Calumet joined the group of base oil producers that had announced posted price increases last week, with these adjustments going into effect Feb. 1-7. According to the suppliers, the increases were driven by steeper crude oil and feedstock prices since early January, emerging economic uncertainties, and an improved supply-demand balance. Many questions remained unanswered regarding President Trump’s tariff imposition on Mexican, Canadian and Chinese imports. His executive action was met by retaliatory measures from China, and saw a one-month postponement in the case of Mexico and Canada amid ongoing negotiations.

The U.S. president also threatened to impose tariffs on goods from the European Union. This caused great concern as a widespread trade war would likely have significant economic impact not only on the nations involved, but also on global trading patterns, particularly those of crude oil and refined products. For example, Asian refiners could benefit from purchases of discounted Mexican and Canadian crude that would boost their profit margins.

Base oil market participants kept a keen eye on oil prices, as the announced posted increase implementation partly hinged on the fact that oil and feedstock prices had strengthened in early January. Oil futures jumped again on Monday on concerns over oil imports from Canada and Mexico – two of the main crude suppliers to the U.S. – but later dipped as the U.S. paused the new tariffs for one month after Mexico agreed to reinforce its northern border to help stop the flow of illegal drugs. A tariff on crude imports from Canada could have a major impact on U.S. refineries, according to OilPrice.com.

“Almost all of Canada’s 4 million barrels per day flow to the United States, with some 65% of those exports taken in by refiners in the Midwest, a region that has no other supply route because infrastructure in the Gulf Coast is geared towards exporting light barrels from the U.S.,” the media outlet reported.

A 10% levy on products from China was still scheduled to take effect on February 4. The 10% tax will be added to the tariffs already imposed on China by Trump in his first term and by President Joe Biden. The Chinese government said it would file an action with the World Trade Organization in response, and also slapped a 15% levy on American coal and liquefied natural gas, as well as 10% on crude oil, farm equipment and some vehicles. These tariffs would go into effect on Feb. 10.

Base oil market players said it was still too early to ascertain what impact these tariffs would have on their businesses, but many domestic lubricant manufacturers were concerned about a likely price increase on raw materials and packaging imported from China, which they said would be difficult to pass on to consumers as competition among suppliers was strong.

The automotive segment could also suffer significant impact from tariffs on Mexican goods as the price of vehicles imported from Mexico would likely increase, and this would depress U.S. car sales, ultimately affecting the fuels and lubricants industry. Several major U.S. automakers operate manufacturing facilities in Mexico.

Base oil consumption was not anticipated to show a significant change until the spring, when it typically improves because of heightened lubricant production ahead of the summer driving season. However, some buyers had secured additional base stock volumes in recent weeks to beat potential price increments given crude oil price volatility.

In some segments of the market, fundamentals were weighed down by oversupply, while in others, they were more balanced. Despite many market uncertainties—or perhaps because of them—several producers have stuck to their plan of implementing posted price increases. The initatives received additional support in the Group I segment from a tight supply and demand ratio. This week, Calumet joined ExxonMobil, HollyFrontier Sinclair, Paulsboro and Safety-Kleen in communicating posted price hikes.

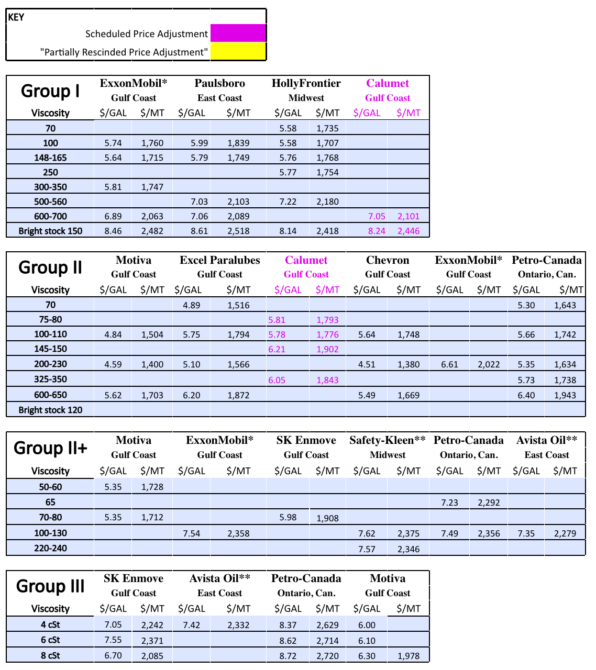

Calumet’s paraffinic price increases will go into effect on Feb. 7. The company’s API Group I SN600 and bright stock will be raised 25 cents per gallon and the Group II 75/80N, 100N, 150N and 325N will be lifted by 15 cents/gal.

According to reports, ExxonMobil had increased its Group I light grades by 15 cents/gal and its heavy-viscosity grades by 25 cents/gal as of Feb. 1. The producer’s Group II cut went up by 15 cents/gal and its Group II+ grade by 25 cents/gal.

