Demanding More from Industrial Lubes

Users of industrial lubricants are seeking innovative solutions that excel in terms of performance and sustainability.

The use of industrial lubricants is broad and wide-ranging. These almost ubiquitous fluids, oils and greases are vital for improving the efficiency, performance and longevity of everything from machinery in factories and processing plants to the fleets of heavy-duty vehicles used in the mining and construction industries.

Yet users and manufacturers are increasingly looking for more from their lubes, beyond them just being able to operate effectively in often extreme conditions.

Besides fundamental attributes such as temperature resistance, friction reduction, wear protection, and excellent thermal and oxidation stability, users are also now demanding a generation of lubricants that boast excellent environmental credentials.

The push for more sustainable lubricants is certainly gaining traction—fueled by growing awareness among end users about the environment and the impact of these products on ecosystems, as well as tougher legislation aimed at reducing carbon emissions. Their uptake will only continue to grow given business’ environmental, social and governance (ESG) requirements.

According to a report by Grand View Research, the size of the global industrial lubricants market totaled $53.17 billion in 2022. Figures from the market research firm suggest the segment will also see a compound annual growth rate (CAGR) of 3.9% from 2023 through the end of the decade.

The impetus for more sustainable lubricants has been particularly noticeable in the environmentally sensitive areas of mining, forestry, shipping and agriculture.

Among other key growth markets are manufacturing, automotive, construction, metals processing and the renewable energy sectors.

“Demand for sustainable lubricants has been steadily growing as companies across various industries prioritize environmental sustainability,” said Anne Brown, head of product development & application engineering for general manufacturing & maintenance at Henkel North America. “This trend is likely to continue as awareness of environmental issues increases, regulations become more stringent and consumers demand greener products. Additionally, advancements in technology and formulations are making sustainable lubricants more attractive in terms of performance and cost-effectiveness.”

Matthew Kriech, CEO of Biosynthetic Technologies and Innoleo added that “lubricants are all about ensuring equipment runs in the most sustainable way possible for its end users. They minimize fuel consumption and ensure long product life of equipment.”

“People tend to think of lubricants as a dirty oil business, but I’d argue that lubricants are probably one of the most sustainable products available,” he said. “Their whole purpose is to reduce friction, and if you didn’t reduce friction, the amount of energy we’d be spending to do the things we do would be orders of magnitude higher.”

Lubricants have been taking a sustainability angle for some time, Kriech said. “I think what’s happening now because of all the regulation, ESG requirements and growing consumer awareness, is there’s more of a focus on the actual internal sustainability of lubricants as well as how they are perceived from a performance perspective.”

Of course, there is still plenty of progress to be made and challenges to be overcome, such as improved testing, sourcing the required raw materials and ensuring compatibility with existing products and equipment.

“There’s not any one solution,” Kriech said. “It’s going to be a convergence of technologies and requirements to get the results.”

He continued: “In recent years, we’ve seen a really big commitment to measuring everything to understand where we are regarding sustainability, so we can make changes. Less energy has so far been spent on actually changing anything. I get the sense the industry is now really starting to take this seriously. I wouldn’t say it’s unified, but the industry is definitely coalescing around the concept of sustainability to move it forward.”

Although the pursuit of more sustainable products has previously meant having to pay a price premium and sacrifice performance, there have been significant improvements made over the past decade or so, Kriech added. That price gap is noticeably shrinking, and this new generation of lubricants has proven to be just as effective as conventional products.

“End users want more sustainable options; they just don’t necessarily want to pay the premium prices for them,” Kriech said. “There are always three things you can optimize your product around, but you can’t have all three: cost, performance and sustainability. It is absolutely possible to build highly sustainable hydraulic fluids, gear oils or greases that have best-in-class performance and meet all of these performance demands, but you’re not going to do it for free. There’s always going to be a cost associated with it.”

“I think everyone has finally realized that you can’t go from zero to 100% in a short space of time; there’s just too much pushback from an end user perspective. The industry needs to make small, gradual changes over time to get us to where we need to be,” he said.

Continued investment into more advanced technologies and formulations is certainly helping to challenge the perception that more sustainable products are less effective than traditional lubes and greases, added Henkel’s Brown.

“Some of the biggest advancements in sustainable lubricants include the development of biobased additives derived from renewable sources, formulations with improved thermal stability and oxidation resistance, and lubricants tailored for specific applications and environmental conditions,” she said.

Brown highlighted examples of newer technologies in lubricants that offer low water washout and result in less frequent lubrication cycles. She also pointed to improved tolerances of machining of mechanical components and the elimination of burrs and flashing, which allow the use of smaller volume lubricant reservoirs or sumps.

“As more companies adopt sustainable practices and invest in research and development, concerns surrounding the effectiveness of sustainable products is diminishing,” she noted. “Increasingly, sustainability is seen as a driver of innovation and quality, rather than a compromise on performance.”

