Dragon Days

According to the Chinese horoscope, 2024 is the year of the dragon. Although this legendary creature often conjures up images of fear and destruction, the year of the dragon is believed to bring prosperity and good fortune. After months of lackluster market fundamentals in 2023, it would be opportune if the favorable qualities associated with the dragon were to infuse the base oils and lubricants industries this year.

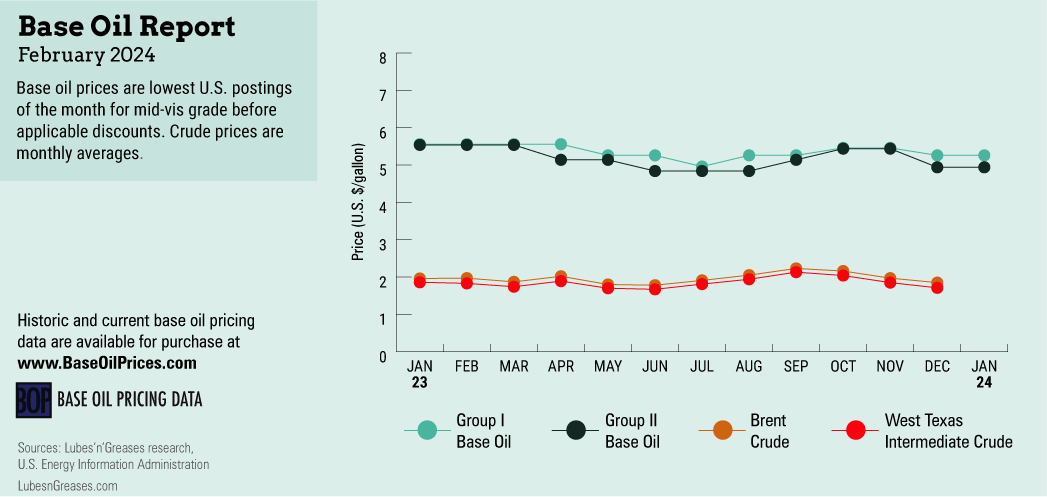

The first week of 2024 ushered in fresh posted price decreases, with SK Enmove communicating that it would lower its Group II+ and API Group III base oil postings by 30 cents per gallon on Jan. 1. This followed announcements by Motiva and Petro-Canada that they would adjust down their Group II+ and Group III cuts with the same effective date, completing a series of decreases that had been implemented since December.

A majority of producers and rerefiners lowered their posted prices in late November and early December, with Group I grades going down by 20 cents per gallon and Group II grades by 15, 30, 35 and 50 cents. Group II+ prices fell by 10, 15, 25 and 30 cents. Most Group III cuts were decreased by 30 cents on Jan. 1, but SK also adjusted its postings down by 15 cents on Dec. 1.

With demand showing a pronounced slowdown ahead of Dec. 31, spot prices gradually lost ground because suppliers tried to encourage domestic sales as well as export transactions, with contract negotiations expected to yield deeper discounts over posted prices than in previous years.

Group I and Group II supplies were deemed plentiful to meet domestic demand, while export business into Mexico eased due to stricter import requirements on refined products.

Brazil continued to show strong interest in U.S. cargoes following an extended turnaround at a local refinery and an unexpected shutdown at a second facility. Brazil was anticipated to import additional naphthenic base oils as a domestic unit was preparing to shut down for maintenance.

U.S. Group II suppliers were still pursuing opportunities into more distant destinations like India, but the market there was ostensibly saturated, as several cargoes were expected to arrive in January, and demand was not particularly robust, with buyers relying heavily on domestic production and imports.

There was still heightened concern surrounding Iran-backed Houthi militants’ attacks on commercial vessels in the Red Sea, which forced shipping companies to reroute their ships around the southern tip of Africa. This resulted in extended transit times and increased insurance and freight rates.

For Group III base oils, buyers and suppliers worried that product shipped from the Middle East would be prevented from reaching the Americas or would incur higher prices. but Asian shipments were anticipated to continue unabated, although general demand was lackluster and some shipments faced delays in the Panama Canal.

Lubricant manufacturers struggled to recoup base oil price increases implemented in August and September 2023 and communicated increase initiatives of their own for late October and early November implementation. However, the most recent base oil price decreases have lifted some of the upward price pressure and allowed some finished product suppliers and distributors to leave prices unchanged or grant small discounts to protect market share.

On the naphthenic front, similar fundamentals to those observed in the paraffinic segment prompted price decreases of 15 cents and 20 cents per gallon in mid-December to early January. San Joaquin Refining did not change the price of its transformer oils.

While naphthenic demand also showed signs of slowing, it seemed more balanced against supply than the paraffinic side, with the light grades described as tight. This was partly attributed to planned and unplanned production shutdowns at naphthenic facilities in the third quarter, along with healthy demand from the export segment.

Naphthenic producer San Joaquin Refining completed a scheduled turnaround at its Bakersfield, California, refinery in early December but shut down the plant again due to technical issues with equipment installed in the hydrotreater. The producer resumed operations in the last week of December and hoped to be able to fulfill its backlog of orders in January.

Aside from sluggish demand, base oil prices came under pressure given falling crude oil and feedstock values. Some refiners continued to favor the production of base oils versus competing fuels due to more favorable margins, and this exacerbated the oversupply conditions.

Crude oil futures were volatile at the start of the year and initially jumped on concerns about Middle East supply disruptions after a U.S. helicopter repelled Houthi attacks in the Red Sea and Iran seemed to escalate its involvement in the altercations. News of an economic stimulus plan in China also boosted prices, as it was expected to result in increased crude demand in the world’s top oil importing nation. WTI February futures were near $75 per barrel at the end of December and hovered in the low $70s per barrel in early January.

Crude oil and feedstock values and macroeconomic concerns impacting lubricant and finished products consumption are likely to be the main factors affecting base oil activity in the first quarter. Hopefully, the market will tip toward the benign qualities associated with a dragon year, rather than the negative connotations of the mythical creature.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com