HollyFrontier Sinclair also communicated a posted price increase on Group I grades, effective February 3, with the producer’s light grades edging up by 15 cents/gal, and its SN525 and bright stock by 25 cents/gal. The adjustments come on the back of significant pressure on base oil margins, and the threat of tariffs that could compress them even further, the company explained.

Paulsboro increased its Group I prices as well, with its light grades moving up by 15 cents/gal and the heavy-viscosity cuts and bright stock by 25 cents/gal, effective Feb. 5.

Rerefiner Safety-Kleen raised its Group II+ RHT120 posting by 25 cents/gal and its Group II+ RHT240 by 15 cents/gal, effective February 1, citing elevated feedstock costs and improved demand signals as the main drivers.

Market players believed it was less likely for the balance of the Group II producers to seek price increases as their inventories were balanced-to-long and prospects of a short-term demand recovery were nebulous. “Spot prices appear steady, so I don’t think there is much of an appetite for suppliers to justify a change in prices currently,” a source commented. Whether additional initiatives would emerge remained to be seen. Some suppliers may be recalling temporary value allowances (TVAs) granted in the fourth quarter instead of adjusting posted prices.

Upcoming plant turnarounds and an expected demand surge in the spring might tighten base oil supplies in the coming weeks. Availability of Group I cuts was strained because of structural deficits and healthy demand in the domestic arena, as well as from the export market. Bright stock was described as enjoying robust demand against cramped supplies.

In the Group II category, most grades were heard to be available, but the 100N and the heavy grades were slightly tighter and this condition may be exacerbated by maintenance shutdowns at a couple of facilities.

In March, Chevron was expected to commence a three-week turnaround at its Pascagoula, Mississippi, Group II plant. The turnaround may lead to a tightening of spot Group II supplies, but contractual obligations were likely to be fully met, sources speculated. The producer does not disclose details about its plant operations.

Calumet will also be completing a two-week maintenance program at its Group I and Group II units in Shreveport, Louisiana, in the second half of February. The producer has assured customers that it plans to have ample inventory to cover orders during maintenance.

The Group III sector was fairly quiet, with the 6 cSt and 8 cSt grades showing tighter conditions than the 4 cSt cut and supporting slightly higher spot pricing as a result.

On the naphthenics base oils side, San Joaquin Refining scheduled an annual maintenance program at its naphthenic base oil plant in Bakersfield, California, which started on January 31. The program will last up to three weeks. The producer was expected to continue meeting contractual obligations during the shutdown, but was not offering volumes beyond those agreed under contract.

Naphthenic prices were largely unchanged, but producers said that they were monitoring crude oil and feedstock values. If steeper costs were sustained for a few weeks, they would likely trigger price revisions, sources said, but none have emerged so far. Balanced supply and demand conditions, particularly for the light-viscosity grades, continued to support steady pricing.

Export activity has been rather muted, especially compared with a year ago, when there was an abundance of U.S. shipments to Mexico, Brazil, West Coast South America and India. High offer prices, increased domestic production in many of these countries coupled with muted buying interest have hampered transactions. Brazil has also been able to source Group I products from neighboring Argentina, while India has been considering competitive offers from Northeast Asia and Middle East suppliers. Buying appetite for Group II may see a revival in Mexico as export prices of the light grades have come under pressure in the U.S. due to growing supplies, and this has made them more attractive.

Crude Oil and Diesel Prices

Oil prices were up in early trading on Monday as Trump’s tariffs loomed, but gains were limited by concerns that a trade war would impact the economy negatively. Prices slumped after tariffs on Mexican and Canadian imports were postponed for a month.

Meanwhile, OPEC+ agreed to adhere to its plan to gradually raise oil output from April. During an online meeting, the group also changed the list of consultants and other firms it uses to monitor production. It will no longer use the U.S. Energy Information Administration (EIA) or Rystad, and will instead use Kpler, OilX, and ESAI for second sources, Reuters reported.

On Feb. 4, West Texas Intermediate March 2025 futures settled on the Nymex at $72.70 per barrel, compared with $73.77/bbl on Jan. 28.

Brent futures for April 2025 delivery were trading on the ICE at $75.80/bbl on Feb. 4, from $77.20/bbl for March futures on Jan.28.

Louisiana Light Sweet crude wholesale spot prices were hovering at $76.92/bbl on February 3, from $75.21/bbl on Jan.27, according to the U.S. Energy Information Administration.

Low-sulfur diesel wholesale spot prices were at $2.46/gal at New York Harbor, $2.38/gal on the Gulf Coast and $2.50/gal in Los Angeles on February 3, compared with $2.48/gal, $2.40/gal and $2.52/gal, respectively, on Ja. 27, according to the EIA.

*ExxonMobil prices obtained indirectly.

**Rerefiner

Gabriela Wheeler can be reached directly at gabriela@LubesnGreases.com

Posted Paraffinic Base Oil Prices February 5, 2025

(Prices are FOB basis, in U.S. dollars per gallon and dollars per metric ton)

Lubes’n’Greases Publications shall not be liable for commercial decisions based on the contents of this report.

Archived base oil price reports can be found here. Historic and current base oil pricing data are available for purchase in Excel format.