The New Year was expected to usher in more export negotiations as domestic activity remained muted. United States suppliers have resorted to exporting supplies to reduce inventories at home, and they have been fairly successful at capturing fresh opportunities. Looking forward into 2025, participants hoped that domestic demand would improve compared to 2024, given that base oil consumption was down by an average of 6-8% from the previous year. The market was also expected to face uncertainties related to the new trade policies and immigration rules likely to be embraced by president-elect Donald Trump.

While some market players entertained positive expectations in relation to Trump’s promise to support the oil and gas industry in the U.S., others wondered whether his intention of imposing tariffs on all imports would result in an increase in the cost of raw materials that many have no choice but to secure overseas. It was heard that some manufacturers have already started to stockpile those items that may be subject to higher tariffs in the new year.

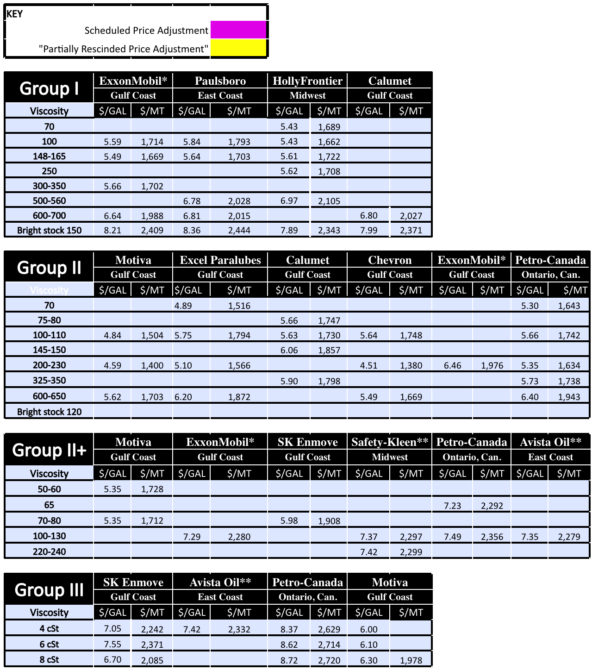

Posted prices were unchanged for the week, but there were reports that at least one supplier was mulling an adjustment to bring its prices more in line with actual market values. The last posted price revisions were announced between late October and late November given sluggish demand, softer crude oil and feedstock prices, and inventory pressure.

Base oil orders had started to ebb in the weeks preceding the year-end holidays and were not expected to pick up the pace significantly until mid January or early February. Availability of most base oil grades remained ample, but the API Group I segment continued to show some tightness as demand for certain grades was steady and a couple of producers were likely to have trimmed operating rates to avoid oversupply conditions.

Bright stock still commanded plentiful of attention and at times it seemed that production has not been sufficient to cover all domestic requirements, particularly as North American Group I output has steadily declined over the last two decades, and bright stock is a difficult grade to replace. Group I grades are still very much sought-after in Mexico and Brazil – two of the largest U.S. base oil importers.

There was also reduced supplies of Group II cuts due to an unplanned shutdown at the Excel Paralubes Group II/III unit in Lake Charles, Louisiana, in November that led to a temporary tightening of short-term spot supply. The producer does not comment on the status of its operations, but sources familiar with the plant’s operations said that the shutdown was caused by a compressor issue. The producer was anticipated to have restarted the base oil plant by the end of the year, but had suspended spot offers and had also been forced to cancel some export orders it had previously agreed to, according to sources. Group II grades had also seen an output reduction as a number of refiners had favored Group III production earlier this year.

Another factor that may affect Group II supplies in the coming weeks was the three-week turnaround Chevron scheduled at its Pascagoula, Mississippi, plant, starting in March 2025. Observers anticipated the company would to start building inventories to cover commitments during the outage and perhaps reduce its spot availability.

The Group III segment appeared well-supplied, particularly 4 cSt, not only because several Middle East and South Korea cargoes were expected to arrive in the U.S. over the next few weeks, but due to domestic refiners having increased their Group III output.

A number of U.S. suppliers set their sights on export business into Latin America, as prices were attractive and logistics are less complicated than for destinations in Africa, Asia and the Middle East. Brazil imported vast amounts of U.S base oils in 2024 and negotiations for additional barrels were ongoing, although discussions came to a halt over the year-end holidays. A 2,000-metric ton cargo was mentioned for loading in Houston to Rio between December 13 and January 15.

Export business to India has been less vibrant over the last few months compared with previous years as demand in India remained lackluster and many blenders preferred to acquire domestic products instead of dealing with the uncertainties of imported cargoes. Nevertheless, sources said that a number of shipments had been lined up from the U.S. Gulf to India in January and February.

On the naphthenic base oils front, there were no official price change announcements, and values were generally stable, supported by a balanced-to-tight supply scenario for the light grades in particular. Seasonal demand for heavy-viscosity pale oils from segments such as the tire and rubber industry weakened, but there were expectations that consumption would pick up again in spring.

In this base oils segment, many players hoped that the incoming U.S. administration’s policies would support demand for drilling fluids, solvents, transformer oils and other applications that require naphthenic base oils in their formulations and were preparing projections accordingly.

Downstream, the year ended with competitive movements among suppliers as demand for finished products was flat and inventories were plentiful. Many blenders were dealing with high production costs despite base oil price decreases in the last quarter of 2024, as other raw materials had not been adjusted down. Some additive suppliers had granted discounts into select accounts, but this was not a widespread situation, while a majority of manufacturers dealt with inflationary pressures and rising energy and production costs. Given a significant reduction in demand for conventional oils from key segments such as the automotive industry, lubricant manufacturers resorted to granting decreases throughout the year to protect market share, with four announcements made during 2024 – although not all suppliers implemented decreases at the same time and the amount of the price reductions varied.

Crude

Crude oil futures were trading at higher levels on Wednesday, buoyed by fresh data showing some growth in China’s manufacturing sector – a sign that recent stimulus policies might be having an effect on the country’s economic recovery – and a larger-than-expected drawdown in U.S. crude inventories for the week ending December 20.

On Dec. 31, West Texas Intermediate February 2025 futures settled on the Nymex at $71.72 per barrel, compared with $69.62/bbl on December 26.

Brent futures for March 2025 delivery traded on the ICE at $74.64/bbl on December 31.

Louisiana Light Sweet crude wholesale spot prices hovered at $74.03/bbl on December 30, according to the U.S. Energy Information Administration.

Low sulfur diesel was at $2.28/gal at New York Harbor, $2.22/gal on the Gulf Coast and $2.32/gal in Los Angeles on December 30, according to the EIA.

Gabriela Wheeler directly at gabriela@lubesngreases.com

Posted paraffinic base oil prices: January 1, 2025 (FOB basis, USD/gallon and USD/metric ton)

Lubes’n’Greases Publications shall not be liable for commercial decisions based on this report.

Archived reports are here. Historic and current base oil pricing spreadsheets are available to buy here.

*ExxonMobil prices obtained indirectly

**Rerefiner