News that ExxonMobil and HollyFrontier announced a posted price increase hit the market this week, with rerefiner Safety-Kleen also communicating a price adjustment. The adjustments may face some resistance, as crude oil and feedstock values have come down from earlier highs, but base oil margins were still under pressure. Volatility in upstream markets continued, with crude oil moving up one day and falling the next.

Base oil demand remained sluggish and was not expected to improve significantly until early spring. Freezing winter temperatures along the U.S. coast of the Gulf of Mexico last week forced plants to run at reduced rates, but the storm did not have a significant impact on production. Port operations and transportation were affected for a few days and were expected to have returned to normal this week.

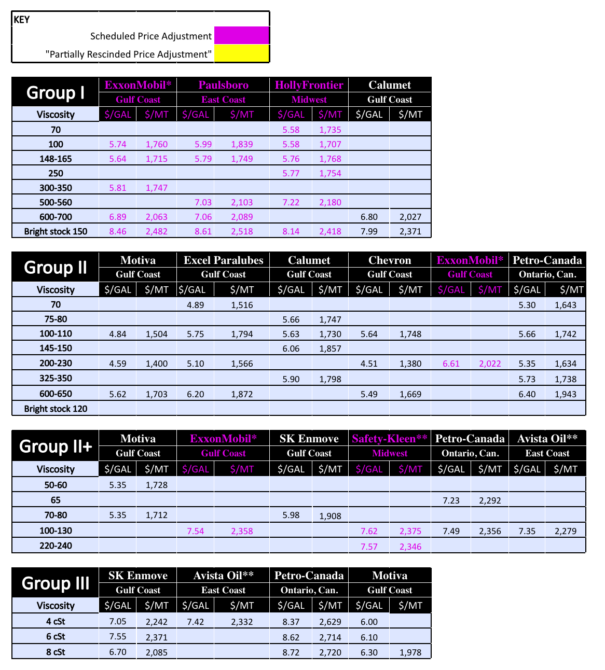

According to reports, ExxonMobil will increase API Group I SN100 and SN330 by 15 cents per gallon, SN600 by 25 cents/gal and Group I bright stock by 25 cents/gal. The producer’s Group II EHC65 will be lifted by 15 cents/gal and Group II+ EHC45 by 25 cents/gal. The company’s Group II+ EHC120 will also be raised by 20 cents/gal, but this cut is not listed below. All of the adjustments will go into effect on February 1. The company explained that it was increasing prices “due to regional and global supply/demand balances changing and emerging economic uncertainty,” with price letters expected to be distributed by January 30.

HollyFrontier Sinclair also communicated a posted price increase on Group I grades, effective February 3. At this time, no adjustments on other groups have been announced, but the company continued to evaluate market conditions. The producer’s Group SN70/100/150/250 grades will be lifted by 15 cents/gal, and its SN525 and bright stock by 25 cents/gal. The adjustments come on the back of significant pressure on base oil margins, and the threat of tariffs that could compress them even further.

Paulsboro will be increasing its Group I prices as well, with its light grades moving up by 15 cents/gal and the heavy-viscosity cuts and bright stock by 25 cents/gal, effective February 5.

Rerefiner Safety-Kleen notified customers that the company would be increasing its postings by 25 cents/gal on its Group II+ RHT120 and 15 cents/gal on its Group II+ RHT240, effective February 1, due to elevated feedstock costs and improved demand signals.

Market players were keeping an eye on crude oil and feedstock prices as they were swayed by geopolitical tensions and the U.S. president’s actions during his first few days in office. Over the weekend, Colombian President Gustavo Petro refused to accept U.S. military planes deporting shackled immigrants, almost leading to a trade war, media outlets reported. The U.S. imports large volumes of crude oil from Colombia and this exchange had caused a short-lived spike in oil prices.

Oil values had also rallied when the U.S. announced fresh sanctions on Russian crude oil shipments and tankers that were intended to curb revenues that Moscow uses to fund its war on Ukraine. However, Russia has found a way to work around these sanctions and is refining more crude oil, in hopes of boosting fuel exports as shipments of unprocessed crude are under embargo, sources commented.