In this spotlight, LANXESS and STARFIRE explain their unique offerings for the industrial lubricants segment.

LANXESS Extreme Pressure Additives Offer Sustainable and Innovative Solutions

LANXESS is one of the world’s largest manufacturers of sulfur carriers, sold under the brand names Additin® and Scopeblue Additin®. In Q4 2023, with a dedication to sustainability and innovation, LANXESS increased production capacity for environmentally friendly, light-colored sulfur carriers.

Highly effective in reducing wear on metal surfaces and prevention of cold welding, Extreme Pressure (EP) additives are used in metalworking fluids as well as greases, gear oils and slideway oils.

With their favorable eco-toxicological profile, excellent performance at high machining speed and in heavy-duty metalworking processes, Additin® EP and Scopeblue Additin® EP are an effective solution for formulators who wish to replace substances such as medium-chain chlorinated paraffins, which have been classified as Substances of Very High Concern (SVHCs) by the European Chemicals Agency (ECHA) due to their environmental persistence and high bioaccumulation potential.

Most Additin® EP additives are eco-friendly and are based on locally sourced, renewable raw materials such as canola oil and its ester derivatives. LANXESS has labeled sulfur carriers based on more than 50% sustainable raw materials with its sustainability brand Scopeblue.

Scopeblue Additin® products have low impact on the environment and show no health hazards. They meet the requirements of the LuSC (“Lubricant Substance Classification”) list—the prime reference for formulators of lubricants intended to apply for the EU Ecolabel.

In Q4 2023, LANXESS increased its production capacity for environmentally friendly, light-colored sulfur carriers by several kilotons, in alignment with our dedication to sustainability and innovation within the lubricant additives market.

Additin® sulfur carriers are extremely versatile and ideal for reducing friction and preventing adhesive and abrasive wear in boundary lubrication. They are available with different molecular structures and activities and thus can be easily adapted to the requirements of specific metalworking processes.

Chlorinated paraffins (CLPs) are also commonly known EP additives. However, their use is increasingly seen as problematic because of their risks to the ecosystem and human health. Additin® sulfur carriers are ideal replacements and even outperform CLPs in most applications.

LANXESS has conducted numerous tribological laboratory testing in the development of CLP-free metalworking fluid formulations with excellent performance.

The strip drawing test is commonly used to simulate the frictional conditions in bar or tube drawing, or in deep drawing processes. In a test series, strips made of cold rolled steel were drawn with lubricants containing 5%, 10% or 20% medium chain chlorinated paraffin (MCCP, 50% Cl) and with different sulfur carriers with only 5% treat rate. With 5% of the active sulfurized olefin Additin® RC 2540, the coefficient of friction (CoF) was as low as that with 10% chlorinated paraffin. With 5% inactive sulfurized triglyceride Additin® RC 2410, the CoF was on the same level as with 20% chlorinated paraffin. With only 5% of Additin® RC 2526—a highly polar, active sulfur carrier based on olefin and triglyceride and containing 26% total sulfur—the CoF was significantly lower than with 20% MCCP (See Figure 1).

Figure 1: Strip drawing test results of drawing oil formulations containing chlorinated paraffin or sulfur carriers

Machining stainless steel is a real challenge for most shop floors. Its surface is almost completely covered with oxides, which makes it difficult for EP additives to interact with the surface to prevent adhesive wear. However, thread cutting and thread forming tests with stainless steel clearly show it is possible to even increase the performance of metalworking fluids by replacing chlorinated paraffins with suitable sulfur carriers.

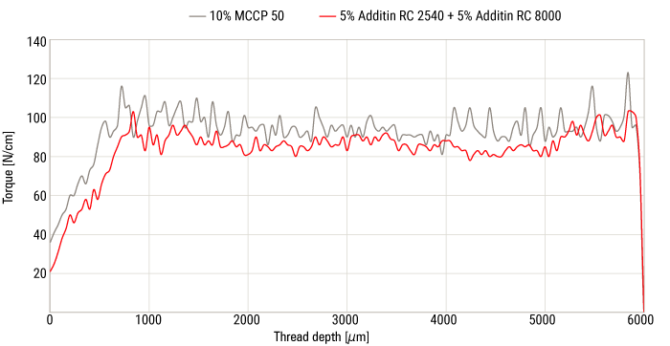

When thread cutting stainless steel AISI 316, the average torque was 8.5% lower with a combination of 5% active sulfurized olefin Additin® RC 2540 and 5% sulfur linked polymer Additin® RC 8000, compared with 10% of a medium chain chlorinated paraffin with 50% chlorine (See Figure 2).

