade read-across for the test.”

Similarly, the new ACEA sequences and JASO GLV1, a light-duty engine oil spec from the Japanese Automobile Manufacturers Association, are using many of the same tests as ILSAC GF-6. Willis noted that there has been an unprecedented increase in utilization of ASTM methods in outside specifications and standards. “This has become a watch point when monitoring hardware availability for these tests,” she said. “In the future, as replacement or new test methods are being developed to support future API and ILSAC categories, the task force and surveillance panels will need to consider outside usage of these tests not just from a hardware usage and test availability standpoint, but also taking into account how these other entities are using the test, which may influence the life of the test.”

For example, Sequence V Surveillance Panel Chairman Andy Ritchie noted that fuel to support the Sequence VH may become limited due to the additional use of the test and the time it takes to qualify a new fuel batch. Committees involved in spec development are also monitoring a mild trend on the Sequence X chain wear test and the potential for a used oil low-speed pre-ignition test that could lead to an ILSAC GF-6 supplement.

Heavy-duty Specs

Heavy-duty diesel activity had been quiet since the launch of PC-11 in 2016, but activity accelerated due to anxieties about the lifespan of key tests for the current category, concerns from Ford about certain API CK-4 engine oils, and the proposed need for a new category.

Ford, supported by some other members of the Engine Manufacturers Association, has requested a CK supplement to include a new wear test. Shawn Whitacre, head of the Heavy-duty Engine Oil Classification Panel, told Lubes’n’Greases that “the timing to deliver on Ford’s category supplement request has been the subject of current debate and continued data gathering. One specific point that has been discussed is related to establishing realistic timelines and also looking at how launching a supplemental category near term could affect a full new category in the long term.

“To be clear, the Diesel Engine Oil Advisory Panel has yet to endorse the supplemental category request, and at the April 1 meeting consensus was not achieved to move forward at this time. Ford’s request is tied to the establishment of their 6.7L valve train wear test, and this is still a test of interest as we head toward PC-12.”

API’s Harmening agreed. “API supports any supplemental category request, and API 1509 outlines procedures for such requests. But the decision ultimately lies in the hands of DEOAP, and at this time voting members have denied the category supplement request.”

He added that the sponsor can resubmit requests with additional information. “Generally speaking, the fast track process is designed to minimize retesting and oil qualification time, thus enabling a supplemental category to be ready for the market in a matter of months,” he said.

EMA has formally requested that work begin on the next diesel engine oil category, and the organization’s vice president, Tia Sutton, cited the California Air Resources Board’s adoption of regulations that will ratchet nitrogen oxide emission limits and mandate extended emission warranty periods. She also noted that the United States Environmental Protection Agency is also considering more stringent NOx limits and that engine lubricant performance can affect achievement of such regulations.

“A new category development allows us to define oil performance requirements that support and enhance hardware design improvements that are targeted to meet regulatory requirements,” said Diesel Engine Oil Advisory Panel Co-chairwoman Karin Haumann, of Shell.

“Given the length of time for a new category development, we want to anticipate future opportunities to ensure that the new category provides for all relevant needs both at the time that it is implemented and into the future,” Haumann said.

Regarding off-road diesel applications and the work of DEOAP, Haumann asserted that engine oil recommendations will continue to be defined by OEMs based on individual hardware needs. The use of API FA-4 oils is increasing as hardware design evolves, but it will take time for hardware changes that will benefit from the use of FA-4 oils to be widely implemented in on- and off-road applications.

“As with the implementation of FA-4, providing a wide range of viscosities will facilitate positive hardware changes in the future,” she added. “While XW-20 has not been explicitly requested, one of the tasks of the New Category Evaluation Team will be to determine what range of viscosities will be suitable for the life of the new category.”

Regarding PC-12, Whitacre said that EMA’s request for a new category is new, and its “wish list” has yet to be developed into a useable framework. “EMA did not ask for a viscosity profile that is thinner than what is currently defined for API FA-4 (2.9 centiPoise HTHS),” he said. “At a high level, they have identified the following three attributes as most critical: improved wear protection, improved oxidation stability and improved emission control system durability. Of course, there are many details that require further definition and that will come to life as this process evolves.”

Whitacre also said that EMA suggested that full backward compatibility may not be a prerequisite for the future category. This would be a departure from recent norms, but could open up new possibilities to better optimize fluids to match the performance demanded by new engines. This is subject to continued discussion.

