Think Spring!

Base oil and lubricant suppliers are hoping for a ramp-up of demand ahead of the busy spring production season. After a year of wilting fundamentals, everyone seems to be counting on a stronger season than last year’s, which was characterized by record low consumption levels and wavering prices. A participant fittingly summed up the sentiment in what could become the industry’s mantra over the next few weeks: “Think spring!”

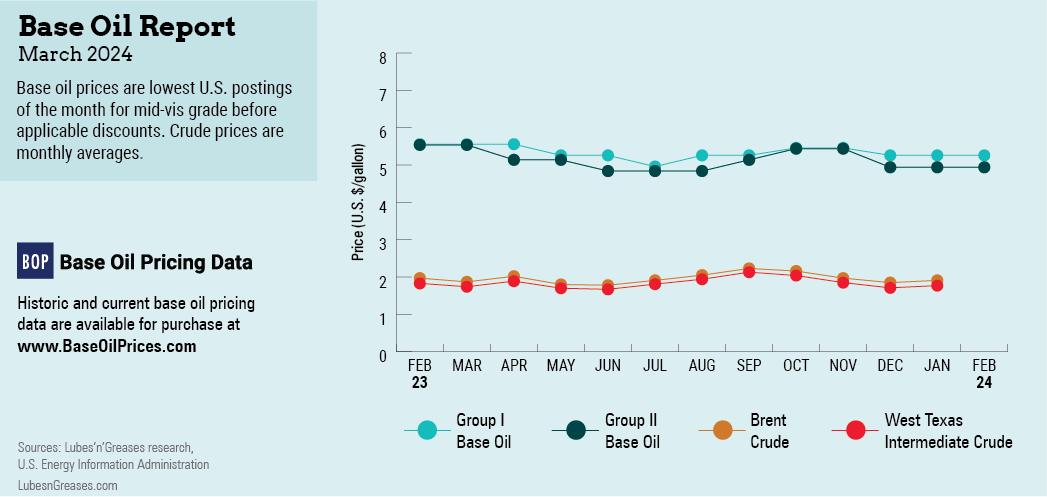

While some suppliers saw few changes in activity in early February, several said orders had started to trickle in, with requirements for industrial applications improving but the automotive segment remaining relatively slow. Some buyers continued to purchase hand-to-mouth on concerns that base oil prices might be adjusted down and they’d be caught holding pricy inventories. However, climbing crude oil and feedstock prices started to exert upward pressure on pricing during the first week of February. Steeper diesel values might encourage refiners to stream more feedstocks into fuel production in detriment to base oil output, tightening supply conditions.

Shipping disruptions linked to Houthi attacks on commercial vessels in the Red Sea continued but did not seem to directly impact base oil shipments to the Americas, except for placing pressure on freight rates. Cargoes moving from the Middle East to Europe, and from that region to India, were rerouted around the southern tip of Africa, adding time and substantial costs to the voyage. The ongoing conflict in the Middle East, with the U.S. becoming more involved after a drone attack by Iran-backed militants killed three service members, also exerted upward pressure on crude and feedstock values.

Crude oil futures jumped in the first week of February as analysts factored in escalating tensions in the Middle East. Reports that predicted lower U.S. oil output in 2024 compared to 2023 also boosted values. Futures had shown a significant drop in previous sessions on concerns about slowing demand, particularly in China.

Even though domestic base oil demand was anticipated to flourish during the spring production cycle, U.S. suppliers were eager to capture export business to keep inventories in check. Spot export prices for Group I and II grades slipped by about 10 cents per gallon as sellers strove to attract buyers. There was some competition with Asian suppliers for business into West Coast South America, while a couple of large cargoes were finalized for shipment to India.

Buying interest from Brazil was fairly steady due to recent production outages in the country, but it had declined from previous months, as a key producer appeared able to deliver all contract volumes, and lower domestic prices in Brazil made U.S. offers less competitive.

A main factor affecting U.S. supply levels was expected to be future exports to Mexico. Volumes moving into the country were expected to drop substantially as the Mexican government imposed new restrictions last October on refined product imports to deter illicit fuel practices. Among the requirements, importers need to apply for a license and justify base stock imports by proving they will be used for lubricants and other finished products.

Vast quantities of U.S. light-viscosity base oils moved to Mexico over the past few years to be used as fuel extenders, but this was anticipated to be restricted, leading to a lengthening of light-viscosity Group I and II grades in the U.S. Participants also noted that many other products like finished lubricants, greases and raw materials that would never be used as fuel extenders have been included in the list of products that require a special import license, adding that a number of one-year licenses had been granted, but no five-year licenses had been approved to date.

Group III availability was deemed ample in most regions, and the U.S. was no exception. Asian cargoes were expected to face fewer difficulties in reaching the U.S. Gulf Coast than in previous weeks, as a backlog of vessels waiting to cross the Panama Canal was slowly being cleared.

On the naphthenic front, a fairly balanced supply-demand scenario and climbing Brent crude futures lent support to light-viscosity base oil prices, but the heavy grades were exposed to downward pressure because requirements have been seasonally soft. However, demand from the asphalt and rubber modifier markets was expected to bloom in the second quarter and likely tighten the heavy grades.

Furthermore, scheduled maintenance programs at San Joaquin Refining’s plant in Bakersfield, California, and Calumet’s plant in Princeton, Louisiana, in December and January, respectively, tightened supplies. A third producer experienced a brief shutdown in mid-January due to extreme winter temperatures, but the San Joaquin plant was not affected by the heavy rains in California in early February.

At the time of writing, it was too early to assess whether sales targets would be met, but most suppliers remained optimistic that consumption would be healthier, as many blenders finished 2023 with lean inventories, only purchasing small volumes to keep up daily operations. Tax considerations also promoted this buying strategy. Buyers were expected to start preparing inventories for the busier spring cycle, which might push requirements to their full bloom.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com