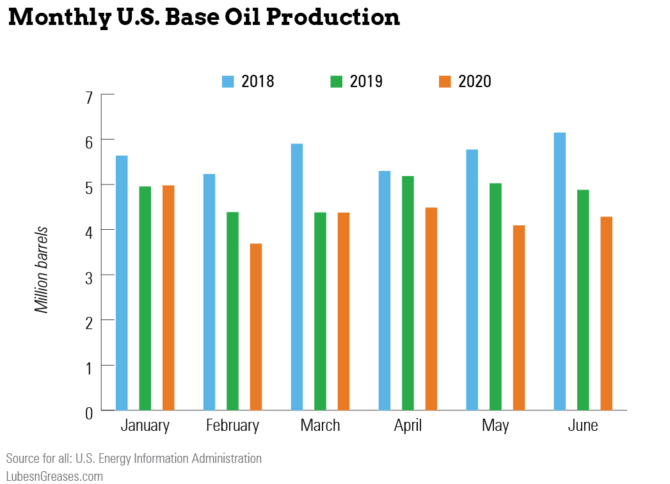

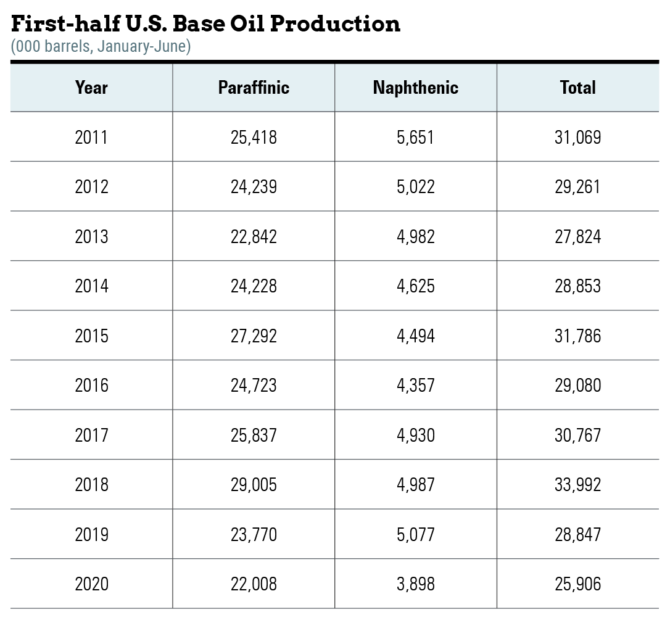

Refiners in the United States produced 25.9 million barrels of base oils in the first half of 2020—10% below what they churned out from January to June 2019, according to data from the U.S. Energy Information Administration. The drop was almost exclusively due to the novel coronavirus pandemic, industry experts said.

Producers barely eked out more base oil than they did during the Great Recession, which was just shy of 25 million barrels in the first half of 2009. But this year’s pain was not equally felt across the industry. Naphthenic plants suffered a 23% decline from the same period last year to 3.9 million barrels, the lowest first-half production total in available EIA records, which date back to 1993. Paraffinic producers, on the other hand, only saw a 7% drop to 22 million barrels, the lowest total since output dropped to almost 21 million barrels in first-half 2009.

“I attribute the majority of this to the COVID situation,” said Clark Smith, vice president of technical service with Cross Oil, which operates a 5,000 barrel-per-day naphthenic plant in Smackover, Arkansas. “Production was normal in January, February and early March. By mid-April, a significant percentage of our customer base was shut down. While production rates are increasing, things haven’t gotten back to normal.”

|

Naphthenic plants suffered a 23% decline from the same period last year to 3.9 million barrels, the lowest first-half production total in available EIA records.

|

Another industry source, who asked not to be named, noted that both Calumet and Ergon had refinery turnarounds in the second quarter. Calumet has capacity to produce a total of 7,000 b/d of naphthenics at its plants in Princeton and Shreveport, Louisiana, and Ergon can make 22,000 b/d in Vicksburg, Mississippi. Together the two facilities account for 65% of U.S. naphthenic capacity.

Several paraffinic plants also moved up turnarounds that had been scheduled for later in the year in order to take advantage of the drop in demand due to pandemic-induced lockdowns that began in March. LyondellBasell’s 3,600 b/d of naphthenic capacity was also lost when the Houston, Texas, plant stopped running last year.