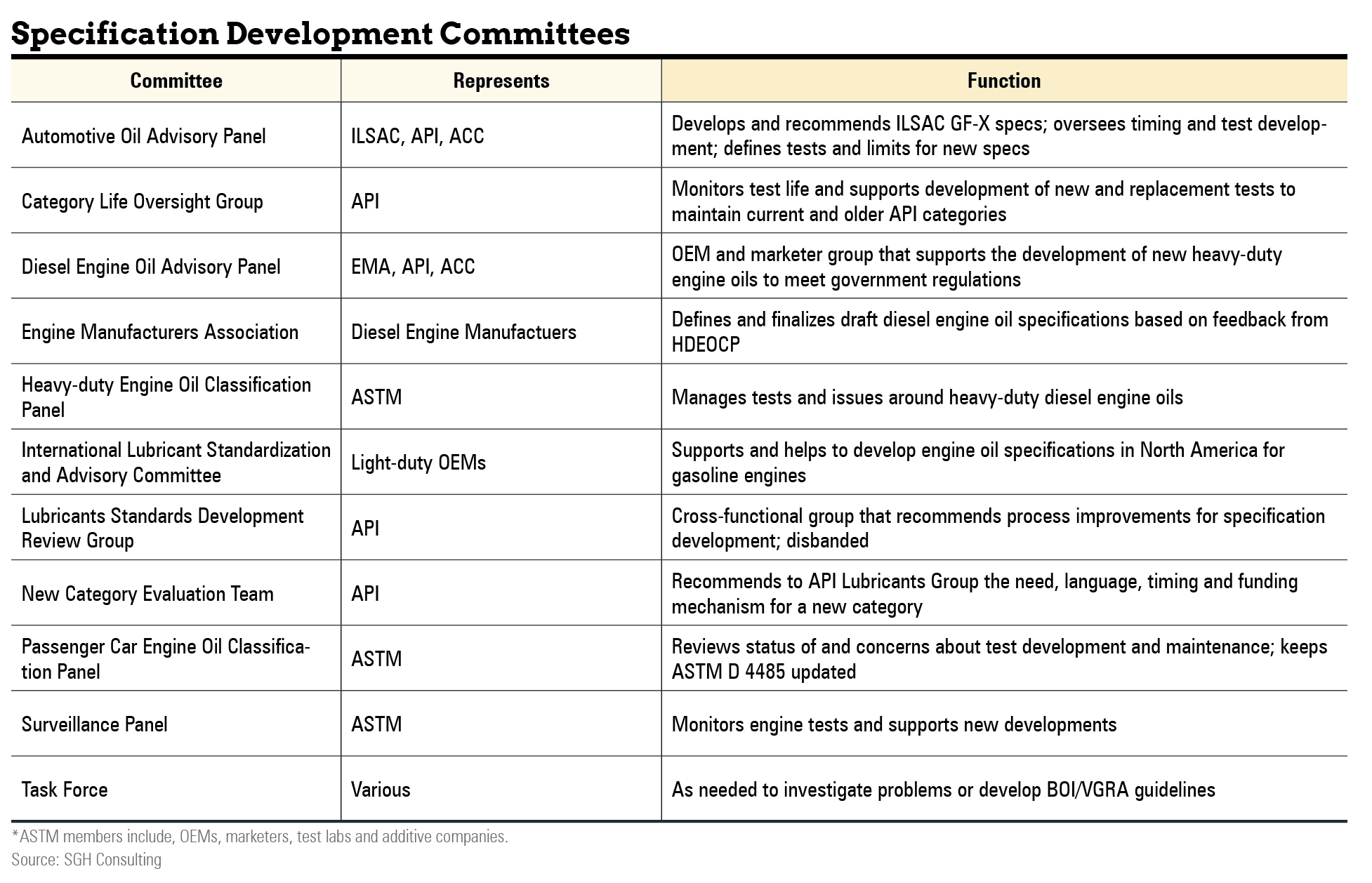

There has been growing desire in recent years to find ways of reducing the cost and time required to develop new oil specifications, and in 2019 API created the Lubricants Standards Development Review Group, charged with recommending revisions to the current system. The group halted its work last year without implementing any major changes, but insiders say committees and panels will still look for ways to save time and money under the existing system. “While mechanisms for API category development remain in place, there is a concerted effort by the industry to gain efficiencies wherever it can,” Harmening said.

“For instance, the new category evaluation team is already forming for the next diesel category request, and a handful of new and replacement tests are anticipated,” he said. “We’ve already seen support from OEMs, especially with respect to tackling the issue with the Mack T-12 test,” which centers on a hardware shortage. “We still believe there is a chance the hardware issue can be resolved by the Mack/Volvo Surveillance Panel, but the industry partners are already seeking alternatives should those efforts fail.”

Category Life Oversight Group Chairman Brent Calcut, of Afton Chemical, said developing a test to replace the Mack T-12 is the biggest and most immediate challenge facing his group. The focus of the test—an oil’s ability to prevent wear of cylinder liners and top rings—is difficult to measure, and the T-12 is ingrained in every API C and F category. The T-12 “has a limited lifespan, and CLOG will need to recommend a replacement,” he said.

Down the Road

Evans said Infineum considers the next five years a crucial period for the industry to adapt to the challenges of moving to a more sustainable world, especially considering calls to shift vehicle parcs from the internal combustion engine to EVs. “We see [need for] ICE engine innovation to support the consumer appetite for fuel economy attributes, to meet the more challenging exhaust emission requirements and to adapt to the requirements of combining ICE with different levels of power electrification,” Evans said. “During any transition, a balance has to be struck on supporting the current and the future. All industry stakeholders are facing this challenge, and we need to learn how to continue to serve the internal combustion engine in the near future more effectively and efficiently, so that we can also resource the new technologies associated with cleaner technologies and products.”

Steve Haffner is president of SGH Consulting LLC. He has over 40 years of experience in the chemical industry, primarily with Exxon Chemicals Paramins and Infineum USA. Contact him at sghaffn2015@gmail.com or 908-672-8012.