As the United States braced itself for another wave of lockdowns, the industry took stock of the base oils market during the ICIS Pan American Base Oils & Lubricants Virtual Conference held last week.

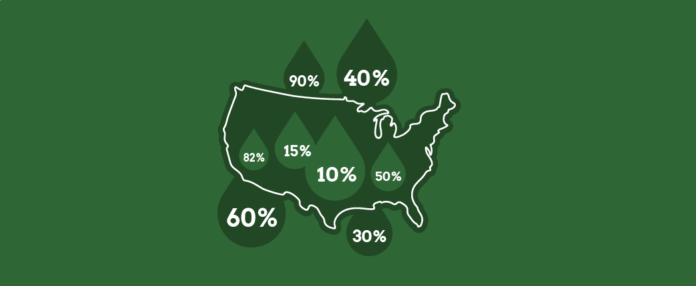

Demand for base oils was down 40%-60% in April and May, and demand for lubricants in end-use markets dropped between 30% and 90%, depending on the application, reported Amanda Hay, ICIS acting managing editor for Americas.

Comparing the months from March to November with the same period in previous years, she estimated that refinery run rates have been 10%-15% below normal, with production at base oil plants even lower.

In April, even with base oil plant operating rates down to 50%-60%, storage tanks were full. “During April and somewhat into May, the U.S. did not have its usual outlet to clear Group II overhang in the export markets, as most other regions were experiencing the same [demand] conditions,” Hay said.

Refinery run rates climbed back up to 82% before a rash of shutdowns during hurricane season. Several plants halted production before Hurricane Laura hit the Gulf Coast on Aug. 25, including the 22,000 b/d API Group II Excel Paralubes plant in West Lake, Louisiana, and Motiva’s 40,300 b/d Group II plant in Port Arthur, Texas. Motiva was back online within two weeks, but Excel Paralubes was unable to restart until late October.

Calumet Specialty Products Partners also dialed back operations at its 11,900 b/d naphthenic and paraffinic Shreveport, Louisiana, base oil facility. The company said it was running normally at the end of August.

This amounted to about 40% of U.S. virgin Group II refining capacity being out of commission for a couple of weeks. “Hurricane Laura significantly tightened Group II, on top of the already tighter supply because of the lower refinery rates,” Hay noted.

“While all Group II suppliers are back to producing again,” she said, “… supply levels have not really improved. The U.S. remains balanced to snug on Group II with spot availability quite tight still.”

By the summer, base oil supply “was mostly sufficient for the domestic U.S. market despite renewed order activity as lockdowns ended,” she continued.

However, Hay attributed most base oil purchases to lubricant companies building inventory either for immediate needs or for hurricane insurance – or taking advantage of lower prices – rather than due to actual demand recovery.

U.S. exports were down by 13% through September, compared to the same period of 2019. However, export volumes in August were higher than last year, mostly due to demand from Brazil and India. “Brazil was experiencing some local production constraints, and that has been driving buyers into the export markets since around June,” Hay said.

Export prices, which are typically 20-30 cents per gallon less than domestic prices, fell about 50% in the second quarter, she reported. But by autumn, they had risen to about 5 cents more per gallon than domestic gallons because suppliers had been focusing on increasing sales to domestic customers.

In general, base oil prices were pushed down in the spring as demand for fuels dragged crude futures to historic lows, and the cost of vacuum gas oil – used as feedstock for base oils – tumbled along with it. Domestic prices for Group I fell 24%, Group II fell 38% and Group III dipped 16% compared to pre-COVID-19 numbers, according to Hay.

However, tightening supply in late summer pushed prices back up again: 16% for Group I, 46% for Group II and 23% for Group III.

Group III prices are now trending higher in the U.S. than before the pandemic, despite heavy use in motor oils, which were hit hard when the pandemic choked off demand. “The fact that the U.S. imports most of its Group III material likely factors into this, as we did have a halt of imports of Group III material coming into the U.S. between March and July,” Hay said.

Currently, “Group I is very snug, particularly heavy grades and bright stock,” she continued. Group II availability is also limited, mostly affecting spot markets and exports, while strong demand in Europe and the U.S. has created shortages of Group III.

Hay said she doesn’t expect a return to pre-pandemic levels of base oil or lubricant demand until the second half of next year or later. “With the coronavirus lingering into 2021, we anticipate that buying behavior will be on an as-needed basis. True recovery, of course, depends on how long [the virus] lingers and how work and travel will permanently change as a result.”