But the dip in overall production began before domestic lockdowns were in place. February 2020 had the lowest monthly total of the first half at 3.7 million barrels. While February is typically a slower month, this represents a 16% drop below February 2019’s 4.4 million barrels.

Although most U.S. automotive plants and support industries shut down from March through May due to the pandemic, East Asia was hit by the coronavirus first and entered lockdown before North America, observed Ernie Henderson, president of K&E Petroleum Consulting. This slowed demand for vehicle and other imports from the U.S. and may have also impacted the region’s ability to produce parts supplied to car plants in North America, which would also have stymied vehicle production. This could have had a knock-on effect on factory-fill lubricant demand and therefore demand for base oil, he speculated.

Another factor in the spring slow-down may have been the sudden drop in crude oil prices in March and April due to the double-whammy of reduced global demand for fuels during lockdowns and increased production from Russia and Saudi Arabia. “Refineries may have needed to restructure some of their operations, including feedstock selection, to reduce production of low- or negative-margin products like gasoline, jet fuel and low-sulfur fuel oils for the cruise ship industry,” Henderson explained. With operations scaling back, base oil plants that are part of larger refineries may have also been forced to rein in production.

Decline Varied by Region

The data also reveal that certain regions within and among the five Petroleum Administration for Defense Districts fared better than others. The super-producing Padd 3, which includes the Gulf Coast, lowered its production rate by 10% from last year’s first half to 20.4 million barrels, on par with the national decrease. However, refineries in the Texas Gulf coast subsection of Padd 3, including ExxonMobil’s Baytown plant with 8,200 b/d of API Group I capacity and 18,800 b/d of Group II, as well as Motiva’s Port Arthur site with 40,300 b/d of Group II capacity, only backed off by 3%. This likely contributed to the district producing nearly 80% of the national total for the first half—even more than the 75% share of national capacity located there.

On the other hand, the Texas Inland subsection, where Valero’s 2,400 b/d naphthenic plant is located in Three Rivers, dialed back production by 53% from the first half of 2019 to 74,000 barrels. The plant made just 5,000 barrels in January and none in February but picked back up in March. Valero did not reply to a request for comment.

The North Louisiana-Arkansas subsection also suppressed its production by more than the national average, down 17% to 4.3 million barrels. That area has a large proportion of naphthenic production and includes Cross Oil; Calumet’s facilities, which can make 4,800 b/d of Group I, 6,600 b/d of Group II and 400 b/d of Group III in addition to naphthenics; and Ergon, which has 3,000 b/d of Group I capacity in Vicksburg, Mississippi, along with naphthenics.

Other plants in Padd 3 include Chevron’s 25,000 b/d Group II plant in Pascagoula, Mississippi; Excel Paralubes’ 22,200 Group II facility in Westlake, Louisiana; and ExxonMobil’s facility in Baton Rouge, Louisiana, with 16,000 b/d of Group I. Together, production at these plants was down 11% to 8 million barrels.

The only plant in Padd 2, production at HollyFrontier’s 9,500 b/d Group I facility also dropped a little more than the national average to 905,000 barrels, down 13%.

Two million barrels flowed out of Padd 1, which runs along the East Coast and includes American Refining Group’s 2,400 b/d Groups I and II facility in Bradford, Pennsylvania; Ergon’s 4,800 b/d Groups I and II plant in Newell, West Virginia; and PBF Energy’s 11,000 b/d Group I refinery in Paulsboro, New Jersey. This was down 9% from first-half 2019.

The California refiners in Padd 5, including Chevron’s plant in Richmond (20,700 b/d of Group II and 1,000 b/d of Group III) and San Joaquin Refining in Bakersfield (8,100 b/d of naphthenics), made almost 2.6 million barrels, down 11% from the previous year period.

Exports Take a Dive

With the global nature of the pandemic, trade flow was also affected negatively.