Figure 2: Thread cutting in stainless steel

Lower torque indicates a lower force that is needed to cut the thread, resulting in lower energy consumption of the machine tool and also lower mechanical stress for the tool, which can result in extended tool life.

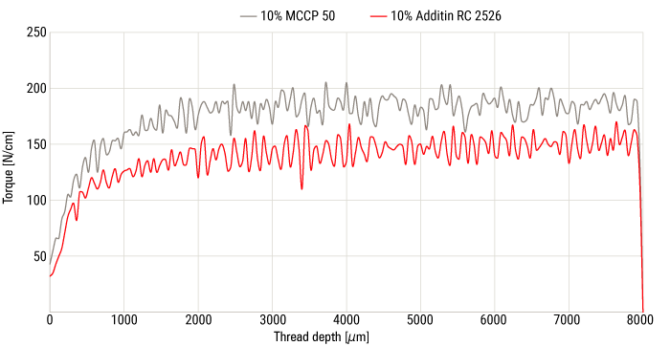

When forming the threads in the same type of stainless steel, the average torque was even 20% lower when running the test with 10% of the highly polar, active sulfur carrier Additin® RC 2526, compared to 10% of medium chain chlorinated paraffin (See Figure 3).

Figure 3: Thread forming in stainless steel

The test results indicate that LANXESS Additin® RC sulfur carriers are excellent EP additives that effectively decrease adhesive and abrasive wear, even with cutting or forming materials that are difficult to machine. They significantly reduce the energy consumption in metalworking processes, show low environmental impact and good sustainability, and are non-toxic to humans and to the environment.

For more information, visit https://lanxess.com/en/Products-and-Brands/Brands/Additin/Extreme-pressure

STARFIRE Is Breaking the Mold

As one of America’s fastest growing lubricant brands, STARFIRE prides itself by not only doing things differently, but by breaking the mold and setting an entirely new standard for sales, support and service.

“At STARFIRE, we like to do business that satisfies our customer needs, not just our own,” insists Tim Wullenweber, VP of marketing and technical services at Coolants Plus, Inc.

The STARFIRE brand has rapidly established itself as a leading supplier of premium lubricants, predominantly servicing the automotive, heavy-duty, on-highway and off-highway, agriculture, construction, and industrial markets.

Its new EX Industrial lubricants line has taken the market by storm with its HYEX hydraulic oils, TALEX gear oils, CIREX compressor oils, EPEX greases and SOLEX specialty fluids, proving a popular, competitively priced alternative to the bigger, more established brands.

STARFIRE’s industrial range has been specifically formulated to offer a robust, reliable and proven solution, no matter how demanding the environment or conditions.

“It’s rare to see someone in our market that has such an extensive portfolio of products as we do,” says Wullenweber. “We offer motor oils, transmission fluids, gear oil, hydraulic oil, antifreeze, grease, aerosol products, pour chemicals and more.”

“The industrial line has been very successful for us. Normally, the STARFIRE brand is sold through our distribution network, but there are opportunities for large industrial customers to work directly with us moving forward.”

Operating out of its main corporate headquarters in Hamilton, Ohio, the business benefits from its own blending facility and packaging plant, which gives it a competitive edge.

Its 10-acre, 300,000-square foot PennStar blending facility in Northampton, Pennsylvania, is capable of producing over 3.5 million gallons each month. Plans are now underway to build an 80,000-square foot extension to provide additional warehousing, with construction due for completion later this year or early next.

“We’ve also been upgrading our packaging capabilities these past few years and are already looking at expanding these capabilities further,” says Wullenweber. “We currently have quart and gallon filling lines, high-speed pail fillers, bag-in-a-box machines, and package everything from pails, kegs, drums, totes, and deliver full transport loads of oil predominantly through our own fleet of STARFIRE tanker trucks.”

The business also plans to build a new corporate building in the Cincinnati metro area, which is scheduled for completion in 2026.

Coolants Plus is independently owned—which also sets the business apart in a marketplace where private equity is routinely acquiring businesses, adds Wullenweber. “This is one of our key differentiators and means we’re able to react quickly to market conditions and make decisions without having to deal with lots of bureaucracy. That makes us extremely agile and benefits not only our growth, but the needs of our customers.”

“We are winning new business every day because customers are realizing there’s a better way to do business. They don’t have to wait weeks or months for orders. We offer the best lead times in the industry—getting product out the door faster than anybody else. A lot of companies out there just don’t understand how we can ship product as fast as we do,” he says. “When customers have a question, they can call us and actually speak to someone right away. It’s a level of customer service that is hard to find these days.”

“Continuing to build on our excellent level of customer service, our extensive product portfolio and our own blending facility and packaging lines gives us the ability to give the customer the kind of business experience that they’re not really used to.”

Find out more about the STARFIRE range of products and access product information, videos and blog content at www.starfire.com.