But crude oil futures have slipped from the steeper levels seen earlier in the month on weak economic data from China, the U.S. president’s promise to support increased drilling, and worries that proposed tariffs on U.S. imports would weaken the economic wellbeing of many nations, leading to reduced global energy demand. West Texas Intermediate futures had been hovering at around $77 per barrel on January 15 and have fallen to levels near $73/bbl.

Aside from the cost uncertainties affecting refining operations, producers were concerned about the fact that base oil demand has been on a downward trend since the COVID-19 pandemic, and did not expect a significant improvement until consumption from automotive applications increased.

Suppliers continued to fill contractual orders as planned and hoped to see increased demand ahead of the spring lubricant production season in late February or March. Suppliers noticed a small uptick in spot business this week, which they attributed to the higher feedstock prices seen earlier in the month. Export business has slowed down slightly because U.S. offers were deemed less competitive than a few weeks ago.

Upcoming plant turnarounds and an expected demand surge might tighten base oil supplies in the coming weeks. The API Group I cuts were already on the snug side because of structural deficits and healthy demand from several domestic sectors, as well as from the export market, with bright stock standing out as one of the most sought-after cuts.

Supply of Group II cuts was also more than adequate to meet current demand, but the 100N and the heavy grades seemed to be less readily available and this condition may be exacerbated by maintenance shutdowns at a couple of facilities.

Chevron was reported to have scheduled a three-week turnaround at its Pascagoula, Mississippi, Group II plant, starting in March. The turnaround may lead to a tightening of spot Group II supplies, but contractual obligations were likely to be fully met, sources speculated. The producer does not disclose details about its plant operations.

Calumet will also be completing a two-week maintenance program at its Group I and Group II units in Shreveport, Louisiana, in the second half of February. The producer has assured customers that it plans to have ample inventory to cover orders during maintenance.

The extreme winter storm that blanketed large swaths of the U.S. with snow last week had limited impact on base oil production, despite the fact that a number of facilities are located in areas where the freezing temperatures had caused road closures and transportation disruptions. Most producers had prepared for the frigid weather by reducing operating rates and running additional power generators.

There were reports that a few units at Motiva’s Port Arthur, Texas, refinery had suffered brief glitches during the storm, but sources said that base oil production had not been affected.

Calumet also saw no output disruptions from the cold snap. “We did a lot to prepare ourselves ahead of the cold weather and it had limited impact. There were certainly some challenges, but we navigated the cold weather well,” a company source commented.

On the naphthenics base oils side, there were no production outages noted, with prices remaining largely unchanged while participants kept a close eye on crude oil and feedstock prices. Recent price spikes had triggered expectations of potential price adjustments, but producers said that the higher values would have to be sustained for some time before any price revisions would be considered. Balanced supply and demand conditions, particularly for the light-viscosity grades, offered additional support to stable pricing.

San Joaquin Refining will start an annual maintenance program at its naphthenic base oil plant in Bakersfield, California, on January 31. The program will last up to three weeks. The producer was expected to continue meeting contractual obligations during the shutdown.

Paraffinic base oils export business has been less vibrant than at the end of the year because of uncertainties in terms of demand from lubricants segments, and the fact that U.S. offers had lost some of their competitive edge since many local currencies have weakened against the dollar. However, there appeared to be revived interest for Group I grades from Europe as the market there has tightened and Asian availability was also sparse. This week, details emerged of a 2,000-metric ton parcel shipped from Houston, Texas, to Rotterdam, Netherlands, in the second half of January.

Conversely, buying interest for Group I grades from Brazil has been lackluster because buyers have been able to secure domestic product and base oil imports from Argentina. A 6,000-ton cargo was mentioned for shipment from La Plata, Argentina, to Santos, Brazil, in late February or early March. At the same time, there was a 1,300-ton cargo expected to be shipped from Houston or Lake Charkes, Louisiana, to Doc Sud, Argentina, in the first half of March.