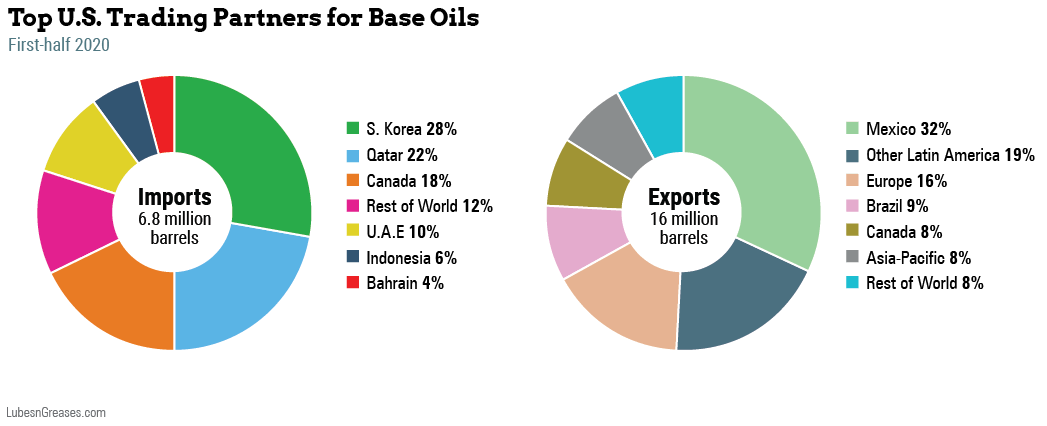

Exports saw the most dramatic decline, plunging to 16 million barrels—17% below January–June 2019—with April and May being the slowest. With production only declining 10% and domestic demand down as well, the question arises of where all of that extra base oil went. “In April and May we entered the Twilight Zone Market of the unexplained,” remarked Joe Rousmaniere, director of business development for base oil trader Chemlube International.

The country’s top trading partners largely retained a steady share of its exports. Canada and Mexico’s shares remained the same, with Mexico taking its customary third of exported U.S. barrels. Brazil gave up about 3 percentage points, which were picked up by the rest of Latin America. Europe took about 2.6 million barrels, giving up 2 percentage points from last year’s first half.

Asia was the only region to increase its share of U.S. exports, jumping from 5% to 8% and taking 1.2 million barrels.

Imports to the U.S. fell to 6.8 million barrels in the first half of this year, down 9% from the year-earlier period. South Korea retained its 28% share of the barrels brought to U.S. shores, followed by Qatar, which dropped from 25% to 22%, and Canada a steady 18%.

“Imports into the U.S. are almost entirely Group III,” said Rousmaniere. These came mostly from SK and S-Oil in South Korea, Shell’s Pearl plant in Qatar, and from the Abu Dhabi National Oil Co. in the United Arab Emirates, he noted. Petro-Canada, for its part, is the only major source of Group III in North America.

All of the barrels from the Adnoc refinery in Ruwais came in January, February, March and June, as the plant underwent a maintenance turnaround in the spring, according to Rousmaniere. Despite the hiatus in April and May, the country’s share of imports to the U.S. increased from 7% to 10%.

A Lower Baseline

The unnamed base oil official is eyeing up the rest of 2020 with cautious optimism. “Production should be stronger, and demand has recovered—not all the way back to pre-COVID levels, but much better than May and June.”

Ernie Henderson isn’t as hopeful in light of historical patterns. During the economic downturn of 2008-2009, significant demand erosion occurred, he explained during the ICIS Middle East Base Oils & Lubricants Conference, held virtually in October. Industry players rationalized production and upgraded technology, placing even more emphasis on synthetics and energy efficiency—all of which drives down volume demand for lubricants and therefore base oils. Demand recovered, but to a lower level than the years prior to the recession.

Henderson forecasts a similar erosion of lubricant demand from the COVID-19 pandemic, with overall demand in the United States settling about 14% lower than 2019 levels.

Other predictions have concurred that demand is unlikely to return to pre-pandemic volumes. In July, IHS Markit said it expected U.S. transportation lubricant demand in 2022 to be 9% below 2019 levels, and industrial lube demand to be down 12%.

“The economy will again recover, but another new norm will result,” Henderson said.

Caitlin Jacobs is managing editor of Lubes’n’Greases magazine. Contact her at Caitlin@LubesnGreases.com.

The Lubes’n’Greases Factbook includes more information on base oil production and trade in the U.S. and other regions. Get your copy at www.LubesnGreases.com/factbook.