A European Company Goes Elsewhere to Grow

Any European lubricant company harboring ambitions to grow is immediately confronted by a daunting fact: For more than a decade, the market in its home region has been steadily shrinking. This then suggests an obvious course of action: Unless it knows how to greatly boost its market share, the company must expand in other regions.

The lubricant business of Spanish energy major Repsol has followed such a strategy and achieved eye-catching results. Within the past several years it bought into joint ventures in two overseas markets, while also working to increase sales in a number of other foreign countries. These initiatives allowed it to grow at a pace several times faster than the global market – even through the disruptions of a global pandemic.

The business seems pleased with the results as officials say they intend to follow the same strategy to even faster growth in coming years.

Repsol’s lubricant sales volume increased to approximately 193,000 metric tons in 2020 from about 138,000 tons in 2015. That represents a cumulative annual growth rate of 6.9% during a time when the global market was growing no more than 1% annually.

To expand on that scale, the company had to broaden the geographic scope of its lubes business. Early in its history, that business focused on its home market. The company was founded in 1987 by Spain’s National Industry Institute—which had been the overseer of the country’s oil industry—as part of Spain’s efforts to gain admission to the European Union.

The Repsol name that the company adopted had already existed for 36 years, introduced in 1951 by state-owned Repsa, Refinería de Petroleos de Escombreras S.A., as a brand name for its lubricants. The lubricant brand was popular from the beginning and eventually became the top-selling brand in both Spain and Portugal.

Two years after founding the company, Spain’s government began to privatize Repsol, a process that would last eight years and culminate with an initial public stock offering in 1997. Two years later, the energy company took its first major steps of looking outward from the domestic market by acquiring Argentine oil company YPF.

Repsol began applying an international strategy to its lubes business around 2005 when it started to sell into foreign markets by working with local distributors. But the effort really took off just three years ago, when the company formed two joint ventures on opposite sides of the world.

“This orientation toward international markets increased from 2018 when we began to look for investment opportunities that materialized in that same year in Mexico with an agreement with Bardahl and, in 2019, with United Oil in Indonesia-Singapore,” Begoña Pérez, Repsol’s senior manager for markets, commercial development and joint ventures, told Lubes’n’Greases in a recent email exchange.

Bardahl Manufacturing Corp. is a United States-based supplier of fuel and lubricant chemical treatments that also happens to be one of the 10 largest lubricant suppliers in Mexico. United Oil Co. is a lubricant manufacturer in Singapore and was a wholly owned subsidiary of Singapore-based United Global Ltd., which also provides fuels and logistics services.

Repsol bought 40% stakes in both United Global and Bardahl de Mexico, Bardahl’s subsidiary in Mexico. The value of the Mexico investment was undisclosed, but United Global will receive U.S. $46.5 million by 2023. In both cases, Repsol gained access to local manufacturing facilities where its products can be blended, as well as established sales operations that could market its products. The joint ventures also continued to market their existing brands of lubes.

At the time, Repsol said that Bardahl held 6% of Mexico’s lubricant market, which it estimated to be 725,000 tons per year. The Spanish company said it aimed to increase that market share to 8%-10%. The United Oil investment was viewed as a launch pad to sell into Indonesia, Malaysia and Vietnam, as well as Singapore. Indonesia is the biggest of those markets, and at least part of Repsol’s capital infusion was earmarked to upgrade a blending plant there, which is operated by United Oil subsidiary PT Pacific Lubritama and has capacity to produce 80,000 t/y. United Oil also owns a 140,000 t/y plant in Singapore.

Formation of such joint ventures is a sensible strategy for suppliers wanting to enter new markets, according to Stephen King, principal of SJK Marketing Services Ltd., a consulting firm in Swindon, United Kingdom. He added that JVs have advantages and disadvantages compared to alternative approaches, such as selling through distributors and forming wholly owned subsidiaries.

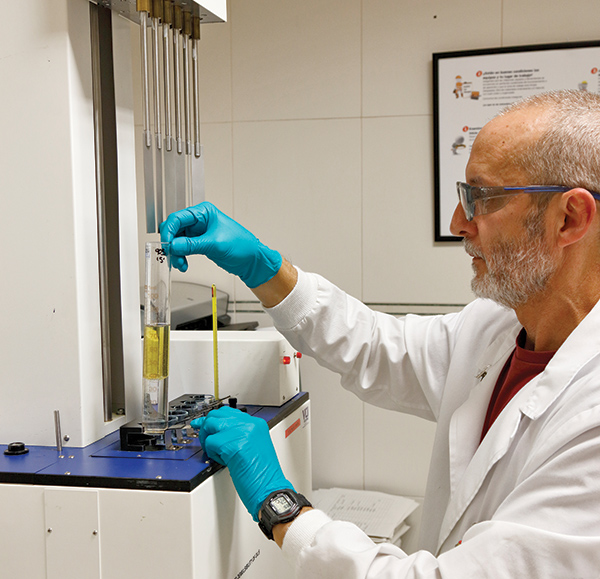

Lubricants are finely tuned at the lubricants laboratory at Repsol’s Puertollano Refinery

Lubricants Plant. © Repsol

“One of the advantages is that you are getting involved in an established business, which hopefully is already successful,” King said in an interview. “Then you can combine that local experience and standing with your own brand and know-how, which should have some perceived advantage. So in some sense it’s easier than starting from scratch and allows you to ramp up sales faster than if you were building the entire business from the ground up.