There has been an small upswing in appetite for Group II and Group III cuts in Brazil, with offers from both the U.S. and Asia being considered. A 3,000-ton lot was being discussed for shipment from the U.S. Gulf to Rio de Janeiro between February 20 and March 10. Similarly, there have been offers for smaller cargoes moving from the U.S. and Asia to other parts of Latin America. A 1,500-2,000-ton parcel was quoted for shipment from Houston to Balboa, Panama, in early February.

Activity in Mexico was steady, but blenders continued to hold off on purchases for as long as possible to gain a better perspective on price direction. Lubricant demand was impacted by uncertainties related to the U.S. president’s plan to raise tariffs on products from Mexico, where U.S. automakers operate several factories. General Motors executives, for example, are closely monitoring the president’s plans because the tariffs could deal a big blow to GM and other automakers that produce vehicles and components in those countries, and probably increase the price of many vehicles sold in the United States, according to The New York Times.

Group III grades were considered to be largely balanced against demand, but there could be some tightening in the near future because of reduced domestic production and upcoming turnarounds at Group III plants in Asia. According to sources, South Korean producer GS Caltex was preparing for a turnaround at its Group II/Group III plant in Yeosu and has started to build inventories to cover term commitments during the outage. The turnaround was anticipated to start in early March and be completed by mid April, likely tightening spot availability in the first quarter.

SK Enmove will be completing a partial turnaround at its Ulsan, South Korea, Group III plant for two months, starting in May, but the shutdown was not expected to have an effect on export volumes to the U.S. because of uninterrupted production on the facility’s other trains.

In other industry news, LyondellBasell is on schedule to cease refining operations at its Houston Refinery, located on the Houston Ship Channel, at the end of the first quarter of 2025, Houston-based Chron.com reported. A gradual ramp-down was scheduled to begin toward the end of January and continue through February. The refinery, which began operations in 1918, produces transportation fuels such as gasoline, diesel and jet fuel, and used to produce base oils as well. The base oil plant had capacity of 1,000 barrels per day of Group II base oils and 3,600 b/d of naphthenics and ceased to operate in 2020. A contract allowing Calumet to market naphthenic base oils from the plant had expired the previous year, and the company decided to shut down the facilities.

LyondellBasell plans to convert the refinery’s hydrotreaters to produce plastic pellets from recycled plastic items, according to a Reuters article. The Lyondell plant is the first of two refineries scheduled to be shut down this year as motor fuel demand is declining. Phillips 66 stated in October that it will shutter its Los Angeles refinery by the end of 2025.

Crude and Diesel Prices

Crude oil futures edged down on Wednesday as API data showed an increase in weekly U.S. crude and gasoline inventories, and there were concerns about Trump’s plans to impose tariffs on Canada and Mexico on February 1. Libya also reported that oil loadings had resumed after protests. News about Chinese startup DeepSeek’s low-cost artificial intelligence model worried analysts that energy demand to power data centers could be lower than previously forecast.

On January 28, West Texas Intermediate March 2025 futures settled on the Nymex at $73.77 per barrel, compared to $75.83 on January 21.

Brent futures for March 2025 delivery were trading on the ICE at $77.20/bbl on January 28, from $79.64/bbl on January 21.

Louisiana Light Sweet crude wholesale spot prices were hovering at $75.21/bbl on January 27, from $80.26/bbl on January 17, according to the U.S. Energy Information Administration. (There was no trading on January 20 due to the Martin Luther King Jr. Day federal holiday in the U.S.)

Low sulfur diesel wholesale spot prices were at $2.48/gal at New York Harbor, $2.40/gal on the Gulf Coast and $2.52/gal in Los Angeles on January 27, compared to $2.63/gal, $2.52/gal and $2.67/gal, respectively, on January 17, according to the EIA.

Contact Gabriela Wheeler directly at gabriela@lubesngreases.com

Posted paraffinic base oil prices: January 29, 2025 (FOB basis, USD/gallon and USD/metric ton)

Lubes’n’Greases Publications shall not be liable for commercial decisions based on this report.

Archived reports are here. Historic and current base oil pricing spreadsheets available to buy here.