Automotive

Rumors of PC-12—as well as the various improvements and challenges that might accompany it—has been abuzz in the lubricants industry for the past several months. The new category is likely still years from being completed and implemented. However, as PC-12 inches closer and closer to becoming a reality, the details of it are beginning to come into focus.

Why is the new heavy-duty category necessary? What challenges might it pose for the lubricants market? What improvements is the new category expected to introduce?

Lubes’n’Greases discussed all of these questions and more with Karin Haumann, the OEM technical service manager with Shell. Haumann is also the chairperson of the American Petroleum Institute’s New Category Development Team.

Why Is the New Category Needed?

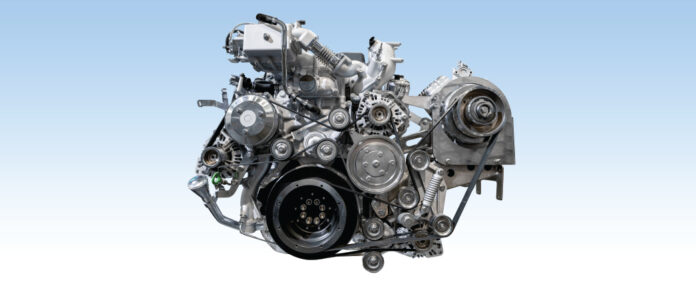

With a majority of original equipment manufacturers as well as many governments and consumers placing a robust and steadfast emphasis on sustainability, many experts have predicted that most internal combustion engine-powered passenger cars will be phased out in the next couple decades in favor of electrified models.

However, the heavy-duty sector differs in that it is expected to take quite a bit longer to completely hop on the all-electric bandwagon, meaning that there will continue to be a need for high-quality heavy-duty lubricants well into the future.

There are also some other factors at play. Haumann cited increasingly stringent nitrogen oxide limits as one major factor affecting the need for a new heavy-duty category. “In late 2021, the Engine Manufacturers Association (EMA) requested that a new diesel engine oil category be developed to meet the needs of future engines,” she said. “Part of the request was in anticipation of new NOx emissions reduction regulations from the Environmental Protection Agency.”

What Improvements Are Expected with the Upcoming Heavy-duty Engine Oil Category?

Haumann explained that some of the key areas identified in the initial request for the new heavy-duty category include the following improvements:

- Increased oxidation performance

- New wear test capability

- Addition of lower oil viscosities to include XW-20 in the F sub-category

- Improved aftertreatment capability

- Expansion of engine elastomer compatibility.

What Is the Impact of New Emissions Requirements?

As mentioned above, part of the reason that the API deemed a new engine oil category necessary was in anticipation of the U.S. Environmental Protection Agency’s more stringent NOx emissions regulations.

So what is the potential impact of the EPA’s announcement regarding the reduction of NOx limits as well as the reduction of the particulate matter limit by 50%?

The API New Category Development Team (also known as the NCDT) “manages the development of new API Diesel Engine Oil Service Categories,” Haumann said. “This includes working with all interested parties to identify areas of increased performance that will enable engine manufacturers to meet the changing NOx emission standards expected in 2027 and requirements for fuel economy for certain engine models. The NCDT has determined the chemical limits that are needed.”

However, Haumann qualified that the NCDT’s work is far from done. “There is still more to be done by the NCDT and oil manufacturers this year and next prior to blending candidate oils to be tested and evaluated,” she said.

What Are the Challenges Associated with Creating a New Diesel Engine Oil Specification?

If you were to ask anyone who has ever been involved with new category development if the process was simple and straightforward, they would likely scoff at you. While the end goal is usually quite clear, the road to get there is often a curvy one that requires frequent renavigation.

So what have been some of the main challenges of category development this time around?

“With engine technology changing, several engine tests used to evaluate engine oils are expected to become obsolete due to diminishing engine hardware supplies,” Haumann said. “Part of the PC-12 development will focus on ensuring backward compatibility with replacement tests and test performance parameters.”

Furthermore, PC-12 will need to include specifications for even lower viscosity engine oils, but previous test equipment may not necessarily accommodate those oils. “Many of the engines used for the current tests are older and not equipped to operate on a low-viscosity oil such as a 5W- or even an 0W-20 oil,” Haumann explained. “We are working to develop and run test matrices to make sure we have the precision and discrimination in the existing tests to be able to facilitate us qualifying the low-viscosity oils.”