However, there are some downsides to the method. “The cons are that you have less control over the culture of the local business, so you have to accept that and work with it or try to adapt it,” King said. “But sooner or later you’ll always have some tension with the partner, even when it’s a good fit. A joint venture also usually requires a larger financial investment than going the distributor route, but then you probably have fewer limitations on opportunity for growth.”

Repsol’s JVs appear to have helped it grow significantly. Earlier this year the company stated that they accounted for 30% of its lube sales—or approximately 58,000 tons in 2020. Those sales more than account for the business’ growth since 2015, and Repsol officials said the JVs allowed it to continue growing even during the COVID-19 pandemic, which caused a significant drop in global lube sales last year.

The company’s internationalization strategy has extended far beyond Indonesia and Mexico, though. Officials said the company now sells lubes in more than 80 nations—in most of them through local distributors. It currently has wholly owned sales subsidiaries in Portugal, France, Brazil, Peru and Singapore. In addition to the joint venture factories, it operates a wholly owned blending plant in Puertollano, Spain.

Repsol intends to continue expanding its lubricant business, stating that it aims to reach sales of 300,000 t/y by 2025. Officials said they will achieve this by acquiring greater market share in Spain and by increasing sales in Spain, Portugal, France, Italy, Romania, Thailand, Indonesia, Mexico, Peru, Brail and Colombia. The company plans to open a sales office in Colombia in 2022.

“To achieve this, we will look to consolidate our position in Southeast Asia and the Americas through our partnerships as well as in other Tier 1 countries where we hope to concentrate our development, while continuing to serve the rest of the markets,” Director of Lubricants Clara Velasco said. “Of course, we are always attentive to any growth opportunity that may arise, both organic and inorganic.”

Reaching sales of 300,000 t/y by 2025 would require accelerating the business’ growth to a cumulative annual rate of 8.5%. At the time of the Bardahl investment, Repsol said it planned to spend up to $100 million on blending facilities in countries other than Mexico, including Indonesia, India and China. Velasco said no such acquisitions or investments are in the works, although the company is watching for opportunities.

Velasco expressed confidence that the company can maintain its rapid growth despite the disruptions of the pandemic.

“Repsol has not been oblivious to the unprecedented situation caused by the lockdowns throughout the world, but the lubricants business has successfully achieved its results in collaborations with its partners and distributors,” she said. “It grew year on year during 2020 and this current exercise. We are still on track to reach our 2025 goals.”

It is worth noting that in mid-2018 the company predicted it would reach sales of 300,000 t/y by early 2021.

Seeking Sustainability

As it strives to keep growing, Repsol’s lubricant business—like many others—is also dealing with several significant trends impacting the industry. One of these is the sustainability movement, and officials say it is affecting the company’s operations, its product offerings and the packaging it uses.

Officials say the Madrid-based company was an early passenger on the bandwagon to reduce greenhouse gas emissions.

“Repsol has a long track record on sustainability and was the first company in its sector to commit, in 2019, to become a net zero emissions company by 2050,” said Clara Velasco, the company’s director of lubricants. “This commitment involves all the business units, including lubricants.”

Like other lube suppliers, Repsol is addressing this by working to improve energy efficiency at its own facilities and by factoring carbon footprints into its choices of raw materials and other business inputs. The Technology Center at the company’s lubricant manufacturing facility in Puertollano, Spain, is trying to develop formulations that help engines reduce fuel consumption and carbon emissions.

It also strives to offer products demanded by customers trying to reduce their own emissions. For example, it is among the lube marketers to introduce lubricants and fluids for vehicles powered solely by batteries as well as hybrids running on batteries and internal combustion engines.

“Mobility will change in the energy transition, and we will accompany this transition,” Velasco said.

In September, the company announced its introduction of plastic containers that it described as more sustainable. It said it had reduced the amount of plastic in them by 10% while guaranteeing that they remained sufficiently strong and leak-proof. In addition, the company began using recycled plastic to supplement virgin resins.

“The new packaging will weigh less and will add recycled materials to its composition, boosting the circular economy and reducing the carbon footprint,” Velasco said.

The packaging, which is being used at all of Repsol’s production facilities—including joint venture facilities in Singapore, Indonesia and Mexico—is also designed to be more ergonomically friendly.

Tim Sullivan is base oil executive editor for Lubes’n’Greases. Contact him at Tim@LubesnGreases.com