U.S. Base Oil Production Continues on the Path to Recovery

The COVID-19 pandemic wreaked havoc on United States base oil production during the first half of 2020, but signs of a slow recovery began to emerge during the second part of the year, said Ernie Henderson, president of K&E Petroleum Consulting. With production volumes slowly returning to more normal levels from July through December of 2020, many industry players held out hope that 2021 would usher in even more favorable market conditions. And for the most part, it did.

However, Henderson noted that “recovery is underway in 2021 but has been impacted by the nagging reminder that the industry is still recovering from the effects of a global pandemic that has not yet been eradicated.”

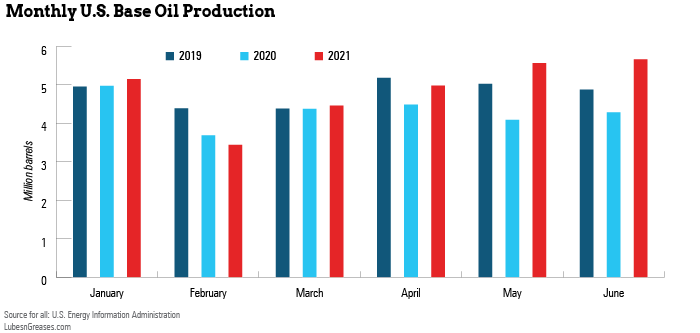

During the first half of 2021, the U.S. produced 29.3 million barrels of base oils, up about 13% from 2020’s half-year total of 25.9 million barrels, according to data from the U.S. Energy Information Administration. Despite some roadblocks placed in the way by severe weather and refinery fires, half-year base oil output rebounded to surpass 2019 levels by the end of 2020. In fact, base oil output during 2021’s first six months outpaced 2019 output volumes during the same period by about 1.6%. This is likely a result of renewed demand after COVID restrictions were lifted as well as a lack of significant refinery turnarounds, many of which were completed in 2020.

(000 barrels, January-June)

| Year | Paraffinic | Naphthenic | Total |

|---|---|---|---|

| 2011 | 25,418 | 5,651 | 31,069 |

| 2012 | 24,239 | 5,022 | 29,261 |

| 2013 | 22,842 | 4,982 | 27,824 |

| 2014 | 24,228 | 4,625 | 28,853 |

| 2015 | 27,292 | 4,494 | 31,786 |

| 2016 | 24,723 | 4,357 | 29,080 |

| 2017 | 25,837 | 4,930 | 30,767 |

| 2018 | 29,005 | 4,987 | 33,992 |

| 2019 | 23,770 | 5,077 | 28,847 |

| 2020 | 22,008 | 3,898 | 25,906 |

| 2021 | 24,599 | 4,672 | 29,271 |

Paraffinic base oil output soared from 22 million barrels in the first half of 2020 to 24.6 million barrels in the same period of 2021, an increase of 12%.

Naphthenic production also began its comeback after suffering greatly in 2020 and being unable to recover to 2019 levels by the end of the year. At nearly 4.7 million barrels, production for the first half of the year was 774,000 barrels more than the same months in 2020—an increase of 20%. However, naphthenic output in the first part of 2021 still fell short of 2019 output levels by about 384,000 barrels, representing a decline of about 8%.

Production Varies by Region

With the exception of the East Coast refineries, the five Petroleum Administration for Defense Districts reported increased output during the first half of 2021. The only plant in PADD 2—HollyFrontier’s 9,500-barrels-per-day Group I facility in Tulsa, Oklahoma—increased its half-year output to 1.1 million barrels, up 21% from the same period in 2020.

Output in PADD 3, which runs along the Gulf Coast and has the largest base oil capacity in the country, also saw increased production this year. Output in the district increased by 13% from the first half of 2020 to 23.1 million barrels. What’s more, PADD 3’s production outpaced first-half 2019 totals by about 2%, despite the severe cold weather event that swept over the region in February. The cold snap decreased the district’s production to just over 2.6 million barrels that month—1.6 million barrels less than it produced the month before.

Refineries in the Texas Gulf Coast subsection of PADD 3 followed the entire district’s upward trend. The subsection produced 8.6 million barrels of base oils in the first half of 2021, about 8% above what it produced in the first part of 2020. The Texas Inland subsection also increased production in 2021. Its refiners churned out 89,000 barrels during the first half of 2021—nearly 20% more than the same period of 2020 but almost 44% less than 2019. The North Louisiana-Arkansas subsection also followed the PADD-wide trend, producing just under 4.7 million barrels. This represents a 9% bump up from first-half 2020 totals. The rest of PADD 3, along the Louisiana Gulf Coast, saw a 22% uptick in production, reaching 9.7 million barrels during the first half of the year.

Similarly, the West Coast refiners in PADD 5—including Chevron’s plant in Richmond, California, (20,700 b/d of Group II and 1,000 b/d of Group III) and San Joaquin Refining’s 8,100 b/d naphthenic plant in Bakersfield, California—produced almost 3.2 million barrels in the first half of 2021, an increase of 24% from half-year output in 2020.

Production in PADD 1, which covers refineries located along the East Coast of the U.S., were not as fruitful in the first part of 2021 as PADD 2, PADD 3 and PADD 5 were. The region produced less than 2 million barrels in the first six months of 2021, 8% less than it did from January through June in 2020. This drop in production may partly be credited to a May 29 fire at Ergon’s refinery in Newell, West Virginia, that caused its base oil unit to be shut down for a short period of time and force majeure to be declared on base oils and other materials made at the facility. The base oil plant at the Newell refinery has capacity to make 2,900 barrels per day of API Group II base oils and 1,900 b/d of Group I.