Given that engine test hardware is not unlimited nor is it always suitable for testing newer formulations, new test development is also critical. “We are developing a replacement test for the Mack T11 soot viscosity tests because those parts are going away,” Haumann said. “There’s some test development and prove-out work being done on all of the other tests to make sure that the existing tests are suitable for lower-viscosity evaluation. Part of the evaluation and work is to be certain that wear and other tests that the oil undergo will perform with a 0W-20 oil up to a 15W-40 oil. That’s a wide range, so we are also introducing some modern reference oils into the system.”

Another challenge—perhaps one that is specific to PC-12—is that the new heavy-duty category is being developed and implemented in rather close succession to other automotive oil standards, like GM’s dexos1 Gen4 standard and ILSAC GF-7. (There has been some back-and-forth discussion about when GF-7 will be introduced to the market, but the most recent plan proposes that the standard will begin licensing in the latter part of next year. (For more information about the development of passenger car motor oil specification GF-7, check out Steve Haffner’s feature in the March 2023 issue.)

This close proximity of specifications may put a strain on resources that will need to be navigated not just by API but also by other such stakeholders as lubricant blenders and additive companies.

When Will the New Category Be Implemented?

While news of the new engine oil category is certainly exciting to the lubricants industry, the exact timeline of PC-12 has been unclear until recently. After all, many lubricant blenders may be wondering when their compliant formulations will need to be ready for first licensing.

According to Haumann, “The request for the first licensing date from API is no later than January 1, 2027. This corresponds with the anticipated 2027 implementation date for EPA and CARB heavy-duty on-highway regulations.”

What Are Some Potential Differences Between PC-11 and PC-12?

Haumann discussed a few key ways that PC-12 will need to differ from its predecessor, such as developing and implementing new tests into the standard.

But what are some other changes that PC-12 will require?

Lubes’n’Greases’ automotive columnist Steve Swedberg listed several potential differences between PC-11 and PC-12 in his April column last year. Let’s review some of those potential changes now.

- Wear tests. API CK-4 and FA-4 included four wear tests, while PC-12 is targeted to have just three.

- Chemical limits. PC-11’s chemical limits for CK-4 and FA-4 are 1.0% maximum sulfated ash, 0.12% maximum phosphorus and 0.4% maximum sulfur. Due to the EPA’s changes in allowable NOx emissions, these levels will likely decrease in PC-12.

- Elastomer compatibility. API CK-4 and FA-4 have test requirements for five classes of seals that are evaluated for changes in volume, hardness, tensile strength and elongation at break, Swedberg wrote. PC-12 may have new seal materials and/or new limits on these parameters.

- Base oil interchange. It is possible that base oil interchange guidelines may need to be revised—or at least reaffirmed. According to API 1509, base oil interchange guidelines are necessary because “not all base oils have similar physical or chemical properties or provide equivalent engine oil performance in engine testing. During engine oil manufacture, marketers and blenders have legitimate needs for flexibility in base oil usage. The API Base Oil Interchangeability Guidelines (BOI) were developed to ensure that the performance of engine oil products is not adversely affected when different base oils are used interchangeably by engine oil blenders.

“The API Base Oil Interchangeability Guidelines define the minimum prudent physical and engine testing necessary to ensure that engine oil performance is not adversely affected by substitution of one base oil for another. The Guidelines are based on actual engine test data, using different base oils, for both gasoline and diesel engine oil performance.”

Swedberg explained that BOI “guidelines are determined by various tests, SAE viscosity grade and API base oil group. In fact, the API base oil group designations were developed for this purpose. The grouping system has expanded well beyond base oil interchange and has become a de facto base oil definition system. Whenever there is a new category test method, BOI data are developed to ensure that this system is maintained.”

For more information about the development of PC-12, check out Steve Swedberg’s column from the April 2022 issue of Lubes’n’Greases. Also, keep an eye out for a couple of features later this year about the need for specifications designed for low-viscosity engine oils.

Editor’s Note: You may have noticed that Lubes’n’Greases’ usual automotive columnist Steve Swedberg did not pen this month’s Automotive column. But don’t fret; Steve’s sage wisdom on all things automotive will return soon in the August 2023 issue.

Sydney Moore is managing editor of Lubes’n’Greases magazine. Contact her at Sydney@LubesnGreases.com