Imports Hit Historic Highs

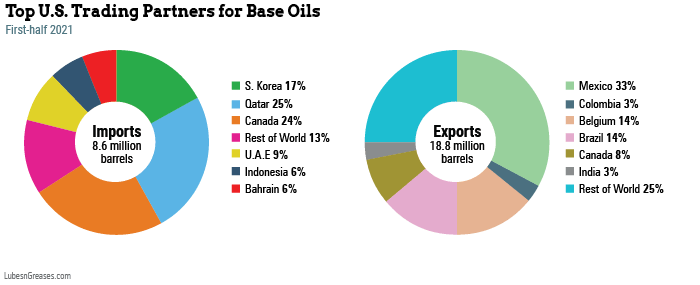

Total U.S. base oil imports during the first six months of 2021 were up significantly from the same months in the previous year. At 8.6 million barrels, U.S. imports during the first half of 2021 were the highest on record and over 28% higher than they were from January through June last year.

What factors may have contributed to this large jump in imports?

Demand for lubricants and fuels slumped when lockdowns were implemented and mobility became limited in March of 2020. However, as most regions of the U.S. eased or even eliminated COVID-induced restrictions in 2021, demand grew to a healthier level.

Furthermore, U.S. base oil production dropped during February when severe cold weather reared its head across large swaths of the country—most notably in Texas, where a large portion of U.S. base oil plants are located. “The freezing temperatures caused significant damage to lines and specialist equipment, all of which required replacement and repairs, taking time and of course money,” said Ray Masson, director of Pumacrown Ltd. “This prevented a number of refineries from producing base oils and other petroleum products.”

Henderson agreed. “The severe cold weather put a temporary halt to the industry recovery,” he said. “This included the need to reduce or halt production and the time to restart production. This also had a significant impact on the supporting logistics of getting base oils to customers, so that they could maintain lubricant production.”

He continued: “If you consider the four refineries that shut down base oil production in February through March due to the cold weather—Motiva in Port Arthur, Texas; ExxonMobil in Baytown, Texas; Calumet in Shreveport, Louisiana; and Holly Frontier in Tulsa, Oklahoma—that represented nearly 40% of North American paraffinic base oil production. That is difficult to recover quickly.”

To meet increasing demand levels with less domestic supply available, the U.S. needed to increase its import volumes. Masson explained that “interim measures were initiated from other regions’ refineries—most notably Europe and Asia-Pacific—to supplement interchangeable stocks of base oils.”

Additionally, the majority of base oil imports to the U.S. are typically Group III oils that hail from Qatar, Bahrain, United Arab Emirates and South Korea. Several key base oil plants in those countries—including those of Adnoc, SK and S-Oil—underwent turnarounds in 2020, limiting the volume of base oil available for export to the U.S. With these turnarounds completed before the start of 2021, the U.S. was able to resume more normal import volumes from several of its key base oil trading partners.

As is usually the case, the majority of U.S. base oil imports during the first six months of 2021 came from Qatar (2.2 million barrels), Canada (2.1 million barrels), South Korea (1.5 million barrels), United Arab Emirates (811,000 barrels) and Bahrain (547,000 barrels).

Notably, imports from both Qatar and Canada saw sharp increases from 2020. For the full year in 2020, Qatar supplied 2.9 barrels to the U.S. and Canada supplied 2.2 million barrels. This year, the two countries have nearly approached those totals in the first six months alone. The Netherlands also increased its supply to the U.S., sending around 117% more base oil to the U.S. from January through June in 2021 than it did during the same months last year.

Exports Trend Upward

At about 18.7 million barrels, U.S. base oil exports from the first six months of 2021 outpaced exports from the same months in 2020 by about 22%.

As the COVID-19 pandemic picked up speed last year, worldwide lockdowns were implemented, and demand in regions around the globe tapered off significantly. Because of this, exports took a nosedive from January through June, falling to just under 15.4 million barrels.

Fortunately, the export market picked up in the second half of 2020 as some economies opened up again, and the U.S. ultimately exported 34.4 million barrels of base oils in 2020—8% below 2019’s total exports.

The top destinations of U.S. base oil exports during the first half of 2021 remained similar to those in 2020. Mexico retained its title as the top importer of U.S. base oils with 6.2 million barrels, while Belgium remained in second place, importing about 2.7 million barrels from the U.S. The top five was rounded out by Brazil, Canada and Colombia—which imported about 2.6 million barrels, 1.5 million barrels and 611,000 barrels, respectively, from the U.S.

In 2020, India made the top five list, importing more than 1.2 million barrels of base oils from the U.S. However, the country dropped off the list as U.S. exports to India eased up after February this year, with India importing only 584,000 barrels from the U.S. during the first half of 2021. This is likely because base oil availability increased in 2021 in countries with which India traditionally trades, like South Korea and Singapore. For instance, turnarounds at SK and S-Oil in South Korea were completed last year, limiting India’s reliance on the U.S. for base oil imports.

Sydney Moore is managing editor of Lubes’n’Greases magazine. Contact her at Sydney@LubesnGreases.com